The embattled New York REIT will look to sell off properties after a proposed $8.4 billion merger with Washington-area landlord JBG Companies fell apart.

The real estate investment trust, which for the last year faced criticism over its external management, had proposed merger with JBG [TRDataCustom] as an alternative to selling off its properties at market prices.

But on Tuesday, JBG managing partner Matt Kelly released a statement saying the deal was dead, Bloomberg reported.

“We were unable to modify the transaction to the degree that would likely have gained shareholder approval,” he said.

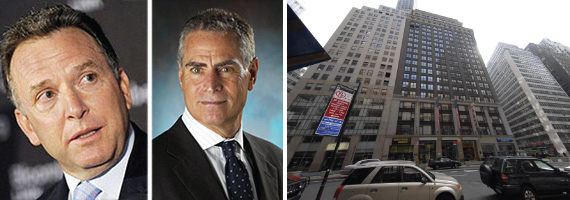

Shareholders Steve Witkoff and Winthrop Realty Trust CEO Michael Ashner, who invested in the company through their WW Investors LLC, opposed the deal, calling it “one of the worst strategic transactions proposed to stockholders by a REIT board in recent memory.” They proposed a slate of five candidates to replace the board in late June.

New York REIT will now look to sell off its assets and return the proceeds to investors. Those include the 750,000-square-foot building at 1440 Broadway just south of Times Square that is home to Macy’s, Mizuho Financial Group and Citigroup.

The REIT also owns a 49 percent stake in the 1.8 million-square-foot tower at Worldwide Plaza On Eighth Avenue. It will search for financing to buy the majority stake, owned by George Comfort & Sons, and to repay its $485 million credit facility.

Shares rose 5.5 percent to $10 on news of the scuttled merger, the biggest gain in the Bloomberg REIT Index, which fell 0.7 percent.

New York REIT first came under fire when investor Nicholas Schorsch, who was connected to the external manager, resigned from the board and 12 other companies in late 2014 after accounting inaccuracies were revealed at another of his companies, American Realty Capital Properties. [Bloomberg] – Rich Bockmann