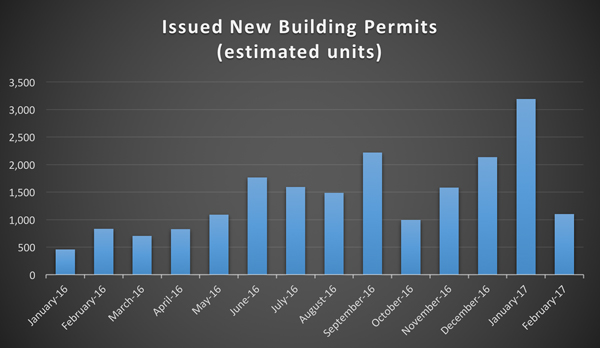

The city issued new building permits for an estimated 4,294 residential units in the first two months of 2017, a sizeable improvement over 2016’s anemic start, when fewer than 1,300 units were approved for construction, according to a new analysis of building permits by The Real Deal.

If you’re pounding your desk and shouting “I knew it: developers are building big rentals without 421a,” it’s a little more complicated than that, for now.

Although the increase in permitted units over the last several months indicates a more robust new development pipeline, there’s reason to believe that some of these new projects were already approved for 421a during the epic permit rushes of 2015, and could qualify with a much more limited construction permit.

Take Hudson Companies’ 350 Clarkson Avenue in Flatbush for example, a 350-unit rental building that got its new building permit approved in January. Hudson Companies’ CEO David Kramer told TRD he already qualified for the now-expired 421a abatement more than a year ago, doing so with only a basic foundations permit. Following rule changes in 2015, developers don’t need the full new building permit just to qualify for the tax exemption.

It’s unclear just how many large-scale projects approved over the last 15 months would fall into that category, but many of the large projects approved so far this year have some kind of other public financing other than or on top of 421a, too. BRP Companies, for example, received a $324 million loan from the city’s Housing Development Corporation for two buildings at the 659-unit development known as The Crossing in Jamaica, Queens. Another HDC-backed affordable housing project, the 303-unit 443 East 126nd Street in the Bronx, also got permits in January.

GID Development Group had two buildings totaling 532 units in its Riverside Center redevelopment permitted, following $220 million in tax-exempt Housing Finance Agency bonds it received for construction.

Other sizeable projects approved include the 70-unit residential condominium tower Daten Group is bringing to Brooklyn’s South Slope neighborhood at 581 4th Avenue.

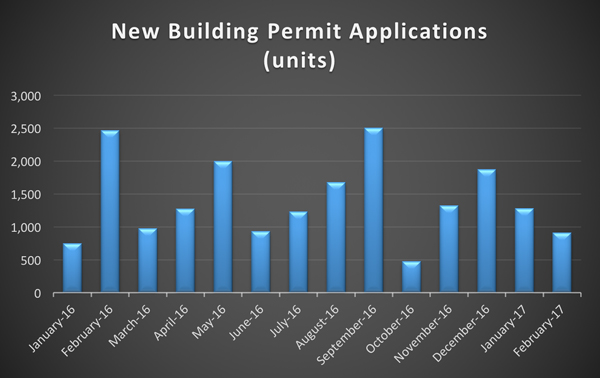

Taking a look at the number of new multifamily applications (not yet permitted) of at least 10 units does not reveal any recent spikes in plans, so from the data available there’s no reason to believe that large-scale projects are entering the approval pipeline at an accelerated rate. Last year, less than 22,000 new units from projects of any size were applied for, down from more than 37,000 in 2015, a TRD analysis showed.

Source: TRD analysis of DOB new building applications of at least 10 residential units, excludes known hotel projects

In January, Gov. Andrew Cuomo proposed a replacement to the expired 421a developer tax exemption, christening it “Affordable New York.” A new tax exemption will still need to pass the state legislature, and as budget discussions wrap later this month there should finally be some movement on that front (although crazier things have happened).

A recent analysis by the city’s Independent Budget Office estimates that Cuomo’s 421a replacement will cost the city $8.4 billion in foregone tax revenue over 10 years. The Cuomo camp maintains that the new program will bring significantly more affordable housing, making it worth the bigger price tag. The plan pushes the percentage of units required to be affordable to 30 percent in many cases, but also lifts the rent-stabilization requirements for many of the market-rate units built with the subsidy.

Although affordability requirements have risen in recent years, the 421a program has mostly subsidized market-rate apartments over it’s more than four-decade history. A December analysis by NYU’s Furman Center found that less than 15 percent of 421a properties contain rent-restricted units.