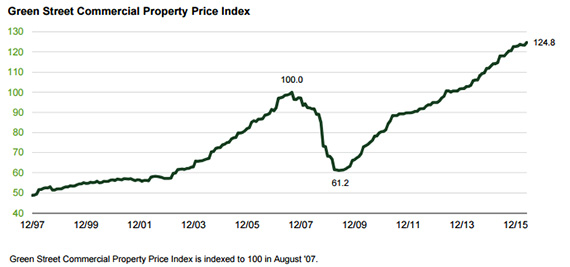

U.S. commercial real estate values continue to experience a slowdown in growth in 2016, according to a new report from real estate research firm Green Street Advisors.

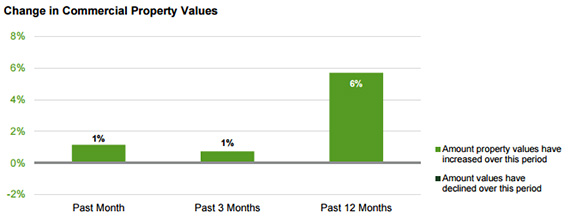

Green Street’s Commercial Property Price Index, which tracks property values nationally, rose just 1 percent in May, the firm said Monday.

But despite the slight uptick, Green Street noted property value appreciation has slowed significantly, after “near-double-digit gains in each of the past few years.”

“So far, 2016 is shaping up to be the year when cap rates stopped declining,” Peter Rothemund, an analyst at the firm, said in the report.

Rothemund noted, however, that commercial real estate prices “are not uniform” in their performance – with self-storage facilities and manufactured-home communities seeing “large price increases,” while lodging and hotel property values “are lower than they were at the beginning of the year.”

Green Street Advisors’ Commercial Property Price Index

Though the Commercial Property Price Index is still 6 percent above where it stood 12 months ago, the index has increased only 1 percent over the past three months, according to Green Street – indicating that commercial property values nationally have tapered off this year.

But those indicators appear to exempt gateway commercial real estate markets like Manhattan — where trophy assets like the Sony Building, at 550 Madison Avenue, have continued to trade for nine figures.