Pour one out for Ben Ashkenazy.

An Ashkenazy affiliate lost its Union Station project in Washington, D.C. in 2022. Earlier this month, Amtrak agreed to pay Ashkenazy’s lender, Rexmark, $505 million for taking the property in eminent domain. Ashkenazy was angling for a piece of that settlement, claiming the lender and Amtrak cut the firm out of the deal.

But a judge ruled this week he no longer had any stake in the property.

Ashkenazy’s affiliate “has no legal or equitable interest in the leasehold Interest that would allow it to remain a party to this case,” said U.S. District Court Judge Amit Mehta.

Mehta’s ruling follows a decision by the U.S. District Court Judge Gregory Woods this week in a case brought by Rexmark against Ashkenazy, which alleges Ashkenazy failed to acknowledge Rexmark’s non-judicial foreclosure.

“Because defendant failed to seek an injunction prior to the consummation of the non-judicial foreclosure sale, its equitable defenses have not been asserted timely,” said Woods.

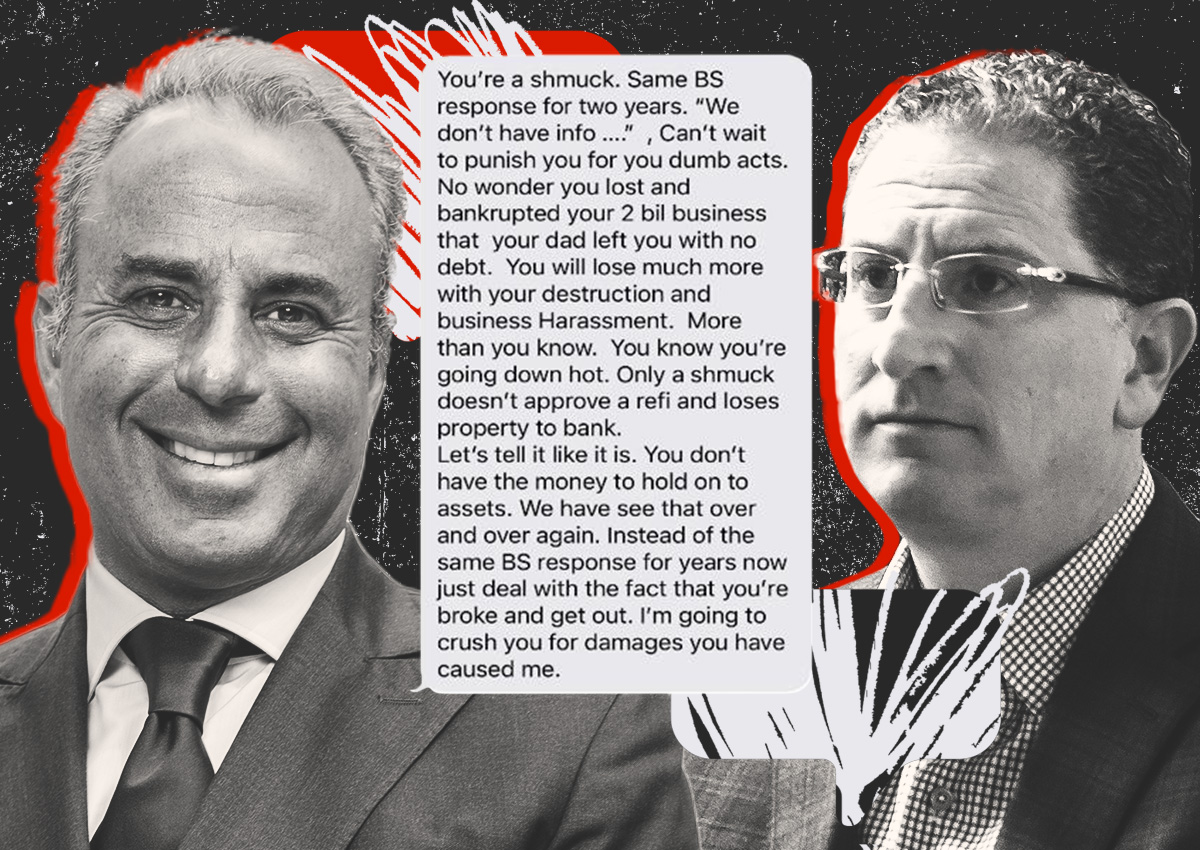

Ben Ashkenazy is no stranger to sharp-elbowed legal fights. He recently settled a lengthy lawsuit with the Gindi family. During the course of that lawsuit, he referred to Raymond Gindi as a schmuck, whom he was “going to crush” for damages in a text exchange.

But Ashkenazy’s war with Rexmark may prove to be the most fruitless of all his recent disputes.

Rexmark, the U.S. agent of a Korean debt fund, sued the Ashkenazy affiliate in 2022, alleging Ashkenazy interfered with its foreclosure. Rexmark also sued Ben Ashkenazy personally, alleging he defaulted on $560 million in debt and triggered bad boy guarantees.

Ashkenazy’s lawyers argued the foreclosure was invalid and Ashkenazy was best suited to run the property.

“My client is an expert pilot in operating a complex aircraft like a 747. They’ve been doing it continuously. They know what they’re doing,” Ashkenazy’s attorneys argued at a hearing.

Things got ugly when Ben Ashkenazy secretly recorded Rexmark’s managing principal Michael Rebibo. Ashkenazy sent one of the recordings to Rebibo in a voicemail, according to court filings.

During a deposition, Ashkenazy denied recording Rebibo. When pressed, however, he finally admitted to it. Ashkenazy’s attorney said Ashkenazy “collected the evidence” at the instruction of his attorney Marc Kasowitz.

The litigation dragged on. Judge Woods granted Rexmark a preliminary injunction restraining Ashkenazy from acting as owner of the property. This week, Judge Woods ruled that Ashkenazy’s affiliate had no interest in the property. The lender properly foreclosed on the property and Ashkenazy failed to contest the foreclosure.

The Washington Business Journal first reported the news about the judge’s decision.

“Throughout the entire period in which the mezz loan was in default, Mr. Ashkenazy had sufficient resources to repay the loan,” said Woods. “He chose not to reinvest any of his own money into the company to cure the default.”

Woods also said the Ashkenazy affiliate pointed to “no principle of equity that would lead the court to conclude that the mezz lender’s hands were unclean, or that its conduct in exercising its remedies was unjust.”

“This decision is a resounding beat-down of the meritless positions that had been advanced to try to disrupt the lender’s exercise of control over its collateral,” said Scharf of Morrison Cohen, who represented Rexmark. “The Morrison Cohen team is thrilled to have vindicated our clients’ rights and debunks the now proven false Ashkenazy narrative that Rexmark was acting improperly.”

Ashkenazy spokesperson said, “We disagree with the court’s decision and will be taking an appeal.”

Read more