In the year since Flagstar Financial, the recent rebrand of New York Community Bank, flirted with failure, the bedraggled lender has worked to unwind itself from the rent-stabilized debt that drove the close shave.

This month, Flagstar offloaded $142 million of that portfolio, finding a buyer in Howard Lutnick’s Cantor Fitzgerald, PincusCo reported.

A spokesperson for Cantor Fitzgerald did not return a request for comment. Flagstar’s spokesperson did not comment in time for publication.

The loans are backed by 27 assets, which are 86 percent rent-stabilized on a weighted average, according to an analysis by The Real Deal.

That high concentration signals the buildings are exposed to the distress wrought by the 2019 rent law, legislation that has strangled revenues in rent-regulated buildings as expenses soar.

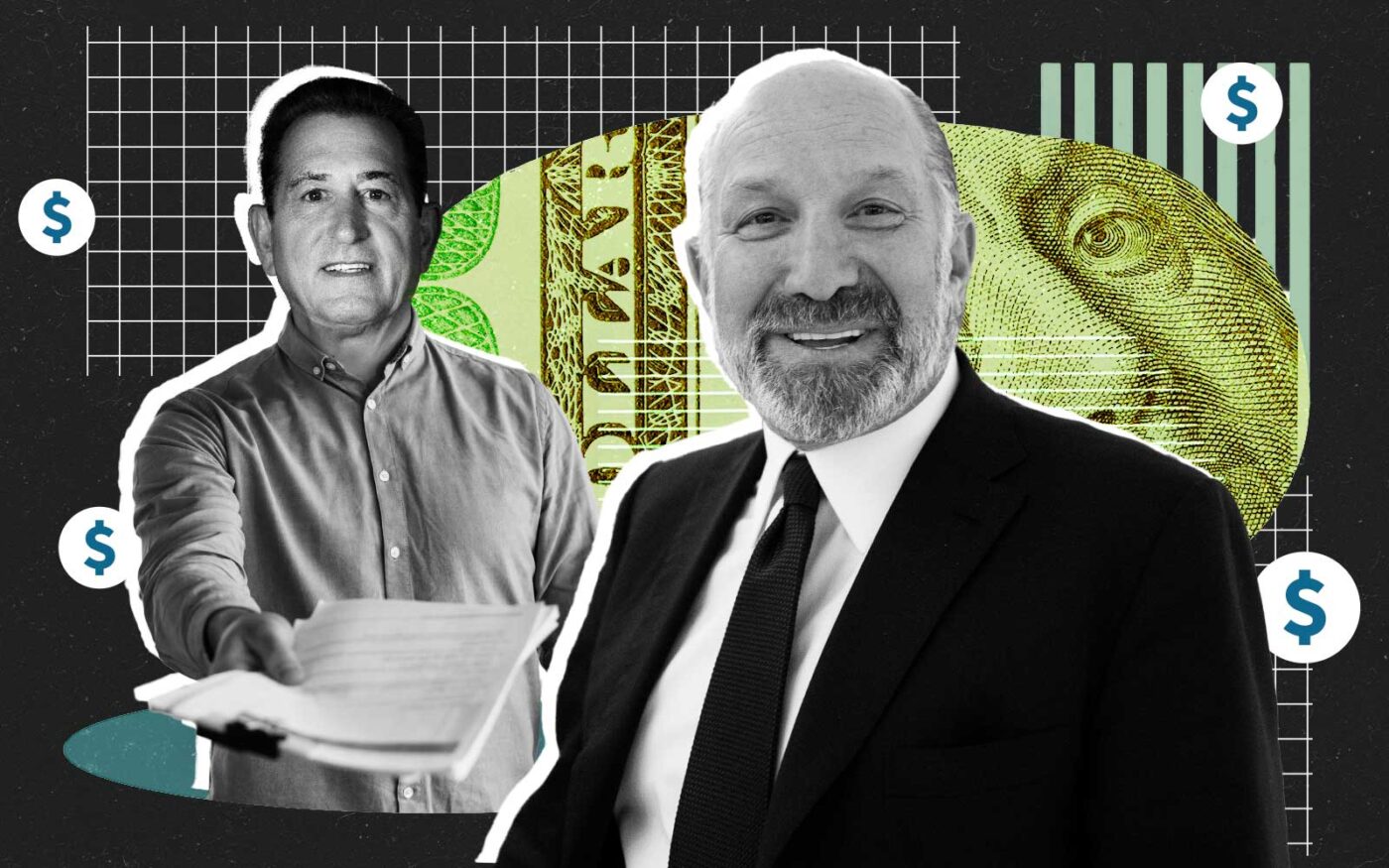

Sources said the Flagstar portfolio was a mixed bag, stuffed with performing and non-performing loans to lure bidders. Some of the borrowers in that bag are household names such as Steve Croman, and prolific owners including Alma Realty, Fairstead and Pinnacle Group.

It’s unclear what Lutnick’s firm paid for the package. Distressed debt typically sells at a discount.

The deal is a drop in the bucket for Flagstar, considering its multifamily loans, half of which are tied to rent-stabilized buildings, totaled $33.1 billion at the end of the third quarter, according to regulatory filings.

Still, Flagstar has pruned its multifamily loans by at least 6 percent since the end of 2023, according to its third-quarter results. The bank reports fourth quarter earnings on Thursday, which should include updates on that progress.

Flagstar spent the bulk of 2024 rebranding itself after a near disastrous start to the year.

The bank shocked investors last January when it axed its dividend by 70 percent to boost capital on the expectation distress would rattle its multifamily portfolio. A few weeks later it disclosed “internal controls” issues linked to internal loan review.

In the first week of March, its stock price plunged 47 percent, sparking cries of collapse before a group of investors revived the lender with a $1 billion rescue capital injection.

Since, Flagstar’s C-suite, currently headed by former Comptroller of the Currency Joseph Otting, has been a revolving door. The bank shed the NYCB moniker late last year and rebranded as Flagstar, a bank that merged with NYCB a couple of years ago.

Read more