Brooklyn’s investment sales volume tumbled in the first half of 2016 as the expiration of the 421a tax abatement program exacerbated a cyclical slowdown, according to a new report by brokerage TerraCRG.

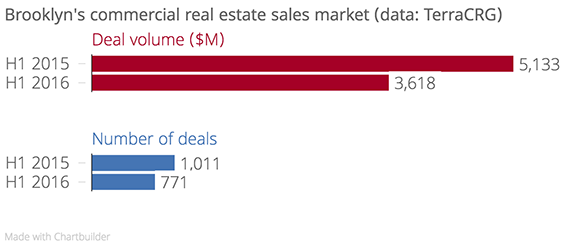

About $3.62 billion worth of commercial property deals closed in the borough until June 30 – down 30 percent from a record $5.13 billion during the same period last year. The number of transactions fell by 24 percent, down to 711 from 1,011 a year ago.

But brokers are optimistic creatures by nature, and TerraCRG’s [TRData] founder and CEO Ofer Cohen pointed out that sales were still strong by historical standards.

Last year, he said, “was a crazy year. We’re basically going back to more normal levels.” Cohen forecasts around $6.5 billion in deal volume for the full year, close to the $6.85 billion in deals recorded in 2014 but well below the $9.5 billion recorded in 2015.

January’s expiration of the 421a program for rental development put a damper on development-site deals, which fell 44 percent year-over year. The number of retail deals fell by 33 percent year-over-year, while the number of multifamily deals fell by 23 percent.

While sales volume fell, prices didn’t, Cohen said – in part because many property owners don’t need to sell.

“When the market isn’t as speculative,” he said, “there is less of a reason for discretionary sellers to put properties on the market.”

Greater Downtown Brooklyn saw $1.22 billion in deals in the first half of the year, leading all submarkets followed by North Brooklyn at $694.2 million. Earlier this week, Related Companies added to North Brooklyn’s tally by buying a Williamsburg rental portfolio for $60 million.