Hightower, a cloud-based leasing portfolio management company, has raised $13 million in a Series B financing round. Venture capital firm RRE led the investment round, which takes Hightower’s total capital raised to $22 million and makes it one of the industry’s deepest-pocketed tech startups.

Joshua Kushner’s Thrive Capital and Bessemer Venture Partners, which led Hightower’s $6.5 million Series A round in August 2014, also participated in the Series B, as did new investors Pritzker Group.

“We’ve been growing like a weed,” said Bradon Weber, co-founder and CEO of Hightower, who added that the startup’s month-over-month growth rate was 25 percent in terms of user base and 20 percent in terms of assets on the platform. He declined to disclose revenues or total square footage, and declined to specify how much equity the founders gave up, but did say that the valuation was “under $100 million.” At the time of the Series A in August, Weber told The Real Deal that Hightower handles about 25 million square feet of New York office space and was projecting annual revenues in the low single millions.

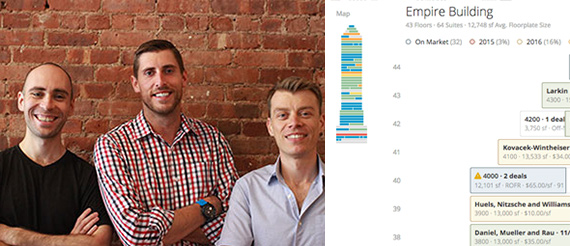

The platform helps landlords and brokers keep track of current and prospective tenants in their often sprawling, multimillion-square-foot portfolios. Landlords can track how space is doing and zero in on inefficiencies in their portfolios, and brokers can assist landlords in marketing available space, find new tenants, and manage their deals in one place. Its major competitor is VTS, which following a January investment by the Blackstone Group was valued at about $35 million.

Landlords on Hightower include New York-based Kushner Cos., Two Trees Management, Durst Organization and East End Capital, as well as major national players such as Shorenstein Properties. Brokerages such as Newmark Grubb Knight Frank, Cushman & Wakefield and JLL are also clients. Landlords pay a subscription fee based on square footage handled on the platform, while brokers pay a monthly usage fee. Hightower is being used in 265 cities across five countries, Weber said, though the firm has offices only in New York and Los Angeles. The new investment, he said, will be used to fund growth into new markets as well as to hire talent for engineering, sales and customer support.

RRE’s investment in this round comes up to about $7 million, bringing its total stake in Hightower to $7.5 million. “We really wanted to invest even more in previous rounds, but Thrive and Bessemer made more competitive bids,” said RRE partner Steve Schlafman, who was colleagues with Weber at Microsoft. Both Schlafman and fellow investor Ethan Kurzweil of Bessemer Venture Partners cited Hightower’s management team as a major reason for investing, and Schlafman claimed Hightower’s technology is superior to rival VTS.

“Any time you have a platform with network effects, there will be one winner and a smaller second winner,” he said. “We were afraid that once there was lock-in among VTS customers they wouldn’t switch, but there are large institutional landlords that have switched,” he added.

There’s been a torrent of venture capital money making its way into commercial real estate. Since 2012, industry startups have raised nearly a billion dollars from investors, and money is flowing in at an increasingly quicker rate. Crowdfunding platform Fundrise raised has $41 million to date, for example, and Kushner’s investment platform Cadre raised $18.3 million. (To see a complete ranking, click here.)