For whom the bell tolls: The industry loves a good crash-and-burn story. And if the protagonist is a mile-a-minute, patent leather-shoe-clad braggart kid from New Jersey, all the better.

Rafi Toledano has been a source of fascination for real estate players (and for me, personally) ever since he emerged as the buyer of the Tabak family’s East Village portfolio. When the former broker from Lakewood pulled off the $97 million purchase in September 2015, people asked themselves: Who is this kid and how the hell did he do it? Most people thought it the deal of a lifetime, a 16-building apartment package in a neighborhood where rents have been climbing steadily, bought for a song. They thought, however, that he would fall – an overleveraged rube, they said.

His confidence, however, remained supreme. In a memorable interview last year with The Real Deal, Toledano described himself as “the ultimate of developers because I’m taking a run-down, neglected building and developing it. Gary Barnett has the easiest job — he gets vacant land, he gets an architect, a good contractor, and he builds up. For me, it’s not like that.” He would hold on to the portfolio for life, he declared, and pass it on to his kids.

Things didn’t quite work out that way. On Feb. 3, his lender, Madison Realty Capital, filed to foreclose on the buildings, alleging that Toledano owes them about $140 million. It was a move that observers had said was long coming, and many expected Madison, a prolific developer in its own right, to take control – in fact, critics of the firm said they made the loan precisely for that reason. But Toledano, who had been scrambling to find a buyer in recent months, emerged with a deal that might see him walk away with a decent payday – sources told TRD that Joseph Sutton, son to Jeff, is in hard contract to buy the portfolio for $145 million. So even if Toledano settles his debts with Madison, he could be looking at a $5 million payday.

That’s a whole lot of shiny suits.

Rendering of Hudson Yards

Land it in the Hudson (Yards): KKR. Wells Fargo. BlackRock. Steve Cohen’s Point 72. And now perhaps Morgan Stanley. In less than two years, Related pulled off the extraordinary: It uprooted the traditional seat of big finance from Midtown, and planted it squarely on the Far West Side.

Defining a developer- demon or public servant?: It seems that developers, no matter how rich or powerful or revered in one-percenter circles they are, need to be seen as champions of the community. Find me a developer who hasn’t gone on about New York being “the greatest city in the world,” and I’ll show you someone who hasn’t mastered the game. Yet developers are often seen as vermin by the very people they hope to inspire.

At the 92Y last week, Harry Macklowe gave voice to this existential dilemma. “There’s this inherent prejudice that the developer is not even a wolf in sheep’s clothing,” he said, “that he is worse than a wolf and almost a predator.” Macklowe definitely has his scars from the court of public opinion – think of the infamous nighttime bulldozing of four Times Square buildings in the 1980s.

No bucks in luxe: In recent years, well-heeled New York renters in Brooklyn and Queens have had a plethora of options to choose from: landlords kept topping each other by offering amenities such as landscaped gardens, pet spas, Bentleys and the like. And the renters seemed willing to shell out the fat premiums those amenities came with.

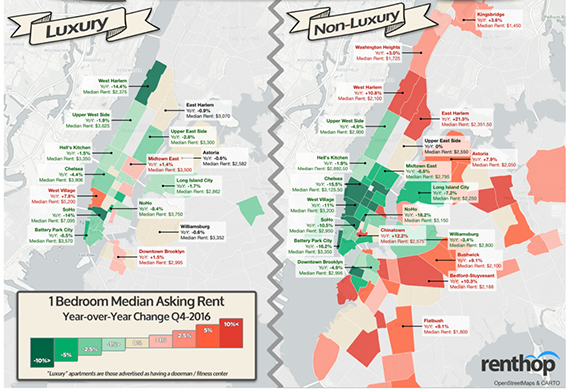

No longer. A fascinating new study from RentHop shows how luxury buildings in Brooklyn and Queens (defined as having either a doorman or gym) are seeing rents slide downwards, even as their more modest counterparts continue to see rising rents. In Manhattan, the rental market across the board is on the downswing – nearly a third of all leases signed in January included concessions, Miller Samuel data show.

There’s a lot of interesting implications here: Will the Hasidim of Brooklyn, for example, tweak their plans for amenity-stacked luxury rental projects in neighborhoods such as Bushwick and Williamsburg? Since they bought their land relatively cheap, there might be more room for them to settle for lower rents than say, luxury rental developers in Manhattan, who could be caught on the back foot.

In the public eye: Howard Lutnick’s ready to let Newmark out the nest. His firm, BGC Partners, submitted paperwork with the SEC related to an IPO for the brokerage. Between that move and the public offering, there’s bound to be heaps of activity at the firm: It’ll likely look to scale up and make some big-name hires to make it a sexier prospect for investors. Though its capital markets group had a big year in 2016, with revenues up 43 percent, the leasing division, the firm’s biggest, saw revenues drop 11 percent. Cushman, also on the IPO track, has already made some chest-pounding moves, and Colliers, which spun off from FirstService less than two years, followed suit. It’ll be fun to see what Lutnick’s lot comes up with.

(Paydirt is a weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick. Read more from Paydirt here.)