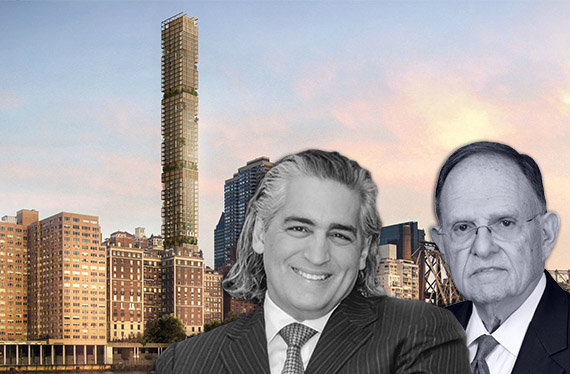

Fortune doesn’t always favor the bold. Bauhouse Group principals Joseph Beninati, Christopher Jones and Daniel Lee are on the hook for more than $24 million because of personal guarantees they signed on loans tied to their former condominium project at 3 Sutton Place, a judge has ruled.

The principals — who had never attempted such an ambitious development project before — were ordered Wednesday to repay the money to their lender Gamma Real Estate [TRDataCustom], which is run by N. Richard Kalikow and Jonathan Kalikow. Gamma prevailed in a foreclosure auction of the property last month.

The court agreed that the loan had been properly funded, despite the principals’ arguments that mezzanine portion of the debt had never actually been funded.

“We are pleased with this latest rejection of Bauhouse’s scorched-earth litigation tactics,” said Jay Neveloff, Gamma’s attorney. “Bauhouse has fought tooth and nail to avoid repaying its loans to Gamma and has lost every step of the way.”

Beninati did not immediately respond to a request for comment.

In a statement, Gamma’s attorneys also pointed to the Bauhouse Group’s personal financial woes, which suggests potential difficulties in repaying the debt.

Beninati and Jones have been slashing the sale prices of their personal properties, the law firm said. In the fall, Beninati reduced the offering price of his 16,000-square-foot, six-car-garage mansion in Greenwich, Connecticut to $14.9 million, more than 25 percent below its initial asking price last spring. In September, a Connecticut entity linked to Beninati and his wife Rhonda Beninati filed for Chapter 11 bankruptcy protection, citing liabilities between $500,000 and $1 million, TRD reported.

Bauhouse assembled the site with $147 million in several high-interest loans, including approximately $20 million in mezzanine debt, from Gamma. But in January, Beninati defaulted on the loans and subsequently filed for bankruptcy to prevent Gamma from foreclosing on the property. Gamma finally acquired the site in a hotly anticipated foreclosure auction. According to a Crain’s article, Beninati invested just $5 million into the Sutton Place project.

Late last month, Gamma filed plans for a 844-foot tower with 369 apartments, though it told The Real Deal that it mostly did so to “safeguard” the property. Community activists and local politicians are pushing for a moratorium on all development over 260 feet.