One of the largest — and newest — office buildings in Boston is headed to auction after a foreclosure action.

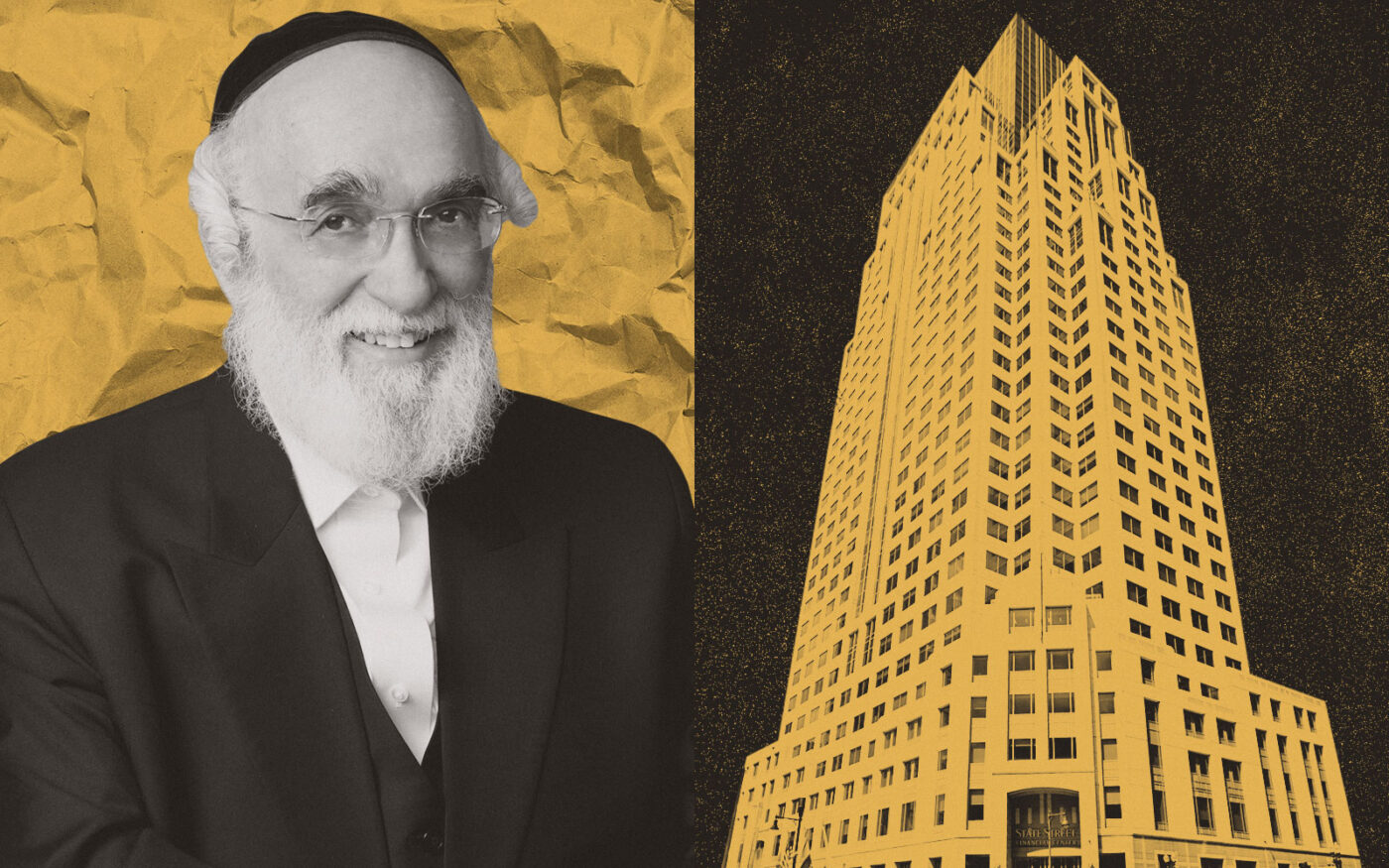

Fortis Property Group’s One Lincoln Street is set to be sold at auction in March, the Boston Business Journal reported. The 36-story, 1.1 million-square-foot property in the downtown district is the 11th largest office building in the metropolitan area, according to the publication.

News of the auction was first reported by Banker & Tradesman.

The property has the hallmarks of a “flight to quality” winner. For one, it is barely old enough to drink, opening in 2003. Then, in 2022, Fortis inked a $1 billion refinancing, which included $200 million put towards building upgrades and leasing costs.

Despite being shiny and new, the building was unable to lure new tenants – a sign of the rocky office leasing market in Boston. Fortis was heavily reliant on the presence of its then-anchor tenant, State Street, which used to share its name with the property. The financial services company occupied 750,000 square feet but relocated to One Congress Street in 2023.

Another significant tenant for Fortis was WeWork, which occupied nine floors and was the building’s largest occupant after State Street left. That is, until the coworking company went through bankruptcy proceedings. Though WeWork didn’t leave One Lincoln altogether, it walked away from two-thirds of the floors it occupied.

Private equity firm HarbourVest Partners became Fortis’ biggest lifeline in 2022 when it signed a lease for 250,000 square feet. No other major tenants have come along since, though.

The property is bogged down by the 2022 $1 billion refinancing, especially in light of a recent $588 million city assessment of the property. Even Fortis has challenged the assessment for being too high as it looks to mitigate its property tax bill.

As Boston’s office market copes with an availability rate hovering around 25 percent, it’s unlikely many bidders will emerge and take a shot at One Lincoln. Instead, the most likely outcome for the auction is a victorious credit bid for lenders DivcoWest and the merchant bank BDT & MSD Partners, sources told the Journal.

Read more