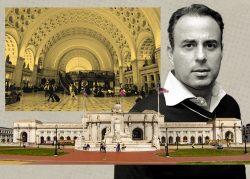

Ben Ashkenazy is contesting a half-billion-dollar deal between Amtrak and a lender, marking another twist in a complex battle over one of Washington D.C.’s most important transit hubs.

USSM, an affiliate of Ashkenazy Acquisition Corp. and the property’s former operator, filed a motion in U.S. District Court opposing a $505 million settlement between Amtrak and Rexmark, a lender that took control of the station in 2022, the Washington Business Journal reported.

The motion claims USSM was “blindsided” by settlement discussions and could be entitled to “potentially hundreds of millions of dollars” that it’s being deprived of because of the agreement.

A judge still needs to approve the settlement, according to the Washington Post. The Union Station Redevelopment Corporation, the federal government-backed nonprofit responsible for oversight of the station and its $10 billion expansion, supports the settlement.

The dispute centers on Amtrak’s use of eminent domain to take control of the historic transportation hub, a move aimed at improving station operations and passenger experience.

The contested settlement represents a significant premium over Amtrak’s initial $250 million set aside to take control of the commercial leasehold but falls well short of the $700 million to $1 billion range that USSM claims Rexmark suggested the property was worth.

The dispute traces back to 2020, when Ashkenazy defaulted on loans secured by a leasehold extending through 2084. Rexmark originated a $100 mezzanine loan in 2018 and bought the $300 million mortgage in January 2022.

An ugly chapter of the dispute emerged in 2023 when court filings revealed that Ashkenazy secretly recorded his lender at least six times. Ashkenazy initially denied recording Rexmark principal Michael Rebibo in a deposition before admitting to doing it once.

Ashkenazy held the space through a leasehold beginning in 2007, when he acquired it for $160 million.

This article has been updated to clarify the roles of Rexmark and the Union Station Redevelopment Corporation.

Read more