Developers are finally taking off their rose-colored glasses. The target offering price of new condominiums approved for sale in New York City is down 34.4 percent year-over-year, despite only a slight drop in the number of offered apartments, according to a new analysis by The Real Deal of offering plans. The data shows just how much developers rolled back on ultra-luxury projects over the last year.

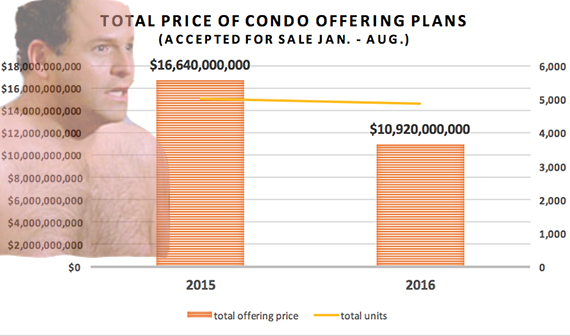

The New York State Attorney General’s real estate finance bureau approved 188 residential buildings with a total of 4,869 condo units through August 2016, for a collective total offering price of $10.92 billion. Compare that to the same period in 2015, when $16.64 billion in new condo offerings were approved across a similar number of projects, 187, and a similar number of units, 4,995.

“This trend makes perfect sense because it demonstrates what we’ve been hearing and seeing since a year ago,” said Jonathan Miller [TRDataCustom], CEO of appraisal firm Miller Samuel. “Developers retooled their projects to better target the sweet spot of the market, which is the lower-end of the new development spectrum, below $5 million, but especially between $1 and $3 million.”

In Manhattan, however, both the price and number of new apartments fell significantly.

There are 2,014 Manhattan condo units approved for sale so far this year, pegged at a total offering price of $7.8 billion. That’s down from 2,908 condos equaling $14.4 billion in 2015, a 45.8 percent drop in asking sales volume and a 30.7 percent drop in accepted supply.

“What you’re really seeing is an increase in the product from the stronger part of the market,” Miller said, characterizing the drop as more of a boost to the $1 million-$3 million supply stock than a loss to the greater condo market where many units are languishing on the market.

“Predominantly, it’s the type of product that’s changing,” said real estate attorney Pierre Debbas. Last year saw marquee new luxury developments hit the market, such as Vornado Realty Trust’s 220 Central Park South ($3.1 billion sellout), Hines’ 53 West 53rd Street ($2.13 billion) and Witkoff’s 111 Murray ($1.04 billion). This year saw the Related Companies bring two big projects to market, 15 Hudson Yards ($1.74 billion sellout), and 70 Vestry ($710 million) and Bizzi & Partners 565 Broome Street ($651 million). Lenders, too, are reticent to cough up funds for new luxury projects, sources told TRD, but are more open to financing projects that hit more affordable price points.

Queens and Brooklyn saw steep increases in the total offering price of new condo supply in the first eight months of 2016 compared to the same period last year. Brooklyn went to a total sellout price of $2.09 billion from $1.53 billion, a 36.7 increase in asking sales volume, and the number of condo units jumped 13.7 percent to 1,657. In Queens, the total sellout price hit $1.09 billion from $690.3 million, a 57.9 percent jump in asking sales volume and a 98 percent jump in new units to 1,158. (The Queens numbers, however, included PMG’s $394 million plan for 391 apartments in the tower at 21-10 Queens Plaza South, a project that PMG representatives told TRD earlier this year it planned to keep rental, despite getting the offering plan accepted. PMG and partner Hakim Organization have since put the development site on the market.)

“During this boom, the mantra was Manhattan is condo and Brooklyn and Queens are rental,” Miller said. “In Brooklyn one could argue there’s a shortage in new condominiums because so much effort has been directed toward the rental market,” he said.

Although he acknowledged the increase in activity in Brooklyn and Queens, Shaun Pappas, a condo attorney at Starr Associates, said he doesn’t expect overall condo development to tilt the way of the outer-boroughs anytime soon. “It’s hard for me to bet against Manhattan,” Pappas said, emphasizing that there was no shortage of money coming from overseas in the post-Brexit universe. “I think more money is going to flow into the Manhattan market over the next few years as the European markets kind of shake themselves out.”