Despite concerns from some major office landlords about what this year would have in store, Manhattan office leasing has gotten off to a robust start in 2016, according to Cushman & Wakefield, with both leasing activity and asking rents on the rise through February.

Manhattan leasing activity exceeded 2 million square feet in each of the first two months this year, with the year-to-date total of 4.4 million square feet representing a 3.2 percent jump from the first two months of 2015, the commercial brokerage said in its monthly Manhattan office market report.

Asking rents in all three major Manhattan submarkets also increased from last year, taking overall Manhattan asking rents to $72.80 per square foot, compared to $69.46 per square foot through February 2015. The Downtown office market, in particular, saw asking rents top $60 per square foot “for the first time ever,” Cushman said.

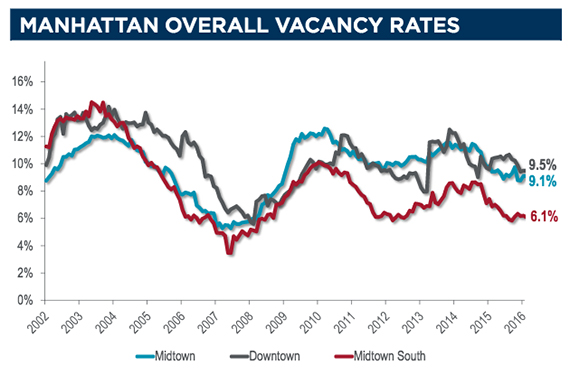

Manhattan office vacancy, meanwhile, stood at 8.7 percent through February, down 0.5 percent from the same point last year. In the Midtown market, office vacancy stood unchanged from January at 9.1 percent and “has remained in the single-digits since year-end 2014,” according to Cushman.

The notoriously tight Midtown South office market, meanwhile, continued to get tighter – falling to 6.1 percent in February, down from 6.9 percent a year ago. Cushman noted “a significant boost in leasing” in Midtown South thanks to tech giants Facebook and AOL each expanding an additional 80,000 square feet at Vornado Realty Trust’s office building at 770 Broadway.

The numbers are notably positive considering concerns aired early this year from key office market players, such as SL Green Realty, regarding what bearish economic indicators — like an expected slowdown in job growth in the city — could mean for Manhattan office leasing.

“I think there was that [negative] psychology at the beginning of the year, when stocks were dropping,” Richard Persichetti, Cushman’s Tri-State research director, told The Real Deal. “[The year] started slow in other aspects of the economy, but there were strong U.S. job numbers coming out last week and now we’re seeing strong leasing numbers for the first two months.”

In fact, the first two months of 2016 proved the third-strongest start to a year since 2002 as far as Manhattan office leasing was concerned, Persichetti noted, with only 2011 and 2014 outperforming this year so far.

He also pointed to a resurgent financial services sector, which is now “starting to take off” after taking a backseat to the TAMI tenants that have driven much of the current commercial office leasing cycle. That has benefited the Midtown office market, where financial services tenants have accounted for almost 41 percent of year-to-date leasing activity, according to Cushman.

But the TAMI sector continued to dominate Midtown South and Downtown through the first two months of 2016 — with technology, advertising, media and information services tenants representing nearly 42 percent and nearly 65 percent, respectively, of all leasing activity in those office markets.