Manhattan’s residential landlords are offering concessions at record levels, as rents remain flat and inventory continues to rise.

Just under 24 percent of all Manhattan leases signed in October had some type of landlord concession, which marks a high of at least six years. By comparison, just over 10 percent of Manhattan leases signed in October 2015 included concessions, according to a new monthly rental report from Douglas Elliman. In Brooklyn, 12 percent of leases signed in October had concessions, up from 8 percent in the same time period last year.

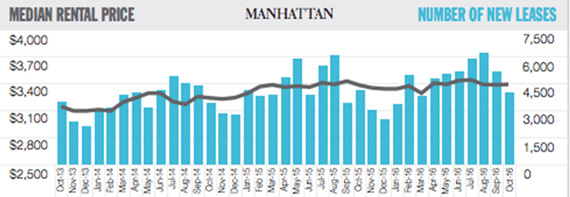

Net-effective median rent prices in both Manhattan and Brooklyn are trending downward, although the changes were not significant. The median rent in Manhattan, taking concessions into account, declined one percent to $3,322. Brooklyn’s median rent, including concessions, fell 0.5 percent to $2,841, the third year-over-year drop in four months. Listing inventory in Manhattan rose 22 percent year-over-year to 7,132. Inventory in Brooklyn also rose 26 percent year-over-year to reach 2,564 listings.

But as is the case with the high-end residential sales market in Manhattan, the luxury rental market is continuing to drop. According to Jonathan Miller of appraisal firm Miller Samuel and author of the report, excess high-end product is causing a softening of that part of the market.

In Manhattan, the median rent for the top 10 percent of the market fell by 11 percent year-over-year to $7,792. Luxury properties in Brooklyn also took a hit. The median for the top 10 percent of rentals in the borough fell by 9 percent year-over-year to reach $5,309. Miller expects rents to remain flat for some time.

“I see rents stuck at a high plateau because of the current strong economic conditions in the city,” Miller said.

In northwest Queens, however, it is a different story. The median rental price in the borough is $2,900, which is a 13 percent increase compared to October 2015. The top 10 percent of properties in the area had a median price of $4,850, a year-over-year rise of 7 percent. Miller pointed out that the northwest Queens rental market has “increased and decreased equally” over the first 10 months of 2016, which indicates overall price trends are “choppy but stable.”

A separate monthly report from Citi Habitats also pointed to a big jump in rental concessions. The report found that 26 percent of new leases contained concessions, compared to 8 percent year-over-year. Concessions have not been this prevalent during the month of October since 2009, according to the report.

“Incentives remain the preferred alternative for owners to keep face rents high while creating a sense of value in the marketplace,” said Gary Malin, president of Citi Habitats. “However, they haven’t shifted the market back to their favor – yet.”