The biggest office sale in Washington, D.C. in 18 months is also emblematic of how far the market has fallen since the pandemic.

PRP Real Estate Investment purchased Market Square for $323 million, the Commercial Observer reported. That’s roughly the loan amount on the office complex, a two-building property at 701 and 801 Pennsylvania Avenue NW.

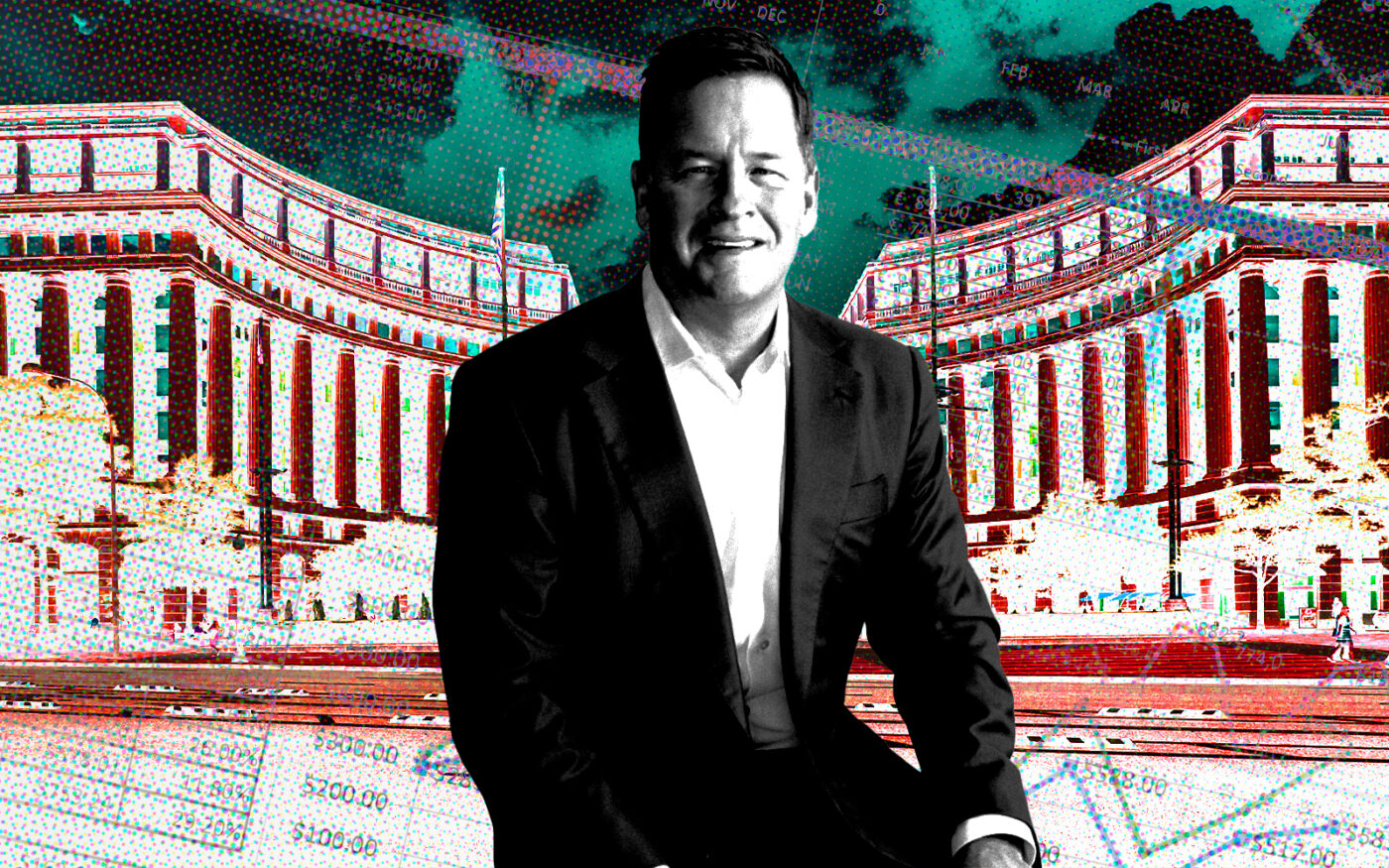

The office portion of the 690,000-square-foot property is 84 percent leased, according to PRP CEO Paul Dougherty. Tenants include the government affairs offices of Visa, Pepsi, Cigna, Prudential and UnitedHealthcare.

The seller, a partnership between Blackstone and Columbia Property Trust — owned by PIMCO — is likely disappointed in its return. Columbia bought the property in 2011 for $611 million, or $905 per square foot, which was a record for the market at the time. This sale barely comes in at half that mark: $464 per square foot.

Even so, the deal is the largest in the market since the summer of 2022.

Last year’s largest sale was Kaiser Permanente’s $198 million acquisition of Station Place III. Prior to that, the market’s benchmark was Japanese investor Mori Trust Co.’s $531 million purchase of 601 Massachusetts Ave. NW in August 2022, according to Bisnow.

Read more

Blackstone purchased a 49 percent stake in the Market Square complex in 2015 at a $595 million valuation. The partners retired $325 million in debt from the Pacific Life Insurance Company; the lender provided a $247.5 million loan to PRP for its purchase, an acquisition made in partnership with an affiliate of Morning Calm Management.

Dougherty predicted the deal would “reset values” in the market. Meanwhile, for Blackstone, it’s another exit from the U.S. office market.

PRP will reposition the 40,000 square feet of retail space in the complex, which has mostly been vacant since the onset of the pandemic. It also plans to upgrade the complex’s lobbies and lease up the remaining vacant space.