President Donald Trump began moving his New York City real estate portfolio into the “Donald J Trump Revocable Trust” on Dec. 31 and New Year’s day, according to an analysis of city property records by The Real Deal.

So far, the president has transferred 71 properties — mostly condominium units inside just a handful of buildings — into his personal trust, one that he promised would be run his eldest sons Eric and Donald Trump Jr, as well as longtime Trump Organization executive Allen Weisselberg.

To date, Trump has transferred holdings in Trump Tower, Trump International Hotel and Tower, Trump Park Avenue and Trump World Tower into the trust, according to TRD‘s analysis of city records. The president’s ground lease on 40 Wall Street and interest in The 1290 Avenue of the Americas office tower, which he co-owns with Vornado Realty Trust, and other properties, however, have not yet officially transferred. It’s unclear if his primary residence, a triplex penthouse at Trump Tower, will eventually be transferred into the trust.

The transfers began hitting ACRIS, the city’s property transaction database, on Thursday and continued throughout the day Monday.

Representatives for both President Trump and the Trump Organization did not immediately return requests for comment.

Trump’s trust, registered in New York, is not new, and already holds many of Trump’s other ownership entities for properties outside of New York, such as the LLC for the lease at the Trump Organization’s new Washington, D.C. hotel — a lease that many argue is in violation of its own terms since the federal government leases the land to the Trump Organization.

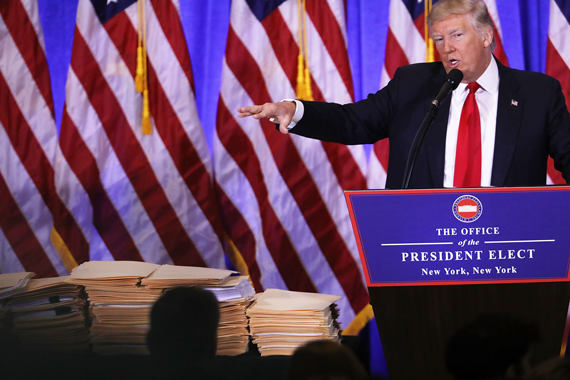

At a raucous Jan. 11 press conference in which Trump barked at CNN reporter Jim Acosta, calling him “fake news,” then President-elect Trump announced that he would move all of his assets into a trust not controlled by himself, in order to avoid the appearance of conflicts of interests. The president also pledged that the trust would have an independent ethics adviser not affiliated with the Trump Organization as well as an internal officer to monitor compliance. Last week, the Trump Organization named that adviser and internal officer. Bobby Burchfield, an adviser to both Bush presidents will serve as ethics adviser and George Sorial, a 10-year Trump Organization veteran, will take on the compliance role.

Critics, including the director of the federal Office of Government Ethics, denounced the move, insisting the president could only truly avoid conflicts of interest through a complete divestment from all of his holdings, not simply a transfer to family members and company associates.

When Trump named his son-in-law Jared Kushner to the position of Senior Adviser earlier this month, Kushner too announced he would place many of his assets into a family-controlled trust and step down as CEO of his family firm.

But so far, there does not appear to have been any change in the ownership entity affiliated with Kushner Companies’ 666 Fifth. Records show the property is owned by 666 Fifth Associates, a Kushner Companies-affiliated entity. Kushner Companies is now headed by President Laurent Morali, while Jared Kushner’s father, Charles Kushner, is operating in an advisory role, a spokesperson said.

A spokesperson for Kushner Companies reiterated prior statements that Jared Kushner will divest from over 35 investments, including his interests in the Observer, Thrive Capital, 666 Fifth Avenue, numerous Kushner Companies’ entities and any foreign investments. Some of Jared Kushner’s assets will be sold to a trust administered by his mother Seryl, with his brother Josh buying some of the assets.

Though Kushner has taken greater steps toward addressing potential conflicts than his father-in-law, ethics experts have similarly raised concerns about whether transfers of interests to family members can be considered a true divestment.

Revocable trusts, or living trusts, are typically used as an estate-planning tool and are designed for elderly or ill property owners looking to prepare their estates for when they die. Such trusts can be completely modified or even terminated by the person who establishes them — in this case, Trump — right up to their death.

During the life of the trust, it is customary for earnings to be distributed to the person who established the trust, while the trustees make day-to-day decisions.