Past a crowd of anti-gentrification protesters on Eastern Parkway – holding a large sign reading “BROOKLYN IS NOT FOR SALE” — developers and investors gathered Tuesday at the Brooklyn Museum to discuss the issues at play in the borough’s explosive real estate market.

The panels at the 6th annual Brooklyn Real Estate Summit touched on a variety of topics, but a few themes resonated throughout – the importance of infrastructure and transportation access, how employers are increasingly looking to cater to a Brooklyn-centric workforce and, of course, where the next “hot” neighborhood is.

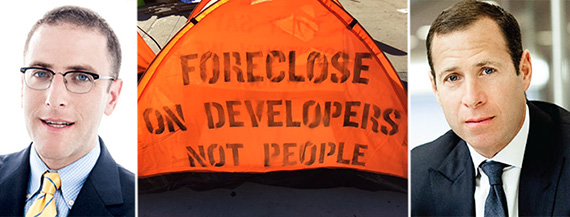

The morning’s first panel – titled “Brooklyn’s Finest” — featured a crop of Brooklyn-focused developers including Heritage Equity Partners CEO Toby Moskovits and Slate Property Group principal David Schwartz, as well as aptsandlofts.com president and founder David Maundrell, who recently sold his firm to Citi Habitats.

“When I was growing up, the L train was the worst train in the city,” Schwartz said, highlighting the transformation seen in the neighborhoods running along the line that have made Williamsburg and Bushwick sought-after areas for developers.

In the morning keynote, Richard Mack, founder and CEO of Mack Real Estate Group, noted Brooklyn’s global appeal, with “C’est Brooklyn” having become shorthand in France for something that’s “cool.” (The c-word, meanwhile, was bandied about profusely over the course of the morning’s proceedings — with numerous panelists citing Brooklyn’s “cool” factor as a distinction that continues to drive the borough’s economic engine and hence, its development.)

“A lot of the trends [in Brooklyn] are trends we see in other cities with a large creative class,” Mack said, noting how young professionals in San Francisco “don’t want to be bussed out to Silicon Valley” for work, forcing employers to create offices around where they live.

When looking at where to build, Mack said he pays attention to how people commute –“We’re looking for places where there are bike lanes, but also where people are riding fixed-gear bikes,” he said. But he also expressed concern about a “risk of oversupply” in the Downtown Brooklyn residential market.

“The quality of life is not where it needs to be to absorb supply,” he said.

As it inevitably does when the topic of emerging markets comes up, panelists also discussed the Bronx. Bold New York’s Jordan Sachs noted a demand among younger, more affluent consumers to be “the first group” to take part in the borough’s redevelopment.

RXR’s Seth Pinsky, who previously was president of the New York City Economic Development Corporation, said the Bronx shares characteristics with areas of Brooklyn that have transformed over the last decade or so, but also stressed the need to preserve industrial and manufacturing services in The Borough That Drive the city’s middle class.

The morning’s final panel – before an afternoon session that includes a keynote from former New York governor and Spitzer Enterprises head Eliot Spitzer – was geared around how developers look to the city’s subway map as a means of plotting the markets they want to invest in.

Jim Stein, senior vice president of Dallas-based Lincoln Property Co., pointed his firm’s office redevelopment of a 100,000-square-foot former factory in Bushwick – noting how the site’s nearest subway stop, The Jefferson Street stop on the L train, had seen a 13.5 percent increase in ridership when the firm decided to invest.

“Look at what happened in Downtown Brooklyn and Long Island City,” Can Tavsanoglu, director of acquisitions & finance at XIN Development Group, said, referring to how proximity to public transit had fueled redevelopment in those neighborhoods, leaving the likes of Astoria and Greenpoint behind.