Howard Lorber will soon have more time to dedicate to his battles at Douglas Elliman.

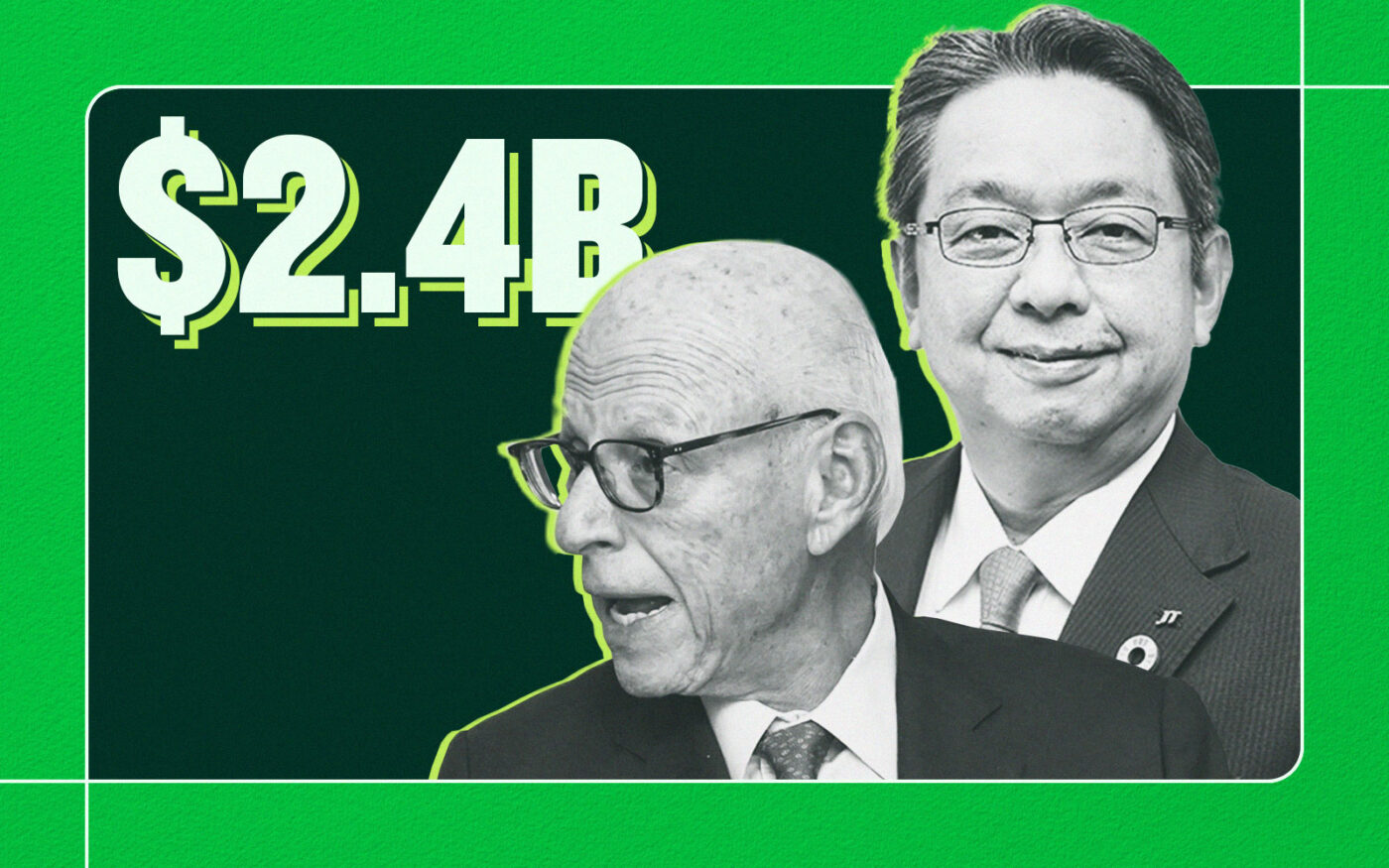

Japanese tobacco giant JT Group is buying Lorber’s Vector Group, Elliman’s former parent company, for $2.4 billion, Vector announced on Wednesday. Vector is still run by Lorber, who stuck around when Elliman was spun off into a public company in 2021.

Based on the acquisition price and Lorber’s reported ownership of more than 3 million shares, he would reap about $46 million from the deal.

Vector owns and operates Liggett Group, a discount tobacco company, and New Valley, a real estate investment group. The latter has been involved in some minority real estate investments, including the 125 Greenwich Street project.

JT agreed to acquire all outstanding shares for $15 cash each. That is a 29.9 percent premium over the 60-day volume-weighted average share price. Vector’s stock closed at $13.99 per share on Tuesday, fewer than 10 cents off its 52-week high.

The deal is expected to close in the fourth quarter, after which Vector will become a wholly owned subsidiary of JT.

JT also dabbles in pharmaceuticals and processed foods, but is best known for its prominent tobacco brands, including foreign rights for Winston and Camel.

It’s unclear what capacity Lorber will continue in if the deal closes, but the real estate honcho already has his hands full at Elliman.

Last month, investor Brad Tirpak urged shareholders to vote against a proposal on Lorber’s compensation as chair of the residential brokerage, as well as a proposal to elect directors each year. Last week, two independent proxy firms recommended Tirpak’s demands. The company’s shareholder meeting is scheduled for Wednesday.

Elliman has been troubled lately by mounting losses and tumbling share prices, as well as the scandal involving the company’s former top brokers, Oren and Tal Alexander.

Lorber’s contract is due to expire at the end of the year. Excluding stock awards, Lorber made more than $4.7 million last year, up by more than $600,000 from 2022, according to an annual report filed with the Securities and Exchange Commission.

Read more