QTS Realty Trust, a Kansas unit of the New York-based private equity firm, has paid $246.8 million for 206 acres to build a second data center in Avondale, 18 miles west of Phoenix, the Phoenix Business Journal reported. It would replace a dairy farm.

The seller of the property at Hermosa Ranch Technology Campus on the southwest corner of Avondale Boulevard and Lower Buckeye Road was TGV Investments, based in Phoenix.

The all-cash deal works out to nearly $1.2 million per acre.

The land lies in a federal Opportunity Zone just north of a $2 billion, 66-acre data center campus planned by San Francisco Prime Data Centers, with 240 megawatts, a substation and a battery energy storage facility.

The QTS land sale closed after Avondale City Council rezoned the site and unanimously approved a major general plan amendment in May for a data center campus.

“Data centers require thousands of skilled workers to design, construct and operate,” QTS said in a statement. “We choose markets like Phoenix because of access to a highly skilled and motivated workforce.”

QTS also plans to build a 3 million-square-foot data center campus on 400 acres in the Loop 303 corridor in Glendale, 10 miles northwest of Phoenix. The project would contain 16 buildings of 180,000 square feet. The Blackstone unit paid $225 million for the site.

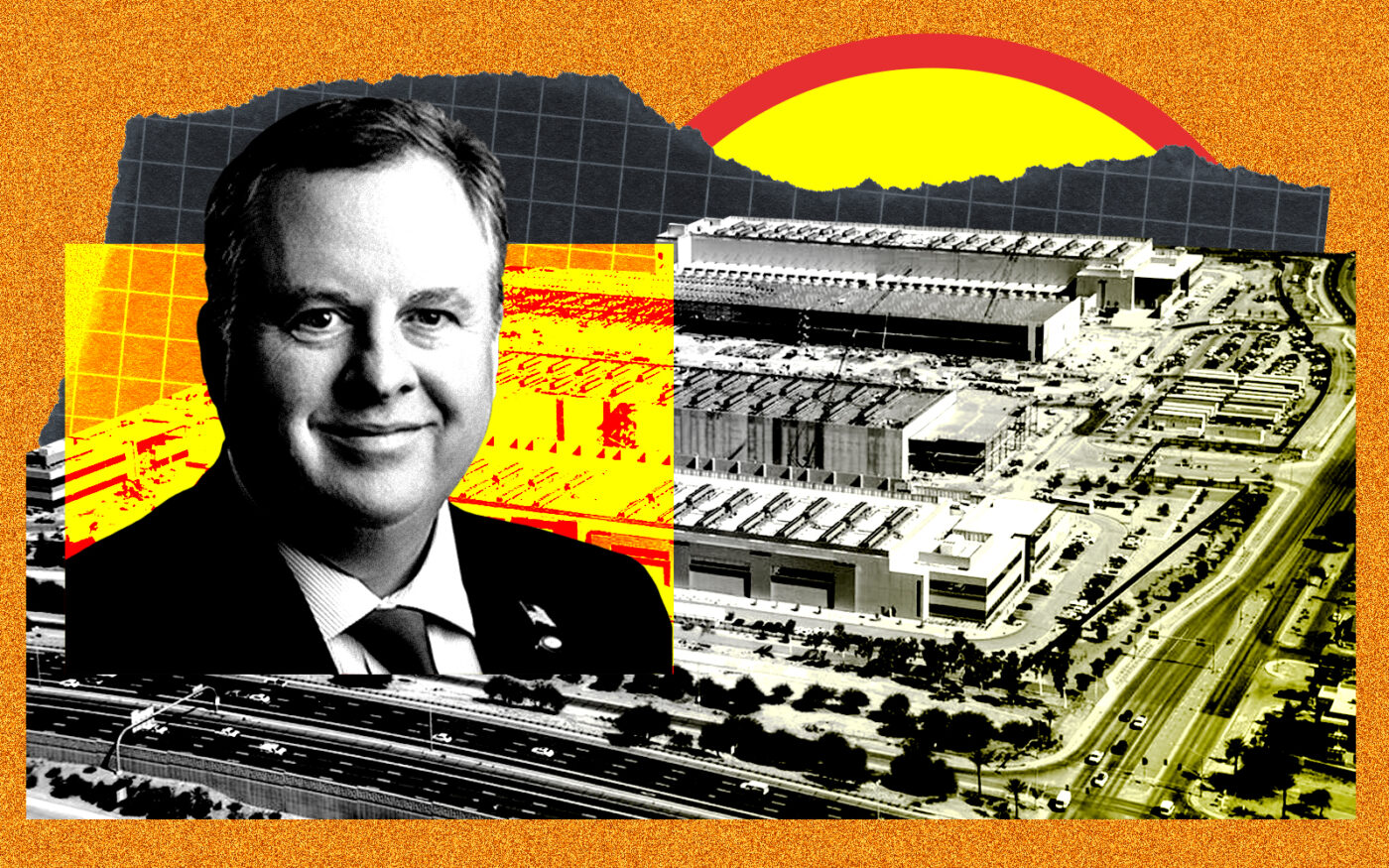

The privately owned REIT, acquired by Blackstone in 2021 for $10 billion, has another data center under construction on 85 acres near 40th Street and the Loop 202 in Phoenix.

Greater Phoenix is a hot market for data centers, given its lack of natural disasters, lower rates and land availability, according to the Business Journal. The vacancy of local data centers at the end of last year was 2.2 percent, or 156,600 square feet of available space, according to JLL.

Some local cities have pushed back against new data center growth, while passing regulations limiting their development over concerns about large power requirements and the shortage of long-term jobs.

Slammed by a slowing warehouse market, Prologis has placed a bet on artificial intelligence — and the data centers required to power it.

The nation’s largest industrial landlord, which reported an 18 percent drop in revenue last quarter, is raising its annual earnings outlook, saying growing demand for data centers could boost profitability.

Read more

Demand for artificial intelligence infrastructure like data centers and energy facilities provides “tremendous confidence in future growth,” Hamid Moghadam, CEO of Prologis, told investors on an earnings call this month.

Blackstone’s flagship fund has made a similar bet by making a major push in the data center market, recognizing the growing need for the properties as AI booms.

In January, its QTS subsidiary announced it would build a $220 million, 471,000-square-foot data center in Dallas-Fort Worth, its second in the region.

— Dana Bartholomew