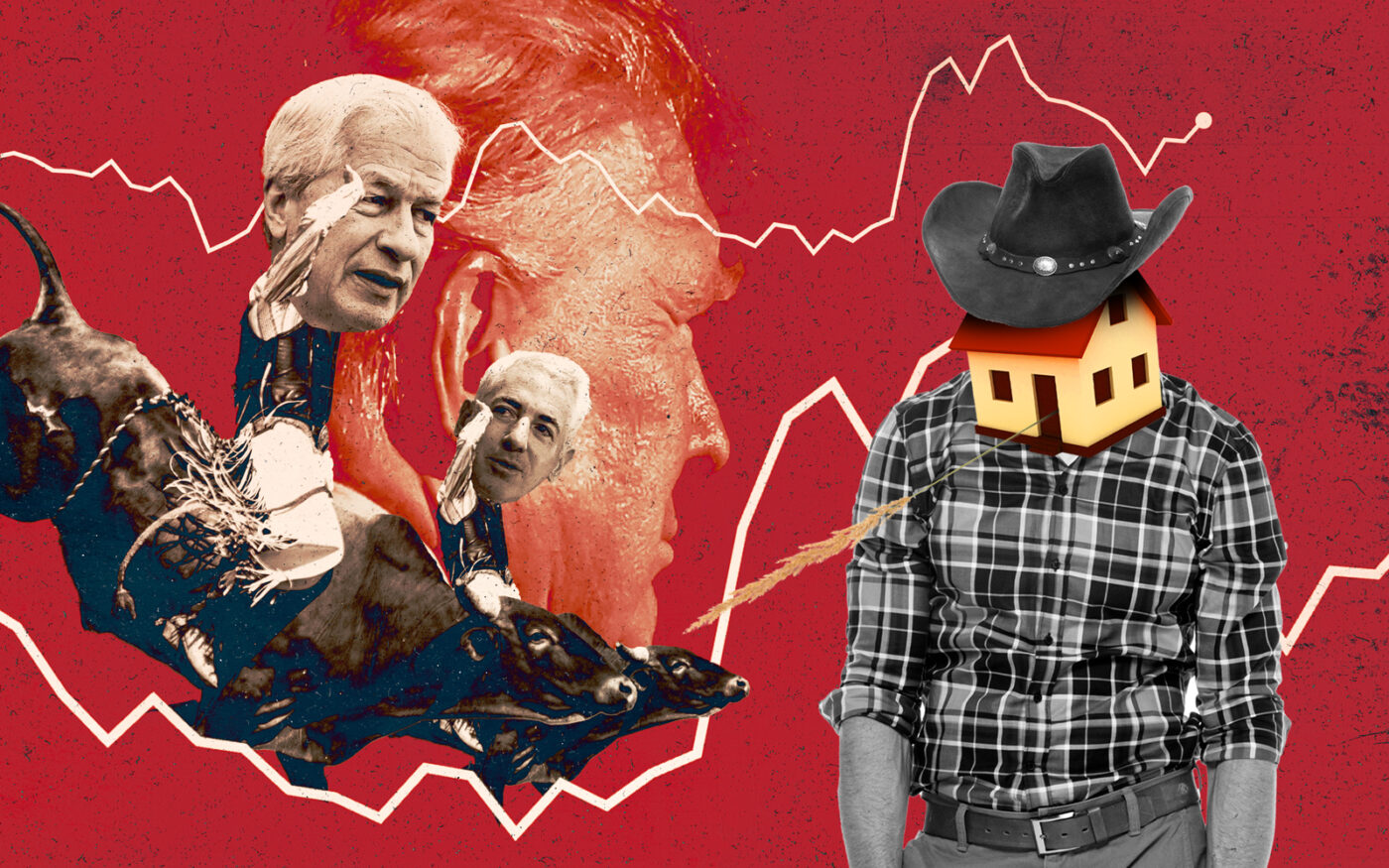

Everyone is talking tariffs. Well, just about everyone.

Hedge funder Bill Ackman dragged Trump on Sunday over “Liberation Day” tariffs, warning they would spur a “nuclear winter,” before celebrating the “brilliantly executed” policy reversal. Citadel’s Ken Griffin called the tariffs a “huge policy mistake” at a Monday event in Miami. Jamie Dimon, in a Fox News appearance, raised red flags about a potential recession because of Trump’s initial tariff plan; economists echoed his warning.

But real estate, a business full of swashbuckling cowboys unafraid to throw elbows, has been uncharacteristically silent.

New York’s real estate lobbying group sent The Real Deal a statement early Wednesday that’s only remarkable for how little it said in so many words.

“Market reaction to the president’s tariff policy is notable,” REBNY president James Whelan said. “We are watching closely and in close communication with members and other stakeholders to analyze potential impacts to project costs.”

In November, PMG’s Kevin Maloney called Trump’s proposed tariff policy a “ridiculous thing” at TRD’s Miami forum. But the developer of condo skyscrapers in Miami and NYC has stayed mute ever since Trump entered office.

Did fears of angering our quick-tempered leader move a typically loquacious industry to bite its tongue? Maybe.

There may be some other reasons, as well. Real estate likely remained mum because it hasn’t overwhelmingly felt the pain. Unlike Wall Street and a handful of REITs, the industry views threats as weeks or months down the line.

No reason to fear — or put heads of state on blast — when the implications aren’t clear.

“The reality is nothing has actually changed yet,” MaryAnne Gilmartin, CEO of MAG Partners, said on Wednesday, prior to Trump’s tariff pause.

“The projects that made sense six months ago, given the relatively long construction and delivery time frames, still make sense today,” Sam Chandan, director of NYU Stern’s Chen Institute for Global Real Estate Finance, said.

Costs? Unconcerned

In the days since Trump announced his big tariff proposal, the markets moved so rapidly that betting on the direction of lumber or instantly putting in orders to stockpile supplies would be reckless, some said.

This proved true when Trump reversed course on Wednesday with his 90-day pause. A 10 percent universal tariff remains in effect, as does a 25 percent tariff on imports of steel and aluminum.

Recent history may also shed light on real estate’s quiet demeanor.

Another insider, for example, speculated real estate stayed calm because the industry had recently suffered its own correction when interest rates soared and valuations plummeted more than 25 percent. An amorphous tariff threat paled in comparison to the acute crisis the industry just experienced.

“I think that’s why people are not really screaming, like it already happened for real estate,” the anonymous lender said.

Those who have crunched the numbers on the costs of Trump’s aluminum and steel tariffs found the impact to be minimal.

Gilmartin, the former Forest City Ratner exec who spearheaded the Pacific Park megaproject in Brooklyn, said the tariffs on aluminum and steel only account for 2 percent of total costs in a new multifamily development. Developers have contingencies for these costs, she said.

“Regardless of policy decisions, the past 35 years in this business makes me believe that New York will be fine,” said Gilmartin.

Maurice Regan, CEO of construction firm JT Magen, had a similar sentiment. Tariffs, he said, have not had any effect on his business thus far.

“For any sensible person, it’s very very difficult to analyze this,” said Regan.

Keep on keeping on

Real estate may not have been worried, but New York City politicians were quick to claim Trump’s policies had negatively hurt development.

Manhattan Borough President Mark Levine took to X last week to proclaim real estate projects “have already paused or been canceled because of these disruptions.”

In nearly a dozen calls with developers, lenders and brokers, The Real Deal was unable to confirm a single project that had been delayed, let alone canceled. Levine’s office did not respond to a request for comment.

“I haven’t seen pauses or delays,” another lender specializing in multifamily said. “I think the cost of carrying these projects makes that prohibitive.”

While there seems to have been some temporary deal pauses on the residential and leasing side of things, that has yet to materialize in other aspects of the commercial business.

“We’re full steam ahead in our pipeline,” Rosie Tilley of multifamily and condo developer Charney Companies said.

Micromovements

Though no developments appear to be scrapped, industry sources reported microshifts in business approaches.

Tilley said the firm had pre-bought some materials, opting to eat the cost of storage over any unknown premium tariffs might tack on.

“We’d much rather acquire and pay to store something at today’s rates than make ourselves vulnerable,” she said.

A multifamily lender said he had “never been busier” but acknowledged his firm — a relatively small New York shop — had leaned more conservative in its underwriting in response to March tariff announcements, lowering the loan-to-value ratios on the debt it had recently doled out.

Shaky ground

Some acknowledged that it’s still early days for Trump’s tariff world, and trade policy remains a moving target.

“The biggest impact is in people’s confidence,” said Regan on Tuesday. “It’s panicking everyone, it’s panicking management; if they are a public company they are feeling it.”

After Trump pressed pause on the reciprocal tariffs Wednesday, another reality sunk in: it’s only a temporary break. It’s also not a true break — China’s tariff rate has ramped up to 145 percent.

“What the 90-day pause doesn’t do is give us any clear sense of what the path to normalization actually looks like,” Chandan said.

And though real estate has kept a relatively cool head in the face of Trump’s tariffs, it’s clear that the whipsawing has frustrated some and exhausted most. And it’s less than three months into his term.

“There’s a lot of commiseration,” Tilley of Charney Companies said. “This is a hard enough job as it is — we have a housing shortage, we have demand to meet.”

“It’s another curveball but boy this one’s a tough one,” she added.

While some business leaders like Ackman praised Trump for reversing course, likening it to his brilliance in the Art of the Deal, real estate execs said overall there is not much they can do to hedge against Trump’s next deal.

And perhaps that next executive decision will be what causes the industry to take a more pronounced political stance.

“This guy — our wonderful president — could come out tomorrow and say the tariffs are back on; it’s just an impossible environment to handicap,” said a commercial lender.