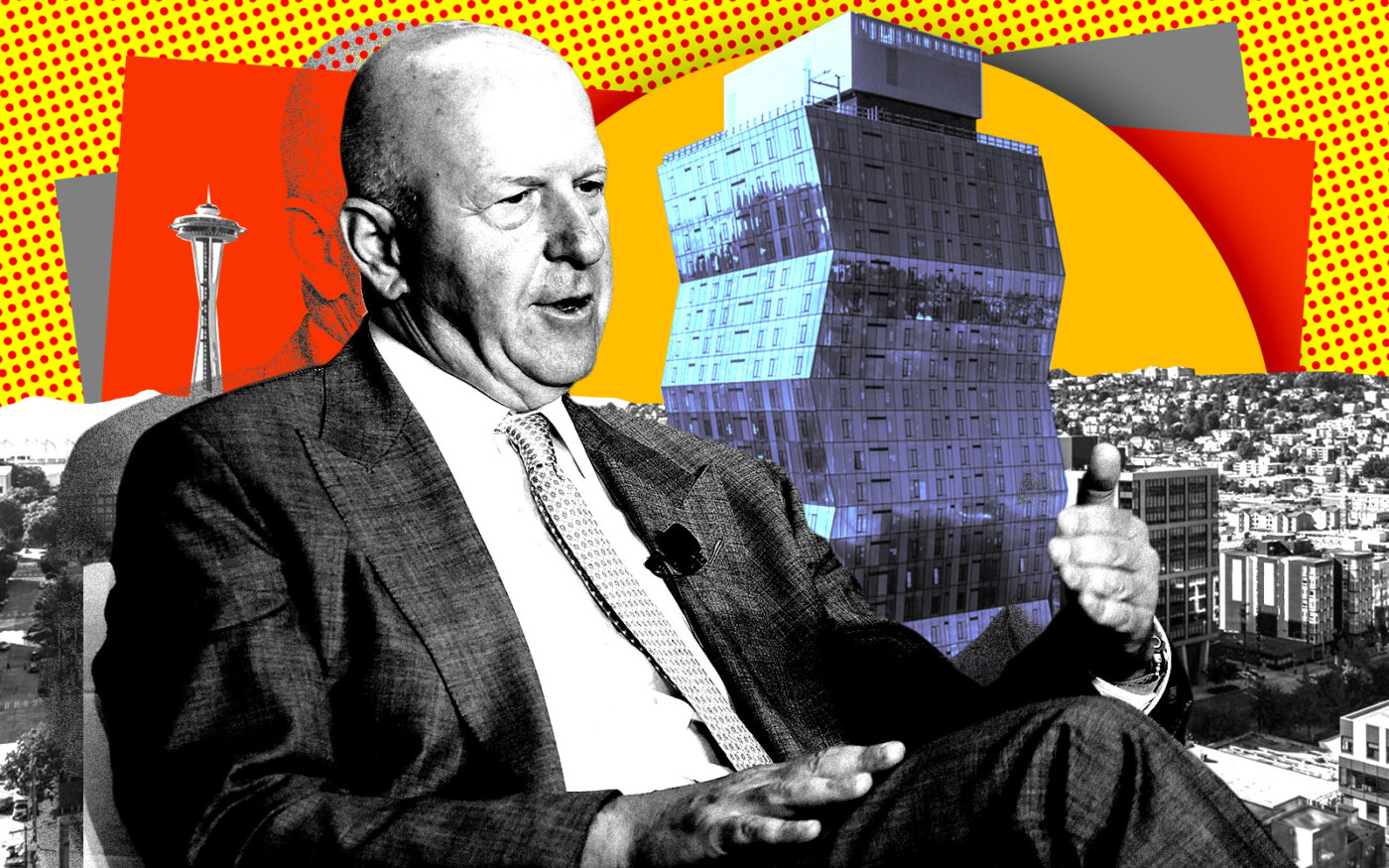

Goldman Sachs can only hope the top of Seattle’s multifamily market has hit bottom now that the firm has paid $175 million for one of the jewels of the Emerald City’s skyline.

An affiliate of the New York-based investment bank has bought Skyglass Tower, the gleaming glass accordion-style luxury high-rise from Glendale USA, a unit of a Chinese developer that has shut down its Seattle office, the Puget Sound Business Journal reports.

The 31-story, 388-unit apartment project opened a little more than a year ago in the South Lake Union District, where it sits between Amazon.com and Apple office campuses. The sale price comes to about $514,000 per unit, about 40 percent off the 2022 peak of Seattle’s luxury rental market.

“Real estate is a cash flow business,” multifamily broker Dylan Simon of Kidder Mathews, who was not involved in the sale, told the Business Journal. “The only way to increase cash flow when interest rates go up is to pay a lower purchase price.”

Gemdale Corporation, parent of the U.S. unit that developed Skyglass Tower, is reportedly in distress amid difficult markets here and in China. Beijing-based news outlet Caixin has reported that Gemdale is selling off assets as it confronts pending maturities on approximately $1.4 billion in debt.

Earlier this year, Gemdale USA executives told the Business Journal they were attempting to refinance Skyglass, and said rents in the building ranged from $4.78 to $6.60 per square foot. Only 89 of the apartments — less than a quarter — had been leased at the time, with incentives of up to eight weeks of free rent on offer.

Marc Renard, part of the Cushman & Wakefield Capital Markets team that worked with Goldman and its Virtu Investments on the deal, said the investment bank beat a varied field of bidders.

“Skyglass attracted global investor interest including pension funds, private equity, family offices and multifamily funds who recognized the merits of this compelling opportunity,” Renard said in a statement. “The depth of capital reflects investor conviction for the future of Seattle and best-in-class developments.”