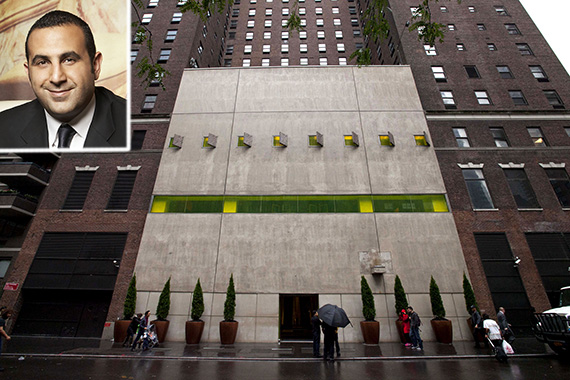

Six months after merger talks collapsed between Sam Nazarian’s SBE Entertainment Group and beleaguered hotel manager Morgans Hotel Group, the two sides have agreed to a deal that will see SBE acquire Morgans for $2.25 per share.

The deal values Morgans at roughly $82 million in equity value and will create a hotel management company with a total enterprise value of around $800 million, the Wall Street Journal reported.

Nazarian, founder and CEO of Los Angeles-based SBE, will serve as chief executive and retain majority control of the combined company. Private equity investor Ron Burkle, who holds a $75 million preferred equity stake in Morgans, will obtain a 25 percent common equity interest in SBE.

SBE will acquire all of Morgans’ hotel management brands – including the Mondrian and the Delano brands – as well as ownership of the Hudson New York in Midtown and the Delano South Beach, the two remaining hotel assets that Morgans still owned. Combined, the new firm will own or operate 20 hotels globally.

“We are pleased to have arrived at a transaction that we believe is in the best interests of our shareholders, while providing a great home for our attractive assets under a renowned hospitality company in SBE,” Howard Lorber, chair of Morgans, said in a statement.

Merger talks between SBE and Morgans collapsed in November after Burkle and former Morgans CEO Jason Kalisman – whose OTK Associates is Morgans’ largest shareholder – disagreed over terms of the deal.

But with an agreement now reached with SBE, Morgans – which was founded by developer and Studio 54 impresario Ian Schrager, and is often credited with innovating the “boutique” hotel sector – may well receive fresh impetus after struggling in recent years.

The company’s share price fell over the past year, hitting a low of $0.79 per share in February, while shareholder infighting – particularly between Burkle and Kalisman – spilled over into the public realm.

Morgans shares jumped significantly in wake of news of the deal, and closed trading Monday up 10 percent at $2.10 per share. [WSJ] – Rey Mashayekhi