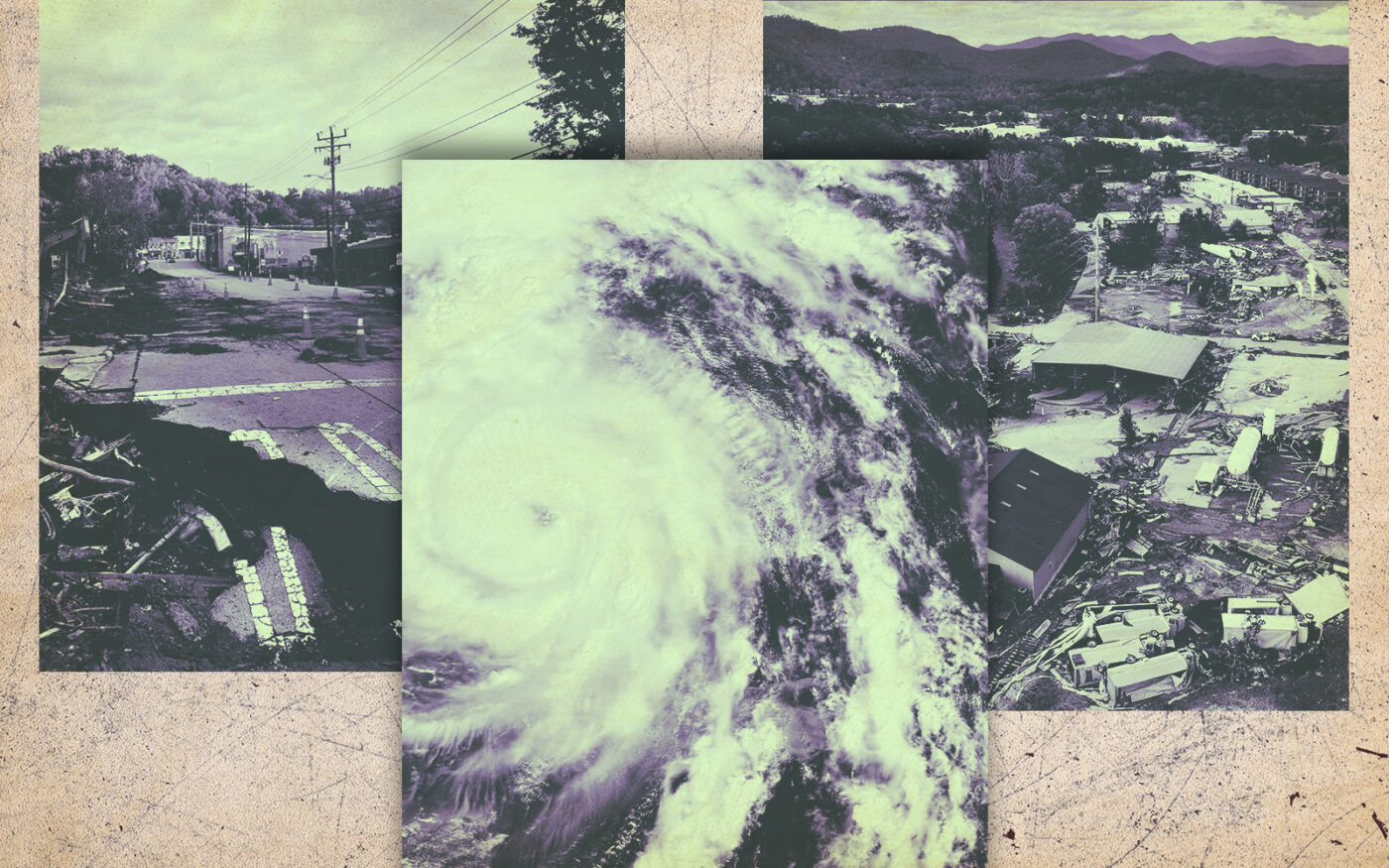

Devastated homeowners looking to rebuild after Hurricane Helene could find their insurance claims knocked down.

Insurance companies tightened coverage after losses from natural disasters, adding exclusions and other provisions to limit damage to their bottom lines, the Wall Street Journal reported. With another storm kicking up, holes in insurance policies are destined to frustrate more owners in Florida.

Besides coverage restrictions, typical policies don’t cover flood damage. Property owners — including those slammed by Helene in Asheville, North Carolina — usually lack separate flood insurance, to keep premiums down or because they believe disaster won’t visit them.

Fewer than one in 100 homeowners in the worst-flooded counties inland have flood coverage, according to a spokesperson for the Insurance Information Institute.

“The hurricane and storm surge path proved that no one is safe,” Alexandra Glickman, global head of real estate and hospitality at insurance broker Arthur J. Gallagher, told the Journal.

In many instances, deductibles for wind-related losses are so high that customers will get no payout for their claims.

Adding insult to injury, insurers sometimes attempt to limit payments to claimants who have coverage. For instance, an insurer might assert all damage to a property is from flooding, even if other factors such as wind were involved.

This can lead to protracted legal fights. Hurricane Ian struck two years ago, but 50,000 claims remain unresolved, according to the state of Florida. Not a single dime has been paid on nearly 40 percent of those claims.

Hurricane Helene caused an estimated $15 billion to $26 billion in property damage, according to Moody’s. The insured loss is expected to be in the range of $5 billion to $15 billion, according to Lloyd’s of London CEO John Neal.

Read more