Vornado Realty Trust is mulling selling a spinoff of its Washington, D.C., business to rival JBG Companies in a deal that could be worth up to $6 billion.

The Washington portfolio consists of more than 16 million square feet of office space, which would be spun off into its own company and then acquired by JBG, Bloomberg reported. The deal — if it goes through — could be worth $4 billion to $6 billion. No final decisions have yet been made.

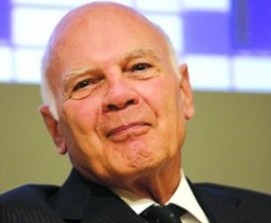

Vornado [TRDataCustom], led by Steven Roth, has rallied of late to consolidate its assets and focus its energies on its core market, New York City. The REIT sold its last Los Angeles property — a 43,000-square-foot Class A office property — earlier this month.

Vornado has been considering selling its Washington office since at least early last year. In an April investor letter, Roth wrote that the REIT has considered “options with respect to our Washington business, such as inviting in a new investor(s) or even separating the business in a spin or in a spin-merge.”

Meanwhile, JBG, which is based in Maryland, ended a merger agreement with New York REIT in August that would have created a publicly traded company with holdings in New York and Washington. Some shareholders opposed that deal. [Bloomberg] — Kathryn Brenzel