(Editor’s Note: This story first ran on March 24, 2016.)

TRD Special Report: On December 10, 2013, regulators summoned the nation’s biggest title insurance firms to 1 State Street.

Much of the hearing focused on the technicalities of title insurance fees and covenants. Representatives of firms in attendance, including Fidelity National, First American, Old Republic, and Stewart, spoke of enabling “the American dream of homeownership.” But then came a question about strip clubs.

Joseph DeSalvo, First American’s senior legal counsel, was asked why his company expensed trips with clients to Blush, a gentleman’s club just off of Route 454 on Long Island.

“Do you think that’s a proper use of premium?” Ellen Buxbaum, a state regulator, asked. “I wouldn’t comment,” DeSalvo replied. But when pressed, he acknowledged that spending millions on wining and dining clients was essential to the business.

“If it’s not entertainment, we would have to market our product in some other fashion,” he said. “So from that standpoint… this has worked out well.”

Title insurance, which in 2014 reaped an operating income of $12.2 billion and net income of over $800 million, has always been an opaque corner of real estate. Though technology has made title searches simpler and cheaper for firms, buyer premiums have continued to rise, given that the industry colludes to keep prices artificially high and uses political clout to block competition, effectively functioning as a cartel.

Title insurance rates in New York are regulated by the state, and since 1993, underwriters have worked together to propose uniform rates through a membership organization, the Title Insurance Rate Service Association (TIRSA), which is led by the industry’s dominant players — Stewart’s John Frates is currently president. While underwriters may file their own rates — deviating from the industry standard — almost none do.

Attempts to regulate the industry more closely have failed. An effort Gov. Andrew Cuomo launched last year to crack down on kickbacks and “inducements” is now dead in the water, according to several sources. And even the Treasury Department’s new requirement that title companies must disclose the identities of buyers who purchase luxury Manhattan real estate anonymously is said by many experts to lack teeth.

“People speak about title insurance seldom with the understanding of the vital role that our industry plays in ensuring that the great and good people of the State of New York have clear ownership to their homes,” Old Republic’s chief underwriting counsel Marvin Bagwell said at the 2013 hearing. But part of that lack of clarity seems to be by design; firms are able to get away with so much precisely because it’s so difficult to answer this question: How does the title insurance industry work?

The Real Deal attempted to find out.

The gang’s all here

A photo circa 1901 of the Santa Ana offices of the Orange County Title Company, predecessor to First American (Credit: First American)

Title insurance in the U.S. emerged in the 1870s as a way to protect buyers from dubious real estate deals. Entrepreneurs would head to county courthouses to copy land records by hand, in an attempt to ensure their clients’ deeds were accurate and free from any lien or fraud.

Martin Kravet, CEO of Royal Abstract, a Midtown-based title agent for developers such as SL Green Realty, Related Cos. and JDS Development Group, thinks of title insurance not as an insurance policy but as a “risk-avoidance product.”

Typically, insurance underwriters and agents such as Royal Abstract research a deed and “cure” any defects. Buyers pay a premium to ensure that in the rare event a deed is challenged, they are off the hook.

“It’s like an umbrella on a sunny day,” said Boaz Gilad, co-founder of Brooklyn-based developer Brookland Capital. “But for the 1 percent of deals that do go bad, you need title.”

Today, title insurance is a multibillion-dollar industry in the U.S. that employs over 50,000 people and enjoys a loss ratio of just 7 percent — for every $100 collected in premiums, it pays out just $7 in claims, according to ratings agency A.M. Best.

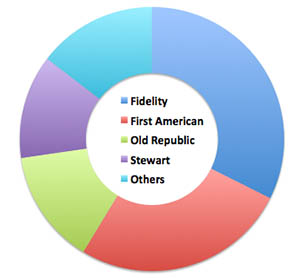

It is also extraordinarily consolidated: According to the American Land Title Association (ALTA), the industry’s main trade group, nearly 90 percent of the market is held by just four underwriters: Fidelity, with 32.4 percent; First American, with 27.9 percent; Old Republic., with 14 percent and Stewart, with 12.7 percent. Together, the “four families” wrote premiums totaling $8.4 billion nationwide in the first nine months of 2015, ALTA data show.

The title insurance industry is extremely consolidated, with just 4 firms controlling nearly 90 percent of the market (Source: ALTA)

These underwriters, however, farm out most of the heavy lifting to a vast network of agencies. Title agents — often attorneys or paralegals who in New York must get licensed — sell the bulk of insurance policies on behalf of the underwriters, and keep the lion’s share of the premium fees, roughly 80 percent. There are approximately 2,800 licensed title agents in New York State, according to the New York State Land Title Association, a state trade group. NYSLTA estimates the title industry in New York employs 10,000 people (directly and indirectly), spending about $500 million annually on salaries.

[vision_pullquote style=”3″ align=””] “It’s like an umbrella on a sunny day, but for the 1 percent of deals that do go bad, you need title.” — Brookland’s Boaz Gilad [/vision_pullquote]

In New York, residential brokerages are also dabbling in title. Manhattan-based Skyline Title Agency is owned by Realogy, parent company to the Corcoran Group and Citi Habitats. Thoroughbred Title Services is an offshoot of Westchester-based Houlihan Lawrence, and Long Island-based DE Title Services is an affiliate of Douglas Elliman.

But title remains a bit player in the brokerage business: DE Title, for example, grew its revenue nearly 55 percent during the first nine months of 2015, but the company still racked up just $3.3 million worth of title fees compared to $449.5 million worth of commission and brokerage income during the same time, according to regulatory filings by Vector Group, parent company of Elliman and DE Title.

The price is right

Steven Day, EVP at Fidelity National

New York’s title insurance rates are among the highest in the country. Buyers of a $1 million pad in Manhattan, for example, would pay $5,162 for title insurance, according to Old Republic’s online rate calculator. Compare that to $2,431 in Los Angeles, $3,650 in New Jersey, $4,900 in Pennsylvania and $5,660 in Florida.

Since rates are a function of real estate values, rising prices have kept premiums high in recent years. Manhattan’s median apartment sales price topped $1 million in 2015, up nearly 22 percent from a decade earlier, according to data from appraisal firm Miller Samuel. Deal volume is also up. Last year, the number of sales hit 11,955 — a 41 percent jump from 2005.

Insurers wrote $830 million worth of premiums in New York during the first nine months of 2015, according to ALTA, a year-over-year growth of nearly 21 percent and the fourth-highest total nationwide. But on top of these premiums are a slew of payments that can significantly boost the consumer’s overall cost.

Many agents, for example, take gratuities — ranging from less than $100 for a residential closing to hundreds of dollars for a commercial closing — as a given. Underwriters have taken a hands-off approach to the matter.

“The closers who we engage to perform the services and be our representative are independent closers,” Fidelity’s Steven Day said at the hearing, and added that gratuities were not “something that we have taken a position on.”

First American’s DeSalvo followed by comparing the practice to tipping at a restaurant.

“Why do you give a waiter a tip at the end of the meal?” he asked. “Shouldn’t he be adequately compensated by the restaurant for the services he performs and shouldn’t you have the ability to walk out without paying a 15 to 20 percent gratuity? It’s the same argument, isn’t it?”

On top of the sweeteners are the myriad of fees, some of which are unique to New York. If a closing takes longer than two hours, an attendance fee is sometimes charged, the underwriters said at the hearing. Sellers are also occasionally charged a pick-up fee, in some cases per mortgage, to retrieve the documents.

“I was a little shocked when I first found out about it,” Ted Dacey of Thoroughbred Title Services said of New York’s specific add-ons at the time. “I [had] been in the business in a number of other states. I didn’t know what a pick-up was. I certainly didn’t know what a tip was with respect to a closing, but just sort of went with the flow.”

Snapshot of mergers and acquisitions listed on ALTA’s website

Some startups sense an opening.

From left: Daniel Price and Jason Gordon

“The fact that all of our major competitors work together to set rates certainly hasn’t created downward pricing pressure,” Daniel Price, CEO of OneTitle National Guaranty Company, told TRD.

He said OneTitle nixed so-called “junk fees” and offers lower rates since it filed its own rate schedule with the state – something that’s possible, although rarely done. Since it launched in 2014, OneTitle has raised $17 million in funding from investors, including $13 million from White Mountains Insurance Group, a publicly-traded underwriter.

Another recent entrant is AmTrust Financial Services, a $5 billion insurance giant that jumped into the title game two years ago after seeing a lack of competition among underwriters.

[vision_pullquote style=”3″ align=”right”] “I certainly didn’t know what a tip was with respect to a closing, but just sort of went with the flow.” — Thoroughbred’s Ted Dacey [/vision_pullquote]

“Our entry to the market signals to those players that we have the capacity and the market size to compete,” said Jason Gordon, president of AmTrust’s title division. Last year, AmTrust wrote just over $4 million in premiums, but Gordon said the company plans to aggressively expand its agency network. He described the competition as “fierce.”

“There’s a lot of agents and essentially that’s how they’re driving business, through transaction volumes,” he said.

Go with my guy

With set prices and a largely uniform product, how do title firms get ahead of the pack?

One of the earliest parties of the holiday season is hosted by Riverside Abstract, a prominent Brooklyn-based title company. More than 1,000 industry executives gathered for Riverside’s bash at ArtBeam to feast on sushi and lamb chops, knock back vodkas and schmooze while techno music blasted throughout the Chelsea loft space.

“All they needed was a few strippers,” one developer who attended said. And the Riverside Abstract party wasn’t an anomaly; title firms have a reputation for going all-out with their events.

[vision_pullquote style=”3″ align=””] “You can’t compete on price, so if someone is going to want to do business with you, one of the ways to [win] business is to service the heck out of them.” — Excalibur’s Douglas Forsyth [/vision_pullquote]

Riverside co-founder Yoel Zagelbaum said the party is the company’s signature event. “We really look at it twofold,” he said. “It’s a thank-you to our clients, and a thank-you to people we work with, a way to show our appreciation and celebrate another year.” Zagelbaum noted that each year, guests tell him they landed business or closed a deal as a result of a connection made at the party. “What goes around comes around,” he said.

“You can’t compete on price,” said Douglas Forsyth, CEO of Excalibur Title Agency, which he formed in 2009 in partnership with TitleVest, a national title agency that was acquired in March 2015 by First American. “So if someone is going to want to do business with you, one of the ways to [win] business is to service the heck out of them.”

Title agents express their gratitude to clients in many ways, frequently donating to charities of their choice or paying for trips.

“No one gets a discount on title,” one prominent New York City investment sales broker said. But “people let title companies treat them well.”

At the 2013 hearing, industry executives tried to put a positive spin on the practice.

“We’ll talk about the 800-pound gorilla in the room,” said DeSalvo of First American, who earlier defended his company’s visit to a gentleman’s club (which occurred under different leadership, he pointed out).

“We participate in that fashion [in entertainment expenses] just like any other company to be competitive within our market,” he said. “It’s not a quid pro quo.”

Excalibur’s Forsyth also found himself on the defensive during the hearing, when regulators noted he spent more than half of his firm’s fees on meals and entertainment in 2011. “That was a tough year,” he said, adding that his company didn’t bring in as much revenue as it projected and therefore went over budget on entertainment.

Martin Kravet

“There is a limit,” said Royal Abstract’s Kravet. “If it sounds egregious, it probably is.” Kravet said he prefers to host cocktail parties to help his clients and friends network. “I don’t ask for a referral fee,” he said. “It’s part of the circle of life – of helping people and ultimately, it comes back to you without having your hand out all the time.”

Lawyers, mortgage brokers and real estate agents can make key referrals, and so underwriters spend millions to woo them. In 2006, a Forbes article reported that First American spent $120,000 a month courting real estate agents with season passes to sporting events and other freebies.

But for title insurers, developers can be the golden ticket.

“I get daily offers, requests for meetings, messages offering anything you want to move title to someone else,” said Brookland’s Gilad. “The premium is very high, so if you get someone like us with dozens of transactions a year, it’s a big account.”

Brookland works exclusively with a small title firm, Downtown Abstract, that proved itself by killing several deals that “didn’t smell right,” Gilad said.

“Instead of looking at it as fees – because it’s a fixed-rate business — I try to say to myself it’s the cost of a deal, like transfer tax,” said Eli Weiss of Joy Construction. Developers often use title as a tool to fully vet a site, he said. “At the end of the day, it’s really who you can get on the phone late at night when you have an issue,” he added.

With new condo buildings, developers may suggest a title company to buyers.

Boaz Gilad and a rendering of Brookland’s condo project at 550 Fourth Avenue in Park Slope (credit: RoArt via New York YIMBY)

“Sometimes they [the sponsor’s title insurer] can charge you a little less and give you a little bit of a break on some of the search,” said Peter Schwartz, head of the real estate practice at law firm Graubard Miller. “Everything about the building is the same. The only thing that changes is the individual buyer because it’s the same seller.”

In what sources said is an increasingly popular practice, commercial buyers will form a joint venture partnership with the title company on their deal, in order to receive a cut of the title fee after closing.

“There’s a gray line that no one wants to talk about,” one top broker said. “It’s something everyone knows.”

Lenders, too, often weigh in on the title process.

“There are lenders who say, ‘We have requirements, we only do business with certain underwriters,’” said Forsyth. Sometimes, they take it a step further.

Aaron Shmulewitz, an attorney at Belkin Burden Wenig & Goldman, said some lenders own “captive” title companies and may tell buyers that the interest rate on their loan is only as low as it is because they are using the bank’s title company.

“While there are all sorts of disclaimers that you are free to use the title company of your choice, there is no doubt as to the wishes of those particular lenders and brokers,” he said. “Sort of, ‘Nice little deal you’ve got there; it would be a real shame if something happened to it.’”

Catch me if you can

By 2013, widespread “inducements,” a term referring to a quid-pro-quo way of winning business, warranted attention from Benjamin Lawsky, the state’s top insurance regulator. New York title insurance accounted for just 9 percent of premiums written nationwide in 2012, but represented 21 percent of national expenses, according to data disclosed during the 2013 hearing. These excessive expenses, regulators reckoned, amounted to $65 million.

Cuomo’s effort to curb inducements and kickbacks in the title industry flopped, sources told TRD.

“The [proposed regulations] were withdrawn, mainly because they were so terribly flawed,” said Bob Treuber, executive director of trade group NYSLTA. A key “inadequacy,” he said, was the lack of distinction made between legitimate marketing and inducement. NYSLTA “is a staunch advocate for trying to drive out some of this kickback-type behavior,” Treuber said.

The Cuomo administration “is in the process of reviewing the public comments” it has received, a Department of Finance Services spokesperson said, but declined to comment further.

Though several of the underwriters declined to comment, a representative for Stewart said the firm welcomes the governor’s “efforts to provide clarity to the market place on business conduct.”

And the Treasury Department’s new LLC disclosure rule, which requires title insurers to identify the true buyers of Manhattan homes over $3 million acquired in-all cash deals through shell companies, is so flawed that it’s effectively useless, sources said. For one thing, it only focuses on sales completed with paper checks and dollar bills, even though wire transfers are ubiquitous in so-called “all-cash” deals.

The wire transfer loophole is “large enough you can drive a fleet of trucks through,” Shmulewitz told TRD in January shortly after the Treasury Dept. announced its initiative. A spokesperson for the department said at the time that it would “adapt in the future accordingly” if it saw a shift to all-wire transactions.

Reforming the title industry is made trickier by its political heft.

Clockwise from top left: ALTA’s Michelle Korsmo, John Boehner, Eric Cantor, Tom Suozzi and Andrew Cuomo

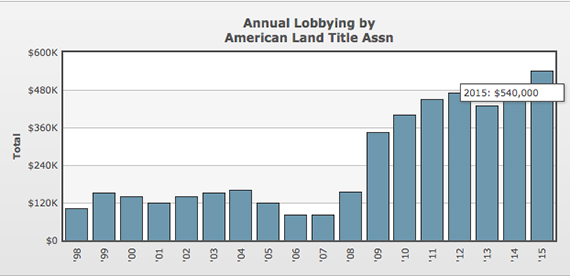

Between 1990 and 2014, ALTA spent at least $4 million on campaign contributions and at least $4.5 million on lobbying, according to data from OpenSecrets, a website by the Center for Responsive Politics that tracks campaign finance. In 2014, ALTA donated large sums to Republican lawmakers, including former Speaker of the House John Boehner (R-Ohio) and former Rep. Eric Cantor (R-Va.), both of whom championed legislation allowing the industry to charge higher fees.

On the state level, title companies donated nearly $261,000 since 2010 to New York’s elected officials (and candidates), according to New York State Board of Elections data. Cuomo, too, has been a beneficiary, with contributions from First Nationwide Title Agency, New York State Title Agents PAC, All New York Title Agency, Benchmark Title and Trinity Title and Abstract. Other politicians with title money in their coffers include former Suffolk County executive Tom Suozzi, who the industry backed against Eliot Spitzer for the Democratic gubernatorial nomination. As New York Attorney General, Spitzer had launched an investigation into price-fixing and corruption in the title industry.

And the industry came under scrutiny again during last year’s arrest and trial of Dean Skelos, the former Republican majority leader in the State Senate, and his son Adam, a former vice president at Long Island-based title agency East Coast Abstract Group.

In February 2011, the Skeloses met with Tishman Speyer CEO Rob Speyer at Rockefeller Center, according to a May 2015 criminal complaint. A month later, the developer retained Adam to produce a title report for its Chrysler Building.

The complaint also refers to an incident in which Glenwood Management’s Charles Dorego arranged for Adam to receive a $20,000 commission from a different title company, though Adam had done no work for the money. Neither Dorego nor Speyer were charged with wrongdoing in the complaint.

ALTA lobbying via OpenSecrets

But despite the air of scandal surrounding the industry, it has yet to face its day of reckoning. And its gatekeepers have been diligent about letting members know what is and isn’t kosher. In September 2013, for example, Phillip Schulman, an attorney with K&L Gates (now at Mayer Brown), conducted a webinar for ALTA members in which he went over the anti-kickback policies put forth in the Real Estate Settlement Procedures Act (RESPA), a consumer protection statute.

An “agreement or understanding need not be in writing or even articulated or verbalized,” one of Schulman’s slides said. It “may include a practice or course of action where the receipt of a THING OF VALUE is understood.” This was followed by a “Wink, wink.” (The wink illustrated how even an implied understanding could be a violation, Schulman told TRD.)

At the end of his presentation, he offered up a RESPA compliance pop quiz for “real estate agents, lenders, title agents and wayward souls.”