Chinese financial services firm China Orient Asset Management Corp. paid $143 million to buy a majority stake in four Flatiron office buildings controlled by the Kaufman Organization, property records show.

News of the deal broke last week when it was reported that China Orient invested about $60 million of equity in the buildings, part of the former Ring Brothers portfolio that Kaufman controls under a 99-year lease.

But the asset manager also took out debt on properties, bring the total purchase price to $143 million, records filed Monday with the city show.

China Orient bought out Kaufman’s previous partner, the Iowa-based Principal Real Estate Investors, which had planned to exit the properties once they started to become stabilized.

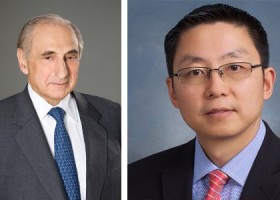

“It was an opportune time for the majority existing owner to sell their interest given their original investment thesis,” said Fredric Leffel, president of Kaufman’s new ventures group.

Kaufman retains a small stake in the buildings and will continue to manage them. The landlord and its original partner acquired 99-year ground leases on from Extell Development [TRDataCustom] in 2014 on the four properties: 19 West 24th, 13 West 27th, 45 West 27th and 119-125 West 24th streets.

The buildings, spanning a combined 341,000 square feet, had been part of the portfolio of 13 neglected buildings that Extell acquired from Frank Ring. Kaufman and Principal pledged to pump $34 million into upgrading and modernizing the buildings.