Anbang Insurance Group has burst onto the world stage in the last two years, making splashy, high-dollar purchases, but much about the company’s internal structure remains murky.

The Beijing-based giant – which bid $14 billion for Starwood Hotels & Resorts this week, topping Marriott International’s offer – is owned by a few dozen corporate investors spread across China, including massive state industrial firms as well as smaller, less-well-known players with opaque ties to one another, the Wall Street Journal reported.

Anbang’s dominant funders before 2014, when the firm vastly accelerated its growth, were SAIC, formerly Shanghai Automotive Industry Corp., China’s largest car company, as well as the state-owned China Petroleum & Chemical Corp, known as Sinopec.

It’s a curious and fascinating rise for a company that about a dozen years ago was merely a regional car insurer.

A couple of years ago, the firm brought on about 31 new shareholders, including firms like Ningbo World Automobile City Co. and Dream Future Investment Co. Many of the companies have very thin public profiles, and several share corporate officers, or were registered around the same time in the same cities. Several of them, contacted by the Journal, either denied knowledge of a connection to Anbang or simply refused to discuss the matter.

Several major Wall Street banks have declined to work with Anbang in the past, in part because of the murky ownership.

The opacity and interconnection – along with Anbang’s well-documented connections to the Chinese government and its CEO Wu Xiaohui’s ties to the family of former Communist Party boss Deng Xiaoping, credited with shepherding China towards capitalism – suggest some of these investors may be vehicles for injecting state funds into the company.

The company received financial backing for its Starwood bid from the state-owned China Construction Bank Corp.

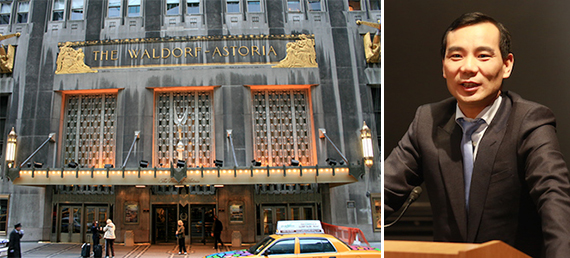

In 2014, Anbang quintupled its registered capital, to 61.9 billion yuan, about $9.5 billion, the Journal reported. The company agreed to buy the Waldorf Astoria hotel that year from the Blackstone Group for $1.95 billion, the largest price ever paid for a single hotel.

Today, the company – which gradually shifted from a focus on car insurance to a much broader array of financial activities – boasts $254 billion in assets. Its stated goal is to become one of the “top 10 comprehensive financial groups in the world,” the Journal reported. [WSJ] – Ariel Stulberg