Real estate attorney Jay Seiden is pretty sure the city is going to muck up 421a for developers.

“Nothing is ever simple,” he said during a panel on Thursday. “The future will be as confused as the last.”

For one, the new 421a doesn’t employ a preliminary certificate of eligibility. Instead, developers apply for the tax exemption after the project is completed. Seiden said this means dealing with increases in assessed values during the three or more years of construction and then being “at the mercy” of the city’s Department of Housing Preservation and Development to provide benefits retroactively. He said HPD likely won’t issue opinion letters — showing the likelihood of receiving the tax break — prior to providing a permanent certificate of eligibility. This could make it more difficult for developers to secure financing for 421a projects.

“I think that’s a critical issue because banks want certainty,” he said. “It may very well that you take three years to complete the project, and then HPD will take another three years [to decide].”

A spokesperson for HPD later confirmed that the agency doesn’t plan to issue opinion letters.

“That said, we are committed to working with developers to ensure the process runs as smoothly as possible,” he said.

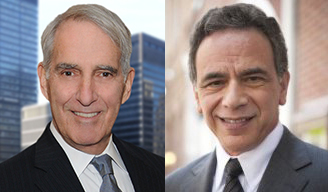

In the basement of the Real Estate Board of New York’s Office On Lexington Avenue, Seiden & Schein held a forum on the new program — officially called Affordable New York, a moniker that both Seiden and his partner, Alvin Schein, intentionally ignored — to highlight some of the questions left unanswered by the Legislature. Earlier this month, Gov. Cuomo signed the program into law as part of the state’s $163 billion budget.

Another issue cited by the panel was whether or not HPD will require developers to provide proof of construction wages for the 300-plus-unit projects that require minimum average wages at the time they apply for the tax break. For projects south of 96th Street in Manhattan, the average is at least $60 an hour. For projects on the Brooklyn or Queens waterfronts, that average is $45.

As the legislation is written, developers need to provide a project-wide payroll report of general contractors and subcontractors within one year of completing their project. If they fail to comply, they are subject to various penalties. The law makes it seem that failure to comply won’t be grounds for denying the exemption altogether. But Seiden said the city is likely to introduce requirements that will make the process more difficult. The HPD spokesperson said the new law “expressly prohibits” the agency from basing approval or termination of the tax break on whether the wages were properly paid.

These are just a few of the ambiguities built into the legislation, including how the city will assess new condominium projects that are eligible for the program and whether it will employ local law to rein in certain aspects of the exemption. HPD is expected to eventually provide clarity on some of these points.

By some estimates, Affordable New York is expected to cost the city $2.4 billion annually. Linda Manley, general counsel to New York State Homes and Community Renewal, noted that the program will leverage private funds to create much-needed affordable housing.

“We have to face the reality that really no amount the state could put forward is really ever going to be enough to satisfy the incredible affordable housing demand in New York state,” she said. She also noted that President Trump’s proposed budget could slash $6 billion from federal housing programs.

“To say that the president’s skinny budget puts us in a period of uncertainty is probably the greatest understatement I could make,” she added.