AT&T is flush with cash after selling dozens of properties to a real estate development firm, only to lease them back.

The telecommunications giant transferred 74 properties to Reign Capital in the deal, the company announced on Friday. The deal closed two weeks ago.

In the deal, Reign took ownership of more than 13 million square feet across the country. As a result, AT&T will realize $850 million in cash proceeds, while simultaneously leasing back much of the space it sold.

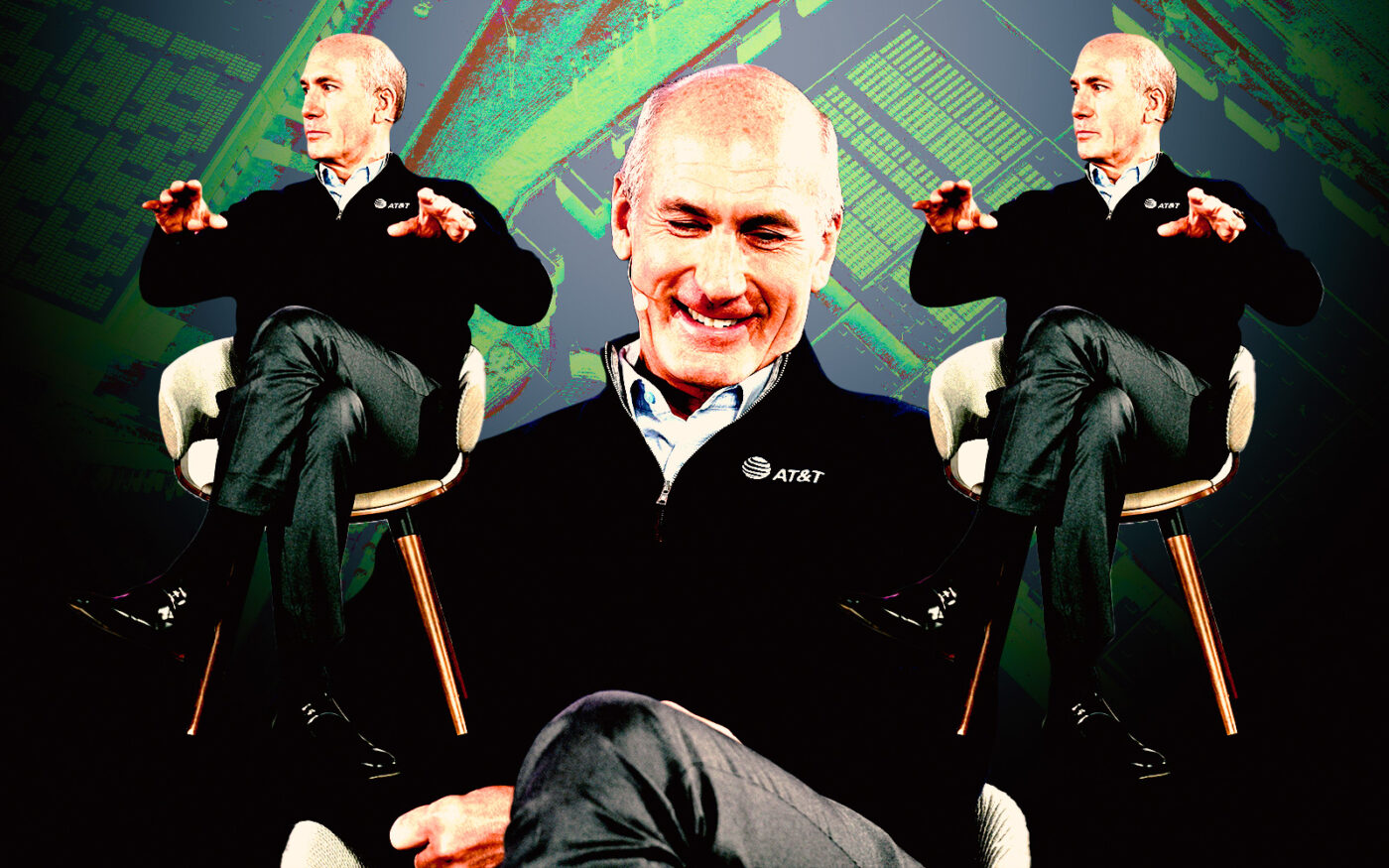

“The uniquely structured deal unlocks value in otherwise stranded commercial real estate space,” AT&T head of global real estate Michael Ford said in a statement.

Sale-leasebacks are deal structures that allow a seller to boost liquidity without sacrificing real estate they are using. The seller relinquishes control of the properties, and over time, rent payments diminish some of the proceeds from the sale.

AT&T will pay rent over the lives of the leases and maintain operational control of the space it needs for access to communications infrastructure.

For AT&T, the deal made sense because of the underutilized nature of the properties it sold. The so-called “central offices” — essentially industrial real estate housing equipment for copper networks — have become obsolete as fiber and wireless networking has taken precedence. AT&T plans to exit the majority of its legacy copper network operations by the end of the decade.

Arguably the most intriguing part of the deal is the provision for financial participation in the revenues of any redevelopment Reign initiates. The telecommunications company will therefore benefit from property value increases. It will also have final approval on the projects to ensure its operational needs are not affected.

AT&T jumped into the deep end with Reign after taking a dip in the shallow side of the pool in 2021, when the partners agreed to a similar deal involving 13 properties and more than 3 million square feet; it netted $300 million in upfront cash in that deal.

Read more