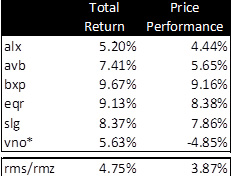

The major New York-focused real estate investment trusts had a largely successful first quarter in 2015, with most outperforming both the MSCI US REIT Index and the S&P 500 Stock Index by some distance.

Boston Properties, AvalonBay Communities, Equity Residential, SL Green Realty and Vornado Realty Trust all reported positive returns for the quarter, despite concerns over rising interest rates that dampened performance in the latter part of the quarter, analysts said.

Boston Properties, led by CEO Owen Thomas, led the way with a total return of 9.67 percent – well above the 4.75 percent return seen in the MSCI US REIT Index, which tracks the majority of the nation’s major REITs, according to data from Midtown-based investment banking firm Sandler O’Neill + Partners. They also outperformed the S & P 500 Index’s 0.95 percent return, according to T. Rowe Price.

A “strengthening New York market” aided Boston, Vornado and SL Green, Sandler O’Neill analyst Alexander Goldfarb told The Real Deal, with all three continuing “to benefit from the demand for office space in the city.” The three REITs have also showed a willingness “to update their buildings and make them more attractive to TAMI tenants,” he added.

Total Q1 stock returns for major New York REITs (credit: Sandler O’Neill + Partners)

Vornado, led by CEO Steven Roth, saw a 5.63 percent return in the quarter, well behind its counterparts in New York, though Goldfarb cited the positive effects of its Urban Edge Properties spinoff. The REIT continues to invest heavily in the Penn Station area, and secured a big lease with IPG at 909 Third Avenue as well as a retail lease with T-Mobile at 1535 Broadway in Times Square.

Vornado’s long-delayed luxury condominium at 220 Central Park South also received the green light from the New York Attorney General’s office during the first quarter, as TRD reported. The quarter did see the departure of Wendy Silverstein, who was co-head of acquisitions and capital markets and was the firm’s top female executive.

Sam Zell’s Equity Residential ran second to Boston Properties with a 9.13 percent return in the quarter, while AvalonBay shareholders saw a return of 7.41 percent for the period that included the firm’s $300 million acquisition of the American Bible Society’s headquarters at 1865 Broadway.

“Avalon continues to invest in development in the city, while EQR remains the best apartment operator out there,” Goldfarb noted. “In a market like New York, where rents go one way, it works to their ability.”

SL Green, led by Marc Holliday, handily outperformed the national indices with a 8.37 percent return in the quarter, behind only Boston Properties and Equity Residential. The REIT, the city’s largest commercial landlord received City Planning Commission approval for its 64-story, 1.6 million-square-foot One Vanderbilt office tower in March, and booked financial services companies Franklin Templeton and Fiduciary Trust International to a 15-year, 126,000-square-foot lease at 280 Park Avenue in Midtown.

Sandler O’Neill does not cover Brookfield Property Partners. But the REIT’s highlights in the first quarter include breaking ground on its 62-story Manhattan West residential tower at 435 West 31st Street, and signing law fim Skadden, Aprs, Slate, Meagher & Flom to a 550,000-square foot lease at 1 Manhattan West — a deal that will allow them to commence construction on the tower. Brookfield also signed financial data provider Markit to a 140,000-square-foot lease at 5 Manhattan West, as TRD reported.

Empire State Realty Trust, meanwhile, consolidated a number of tenants at the Empire State Building – with Media General inking 27,000 square feet on the building’s 62nd floor and Workday relocating to 21,000 square feet on the building’s 49th floor from its existing space at the REIT’s One Grand Central Place.

Goldfarb noted how “continued growth in the market” had alleviated concerns among investors over the impact of new construction in the office market.

“Two or three years ago there was a lot of concern over construction — new projects pulling tenants away from Midtown and creating swiss cheese out of the office towers,” he said. “That hasn’t happened.”