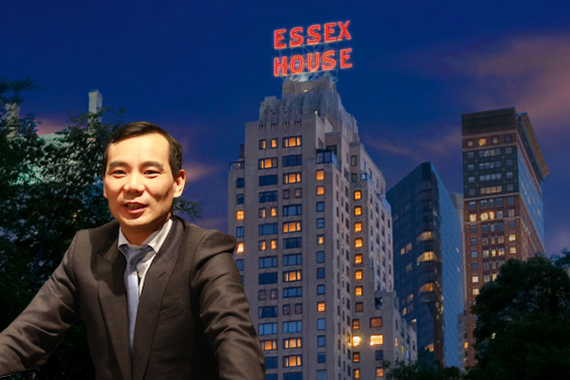

Anbang Insurance Group closed on its acquisition of the Strategic Hotels & Resorts portfolio from the Blackstone Group. The Chinese insurance company bought 15 of 16 of the U.S. properties, which includes the iconic Essex House at 160 Central Park South.

Anbang reached a deal with Blackstone [TRDataCustom] in March to pay $6.5 billion for 16 hotels, but the purchase of the portfolio’s 16th and final property, Hotel del Coronado near San Diego, is under review by the inter-agency Committee on Foreign Investment in the United States, Bloomberg reported.

The deal is the biggest real estate purchase by a Chinese company in the U.S. to date, according to Bloomberg, and part of Anbang’s two-year shopping spree for foreign investments, including the $1.95 billion purchase of the Waldorf Astoria.

The Chinese insurer, which is looking to make a public offering in China, is best known in the U.S. for its aborted $14 billion bid to buy Starwood Hotels & Resorts, also in March.

In a move that mystified and rattled investors, Anbang first made a $12.9 billion bid for Starwood, which had already agreed to sell to Marriott, then after starting a bidding war, abruptly withdrew its offer, which had escalated to $14 billion.

Marriott completed its acquisition of Starwood last week.

Anbang’s real estate assets are worth $120 billion, and owns properties in Belgium, Holland, the U.S. and Canada. It was one of a wave of Chinese companies investing in New York and U.S. real estate. The Real Deal looked at seven iconic properties owned by Chinese investors. [Bloomberg] — Chava Gourarie

Correction: A previous version of the story provided an incorrect valuation for Anbang. Its real estate assets are valued at $120 billion.