Manhattan landlords may be losing money on vacant offices but the city isn’t.

With the Big Apple’s office vacancy rates hovering just below 25 percent, the assessed market values on them have increased, boosting the city’s tax revenue, the New York Times reported based on a new state comptroller report.

The overall tax-assessed value of the city’s towers has increased by $2.5 billion over the past four years. It ticked up from $202.3 billion in July 2020 to a current $204.8 billion.

But building owners are not enjoying similar gains on the value of their assets.

Tax-assessed values don’t necessarily reflect actual sales values. Swiss bank UBS sold 135 West 50th with an assessed value of $295 million at a fraction of that at $8.5 million.

Property taxes are the largest revenue source for the city’s police, fire and sanitation services.

The city will collect $7.6 billion in building property taxes over the next fiscal year compared to $5.8 billion it collected in 2020, according to the Times. This figure accounts for about one-fifth of all property taxes expected to be collected in the 2025 fiscal year.

Office vacancy rates reflect work-from-home policies that arose during the pandemic which has resulted in many companies reducing their footprints.

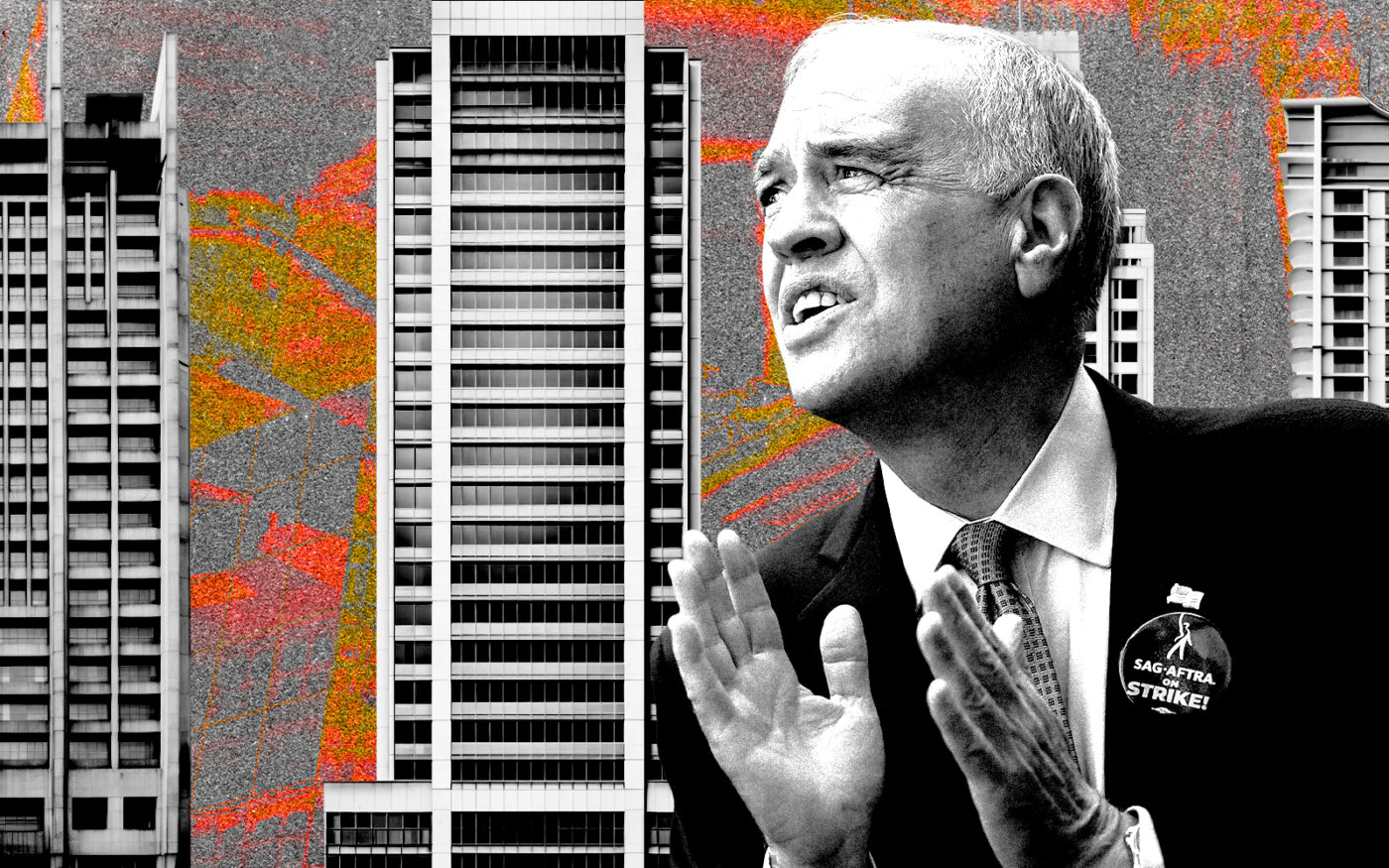

The number of office-type jobs in the city are back to pre-pandemic levels of 1.5 million. Still, “The value of office buildings in New York City is tied to demand for space that comes from new and expanding businesses hiring workers,” New York State comptroller Thomas DiNapoli said in a statement.

While the jobs may have bounced back, the demand for office space has not. More employees work in hybrid roles creating the highest percentage of vacant space the city has had in decades.

Real estate firm Cushman & Wakefield told the Times that 23.6 percent of all office space is vacant, up from 11 percent before the pandemic.

New York State deputy comptroller Rahul Jain is still spinning some optimism, telling the times, “People were expecting them to fail and clearly that’s not the case.”

Jain noted that valuations and tax revenue could decline if companies cut office sector jobs or reduce their office footprints, or we have a recession.

Property values have grown across the city, but most of that has been fueled by Hudson Yards. In fact, two-thirds of the overall growth from 2020 can be tied to it, with its value increasing by $6 billion over that time, the outlet said.

Read more

That said, office buildings outside major commercial areas also saw property values increase, like Downtown Brooklyn and Union Square, according to the report. Jain said those were due to firms seeking good deals.

Unfortunately for building owners, there isn’t much they can do about rising assessments. Though some have tried, but the chances of winning a reduction to a tax assessment are slim.

— Christina Previte