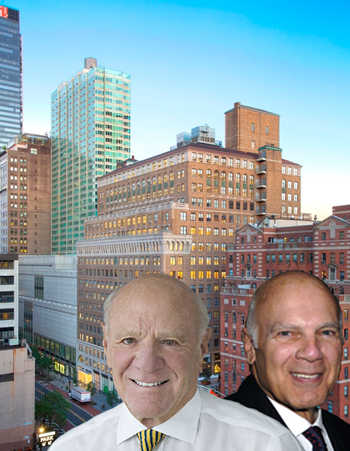

Home improvement website HomeAdvisor.com — owned by media mogul Barry Diller’s IAC — inked a deal for a new West Side headquarters.

The company is taking 43,000 square feet at Vornado Realty Trust’s 330 West 34th Street, CEO Steve Roth disclosed during the REIT’s earnings call Tuesday. On Monday, IAC announced a $500 million deal to buy HomeAdvisor rival Angie’s List.

According to Roth, strong office demand boosted the company’s first-quarter revenue to $620.8 million, up from $613 million in 2016’s first quarter. Net income was $73.8 million compared to the prior year’s $91.6 million loss.

The struggling retail market was a different story. “As I do the math, our retail business is valued at virtually nothing,” Roth said, referring to Vornado’s stock price.

But he said Vornado is “buttoned up” on Upper Fifth Avenue and in Times Square with just one lease set to expire in those prime submarkets through mid-2019. That lease — Massimo Dutti’s store at 689 Fifth Avenue — is currently priced at 50 percent under market, he said.

For the rest of its portfolio, just under 400,000 square feet of retail leases are set to expire by mid-2019. Roth said the REIT is in a strong position at key spots, including 34th Street, where Old Navy’s 78,000-square-foot lease is 50 percent below market, Roth said. Vornado’s basis at 435 Seventh Avenue, where the retailer H&M occupies the entire 43,000 square feet, is also low enough to “be realistic in pricing,” he said.

According to Roth, Vornado bought 435 Seventh for around $30 million, and the retailer generates around $20 million a year in income for its landlord, he said. “[The building] is probably worth north of $400 to $500 million and we own it for $30 million,” he said.

“We admit it’s soft. We’re not ducking that,” Roth said, of the retail market. Rents throughout the market have “clearly gotten too high,” causing business to slow. “When retailers’ basic business model and format is under siege, they’re not aggressively interested in stepping up to high-profile asset and we’re finding that.”

Vornado would be realistic in pricing, he said. “We take what the market will give us and move on.”