U.S. workers are heading back to the office.

More companies have committed to returning to office culture, leaving behind remote work policies they adopted during the pandemic, the Wall Street Journal reported.

One third of all companies mandated a return to office five days a week in the third quarter, up from 31 percent in the second quarter, according to Flex Index, which studies workplace strategies.

That ended a streak over the previous five quarters when the rate of in-office work had reliably fallen, as low unemployment rates had given employees the upper hand in their quest for more remote work.

Now, the white collar workforce has seen growth decline, transferring the balance of power back towards management.

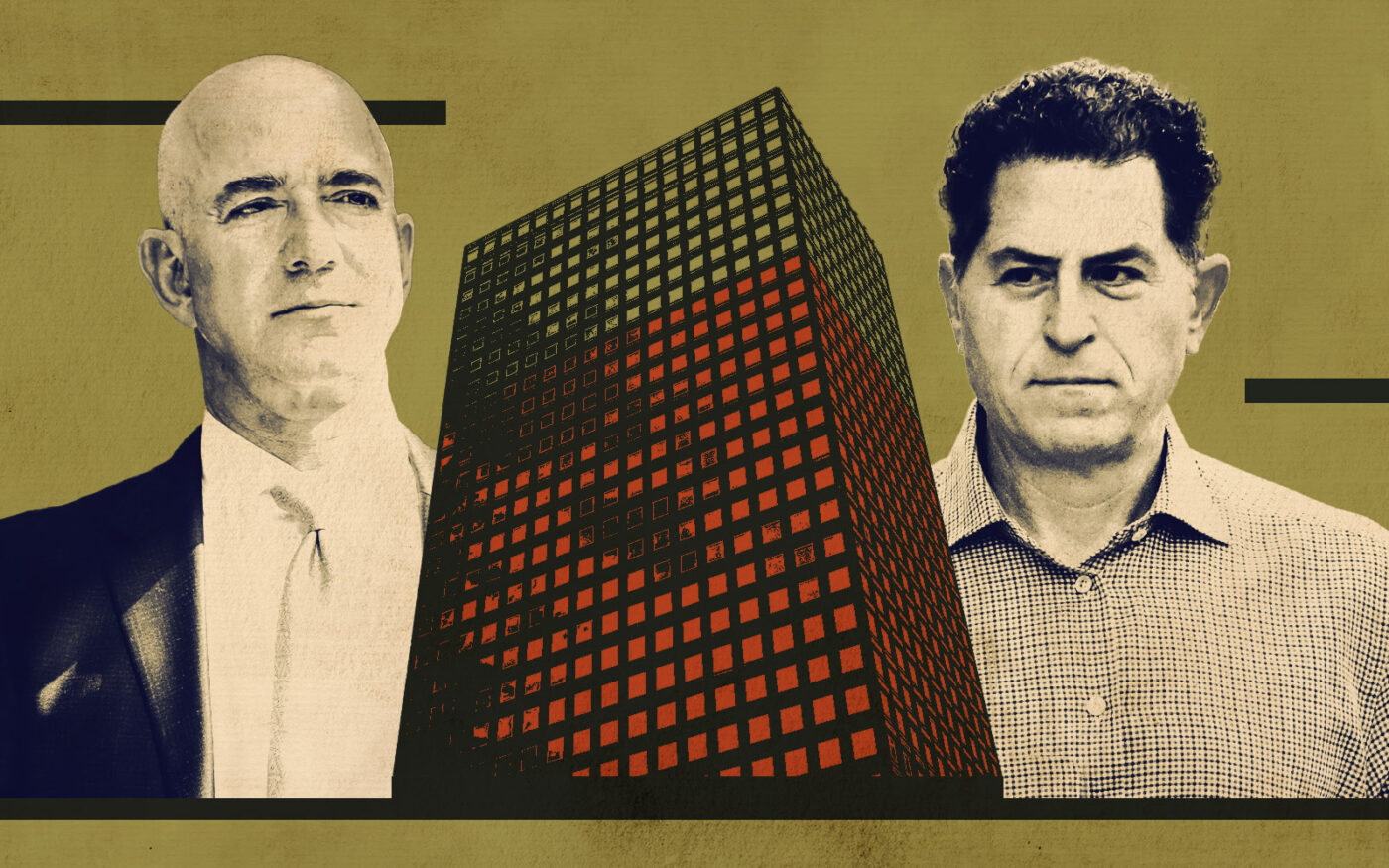

Amazon called their corporate workforce back to the office five days a week. The e-commerce giant is now in talks to lease additional office space next to their company headquarters in the former Lord & Taylor building at 424-434 Fifth Avenue, which hosts 2,000 employees.

Dell Technologies is also now requiring their global sales team to head into the office full time, while 3M told senior employees to increase office time at the company’s headquarters and other sites.

No one expects workplaces to completely return to pre pandemic attendance requirements, and the increased rates of an in-office workforce doesn’t indicate an end to office market challenges. The vacancy rate is stabilizing at a near record 13.8 percent, up from 9.4 percent in the fourth quarter of 2019.

Since the second quarter of 2020, U.S. companies have vacated nearly 209 million square feet of office space, the highest amount ever recorded in a four and a half year period, according to CoStar data. Much of that vacated space is considered obsolete and might never see corporate occupancy again.

After eight consecutive quarters of reduction in corporate space, the amount of occupied offices essentially remained flat during the second and third quarters of 2024.

New York is experiencing steady reductions in vacancy rates, as financial firms like Citadel, Ares Management and Blue Owl Capital look to expand. Artificial Intelligence firms out of San Francisco have begun to move to other markets like Denver, Seattle, and Atlanta.

Companies are utilizing in-office perks like luxury gyms and fine-dining restaurants to sweeten the deal for workers to return to their desks.

HSBC Bank, which in 2022 leased approximately 200,000 square feet for its U.S. headquarters in Tishman Speyer’s new Manhattan development The Spiral, tacked on an additional 35,000 square feet this year after in-office attendance rose to 80 percent, up from the 40 percent at the bank’s previous office.

Real estate developers are taking note of the shift in sentiment.

Earlier this month, Tishman Speyer completed a $3.5 billion refinancing on a revamped Rockefeller Center, the largest issuance ever recorded for a single office asset. The move provided a blueprint for owners of other well-leased office properties to follow.

Investor interest in distressed properties has been rising as prices drop; real estate firm Eastdil Secured has completed 18 office sales with a valuation of $2.6 billion, led by lenders disposing of assets.

But defaults and other missed payments are still plaguing the market. In September, the delinquency rate on office loans converted into securities increased to 8.36 percent, the highest rate seen since November 2013, according to data firm Trepp.

Banks, while reporting third quarter earnings, say problems with office loans overshadow other types of commercial property struggling from late pandemic-era high interest rates.

Roughly 40 percent of office leases secured at the start of the pandemic have yet to mature, according to CoStar. Once they do, many expect office tenants to offload space.

“The winding down is not over,” Phil Mobley, CoStar’s national director of office analytics, told the outlet.

— Caroline Handel

Read more