Pending home sales in the U.S. saw a slight dip in the month of May compared to the same period in 2015, the first year-over-year decline recorded in almost two years.

After a steady climb for three straight months, the pending home sales index slid 3.7 percent from April to May to 110.8, according to a report issued by the National Association of Realtors on Wednesday. That’s 2.6 percentage points higher than forecasted. The number of pending resales reflects a 0.2 percent decrease from May of 2015.

The NAR considers 100 to be a healthy figure on the index. The index hasn’t dropped year-over-year since August 2014, according to the NAR.

Despite the slowdown in May, overall projections for 2016 remain positive. NAR forecasts that 5.44 million previously owned homes will be sold this year, 3.7 percent more than last year.

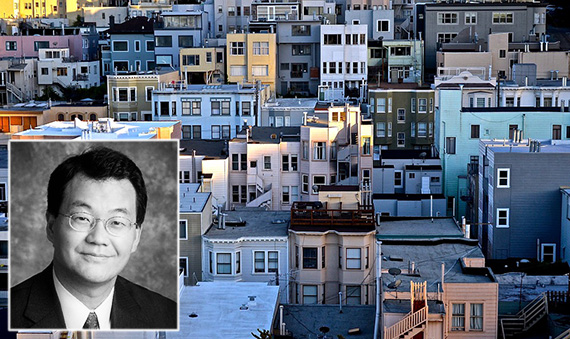

The cooling in May can be attributed to the increase in closings in the spring due to high demand and the high pace of sales, NAR chief economist Lawrence Yun said in a statement. Because of heightened activity in previous months, inventory fell and dragged down the number of contracts in May, he said.

“Total housing inventory at the end of each month has remarkably decreased year-over-year now for an entire year,” said Yun. “There are simply not enough homes coming onto the market to catch up with demand and to keep prices more in line with inflation and wage growth.”

The drop in pending sales from April to May was highest in the Northeast, with a 5.3 percent drop. The Midwest slipped by 4.2 percent, the West Coast by 3.4 percent and the South by 3.1 percent.

The Brexit may be a source, both positive and negative, of market volatility, according to Yun. Britain’s exit from the European Union could lead to even lower mortgage rates and increased demand from foreign buyers, but could also dampen the overall demand for home buying, he said. [NAR] — Cathaleen Chen