For the first time in seven years, the Manhattan office market is set to have a negative absorption rate, as leasing activity through the third quarter hasn’t been able to keep pace with additional supply.

Absorption year-to-date sits at negative 2.2 million square feet, according to Colliers International’s [TRDataCustom] third-quarter office report. Unless the fourth quarter delivers some unexpected surprises, this will be the first year Manhattan sees negative absorption since 2009.

“Unless several large blocks of space are leased, or otherwise removed from the market to counter the year to date negative absorption, Manhattan will have negative yearly absorption for the first time since 2009,” said Franklin Wallach of Colliers’ research group.

By the third quarter of 2009, the absorption rate plunged to negative 9.09 million square feet as tenants shed space amid the financial crisis. This time around, the rate is negative due to additional supply, namely in places like the Far West Side and the Financial District.

Despite the addition of new supply, however, the Downtown market shows positive absorption of nearly 570,000 square feet, while both Midtown and Midtown South were negative.

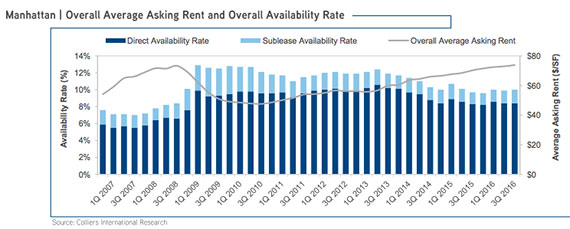

The average asking rent in Manhattan climbed to $73.85 – surpassing its 2008 peak – primarily on rising rents in Downtown and Midtown South. For the past two quarters, Midtown South has been the most expensive office market in the city, the Wall Street Journal recently reported.

Midtown’s average asking rent of $83.49, however has yet to climb back to its 2008 peak.