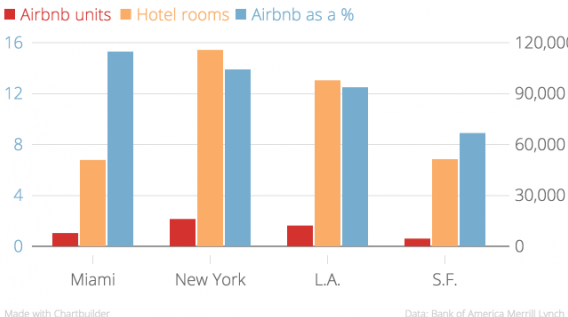

Airbnb’s listings are concentrated in the U.S.’s biggest hotel markets, exposing hospitality firms in New York – as well as Los Angeles, San Francisco and Miami – to disproportionate levels of competition from the service, according to a new report from Bank of America Merrill Lynch.

Nationwide, Airbnb-rentable units make up roughly 2-4 percent of total hotel room supply. In New York though, that number is 13.9 percent, the second highest of any city in the country after Miami, which had a rate of 15.3 percent.

Another report, produced for the Hotel Association of New York by HVS Global Hospitality Services, and released in October, found a “direct loss” to the city’s hotel industry of $451 million between September 2014 and August 2015.

Those numbers are likely to grow. The new report, which analyzed data compiled by analytics firm AirDNA, said the number of listings offered through the service nationwide grew 150 percent between August 2014 and August 2015.

San Francisco-based Airbnb raised $100 million in a recent fundraising round, with the company valued at $25.5 billion.

National lodging companies that make large proportions of their revenue in the biggest U.S. markets – such as Host Hotels and Resorts, owner of the Marriott Marquis Times Square and five others; and Hersha Hospitality Trust, which owns 17 hotels in the city – are the most threatened by the short-term rental service, according to the BOAMR report.

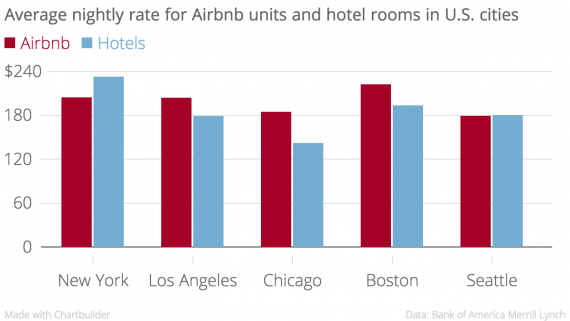

One of the analysis’ more surprising findings was that, nationwide, the average Airbnb rental costs significantly more than the average hotel room. Rooms booked through the service cost around $196 dollars per night on average, while hotels charged about $122 dollars a room, a difference of about 60 percent.

New York, though, was one of just three exceptions to that trend. Here, the average Airbnb goes for about $204 a night, according to the report, while the average hotel room goes for about $233 dollars per night, about 12 percent more. Seattle and Oahu Island, HI were the only other markets where hotels cost more on average.

Earlier this month, the city’s Independent Budget Office estimated that $546 million in hotel occupancy tax would be collected in Fiscal Year 2016, a drop of $14 million from the prior year.

Back in August, a representative of the Hotel Association of New York said the group was attempting to put together a class action lawsuit against Airbnb, though to date no suit appears to have been filed.

Last year, The Real Deal queried seven hotel industry players about the company’s impact on their businesses.