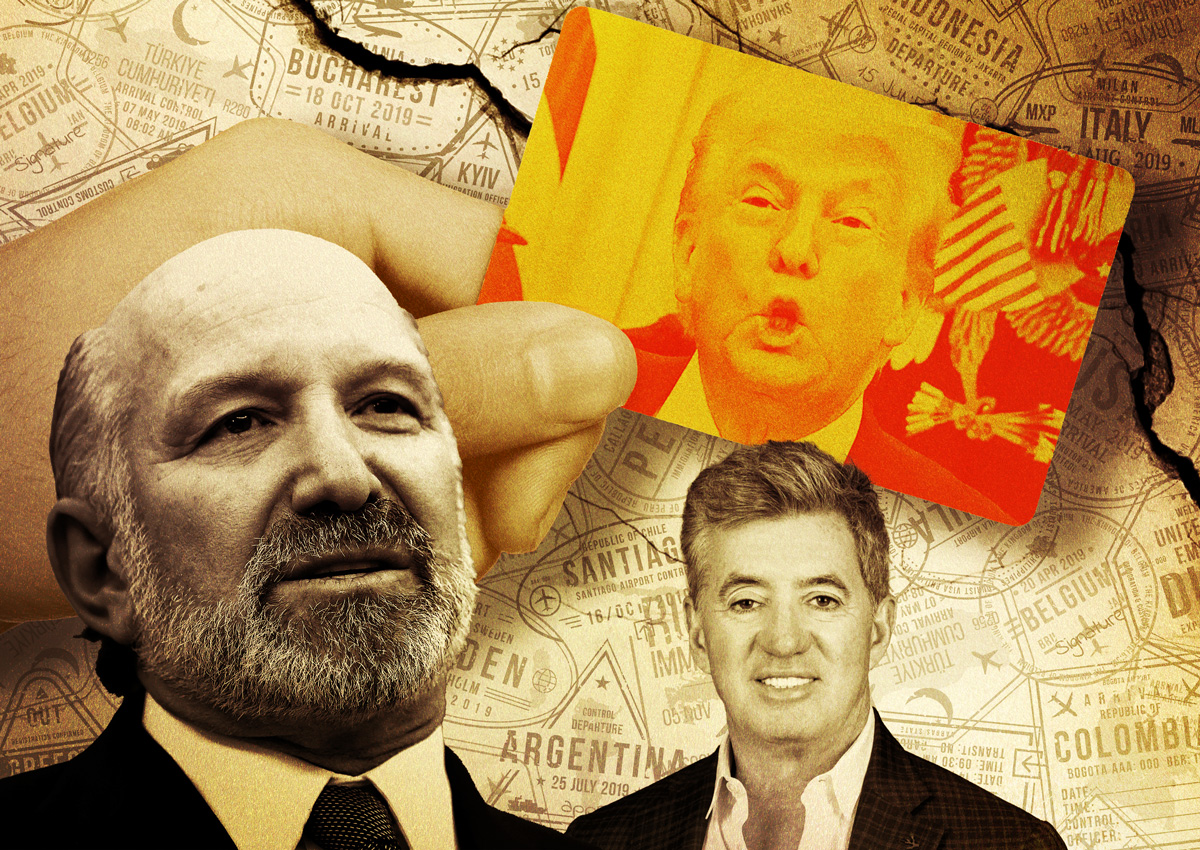

Howard Lutnick’s call to end EB-5 and replace the federal program with a “golden visa” shocked some of EB-5’s biggest players.

“Nobody saw this coming,” said Ronald Klein, an attorney at Holland & Knight, who has lobbied on EB-5 issues.

“This came out of left field,” said Nicholas Mastroianni of the U.S. Immigration Fund, one the largest EB-5 regional centers in the U.S.

It appears that the Commerce Secretary’s proposal to kill EB-5, a program once referred to as the “crack cocaine” of real estate financing, was not brought up to the industry’s players, from regional centers to attorneys.

Those in the EB-5 world are just as perplexed about Trump’s pitch to replace the program with a $5 million visa.

“It’s not reality,” said Mastroianni about Trump’s golden visa idea. “There is zero chance of a substantial amount of people investing $5 million.”

Trump said the golden visa will help pay off the federal deficit. “The people that can pay $5 million, they’re going to create jobs,” the president told reporters. “It’s going to sell like crazy.”

But Mastroianni notes that converting foreign currency to U.S. dollars for Trump’s golden visa is complex. In mainland China, for instance, the government only allows up to $50,000 to be converted from Chinese Yen to U.S. dollars. In India, there is a major tax on overseas financial transfers, among other challenges.

Few people in the world have $5 million in liquid cash. Most EB-5 investors are from China and India, who cobble together their savings from family or friends to make the minimum investment of nearly $1 million, according to Mastroianni.

“I’m worried about the whole EB-5 industry,” said Mastroianni.

EB-5 proponents also wonder about how Trump would end the program. It was created by Congress in 1990, and former President Joe Biden signed legislation in 2022 keeping it in place until 2027.

“For current projects and investors, there should be minimal immediate concern,” said Jill Jones, a general counsel with JTC Group, who has worked on 600 EB-5 development projects.

Trump could slash jobs at USCIS, the office in charge of administering the program, a move which would likely further delay the visas’ processing times.

During the EB-5 boomtime of the early 2010s it seemed like every real estate developer wanted a piece of EB-5 in their capital stack. Mastroianni flew around the world facilitating most of those deals; regional centers like Mastroianni’s USIF acted as middlemen between developers and foreign investors.

Developers usually used EB-5 money as a loan to fund gaps in their capital stacks. It went to finance mega projects like Related’s Hudson Yards in New York City. The program allowed foreign investors a chance to obtain a U.S. visa in exchange for $500,000 and the creation of American jobs.

But the program became an easy target for fraud, too. High-profile cases including Vermont’s Jay Peak Resort and Palm Beach’s Palm House Hotel left a black eye in the industry. Developers started turning to other forms of financing.

Lutnick said that the risk of fraud was a key motivator to end EB-5.

“It was full of nonsense, make-believe and fraud, and it was a way to get a green card that was low price,” Lutnick told the media on Tuesday, as reported by Reuters. “So the president said, rather than having this sort of ridiculous EB-5 program, we’re going to end the EB-5 program. We’re going to replace it with the Trump gold card.”

Ronald Fieldstone, an attorney at Saul Ewing who has worked on more than 450 EB-5 projects, notes that the 2022 legislation added new measures to weed out fraud. Those measures included sanctions if a regional center files misstatements, as well as increases in minimum investment amounts.

“We think he [Lutnick] inappropriately slammed the program,” said Fieldstone.