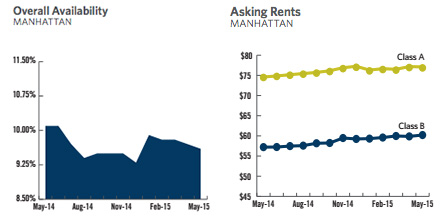

Availability in the Manhattan office market dropped to 9.6 percent in May thanks to a decrease in supply in the Midtown and Downtown submarkets, according to commercial brokerage DTZ’s monthly report.

Midtown office availability dropped to 9.7 percent in May while Downtown availability shrunk to 12.2 percent, trends that were partially offset by an increase in available space, to 6.8 percent, in Midtown South, according to DTZ.

Class A asking rents dipped across all three submarkets to an average of $77.09 per square foot in Manhattan – down nine cents per square foot – while Class B asking rents reached an average of $60.21 per square foot, eclipsing $60 per square foot “for the first time in history,” DTZ said.

The Manhattan office market “remains strong as we approach the mid-year mark,” Richard Persichetti, DTZ’s vice president of research, marketing and consulting, told The Real Deal.

“The increase in available supply in Midtown South only creates more opportunities for tenants in one of the most sought-after markets in the country,” he added, predicting that available supply in Midtown and Downtown would decrease further over the rest of the year.

DTZ noted that the market “continued to chip away” at 2.3 million square feet of negative absorption posted in January, having posted around 1 million square feet of positive absorption through May since the start of the year.

The Midtown market “has recovered almost all” of nearly 1 million square feet of space brought to the market at the start of the year.

The Downtown market inked only one leasing transaction greater than 100,000 square feet through the first five months of the year, DTZ added, compared to six such deals through the same period last year. The firm noted that 75 percent of Downtown’s leasing activity has come from leases under 20,000 square feet, compared to 70 percent last year.

DTZ acquired rival brokerage Cushman & Wakefield in a $2 billion deal last month, with Cushman’s Ron Lo Russo set to head the combined company’s New York office.