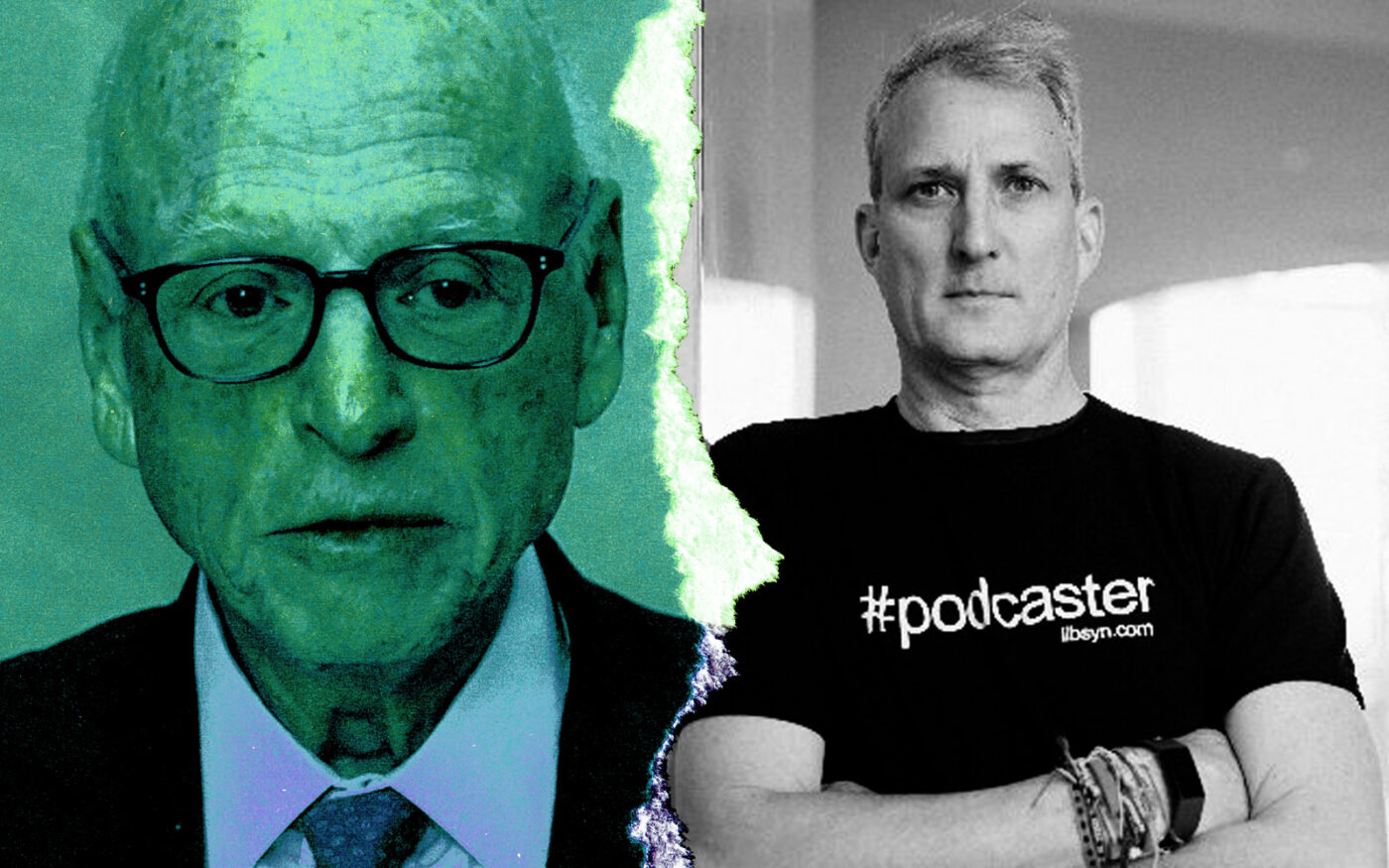

A Douglas Elliman shareholder took aim at chairman Howard Lorber in a letter to fellow investors, urging them to turn on the longtime executive after mounting losses and sexual assault allegations related to the company.

Investor Brad Tirpak asked shareholders to vote against a proposal concerning executive compensation at the annual stockholder meeting, slated for Aug. 21. The letter published Wednesday morning also called for the company to begin its search for a new chief executive, as Lorber’s contract is set to expire on Dec. 29.

When Elliman spun off from parent company Vector Group in 2021, “the goal was to make $100 million,” Tirpak told The Real Deal. “Now the goal is to break even.”

“The board rewards [Lorber] for losing money,” Tirpak said. “Your boss fires you if you lose money, that’s what happens in the real world.”

The investor also called for votes for the proposal to elect directors each year, aiming to get compensation in line with stockholder returns, citing a proxy statement filed by Elliman in June that lowered the standard used by the board of directors to determine executive bonuses.

“Under the 2022 bonus structure, management would have widely failed the Adjusted EBITDA Threshold, fallen short of the Gross Transaction Value Target, and whiffed the Dividend Threshold,” Tirpak wrote.

The letter also points to the Diversity, Equity and Inclusion portion of Lorber’s bonus, of which he “received the Maximum permissible award” despite news of sexual assault allegations against two of the brokerage’s longtime top producers, Oren and Tal Alexander.

“Stockholders deserve to know how the assault and harassment claims were handled by management,” Tirpak wrote.

A spokesperson for Elliman said the company will “carefully review” the letter and said its board of directors and management team “maintain an open dialogue with, and value constructive input from, our stockholders.”

“Douglas Elliman notes that the former brokers accused of sexual assault left the Company more than two years ago, and there were no complaints against them when they were at the Company nor was there any concealment or preferential treatment with respect to those brokers,” the firm said in a statement.

Former Elliman broker Brian Meier told the New York Times it was understood chairman Howard Lorber was aware of “at least one incident,” the outlet reported. Stephen Larkin, Elliman’s vice president of communications, confirmed that Lorber had heard of an incident but maintained that it was confidential and not an official human resources complaint.

The investor called for the board to claw back Lorber’s 2023 bonus, drop the deal for Vector’s private jet and begin searching for a new CEO.

Lorber’s use has been well-documented while overseeing Elliman’s national footprint.

As of 2022, Lorber was allowed $200,000 in private jet usage, on top of a car and driver. Elliman paid nearly $600,000 in the first quarter of this year to lease a jet from parent company Vector Group, according to a filing with the Securities and Exchange Commission.

TRD previously reported the company’s yearslong campaign to cut costs didn’t extend to executive bonuses.

The company’s amended annual report. Excluding stock awards, Lorber earned more than $4.7 million last year, up by more than $600,000 from 2022.

His compensation boost was due in part to a 10 percent raise in his base salary, included in his contract. Other executives, including chief financial officer Richard Lampen and chief technology officer David Ballard, received 5 percent raises.

While the firm slashed the bonus of brokerage president and CEO Scott Durkin, both Lorber and Lampen were awarded more than the previous year under the company’s non-equity incentive plan, which takes into account performance metrics like adjusted EBITDA and transaction volume.

This article has been updated with a statement from Douglas Elliman in response to the shareholder’s letter.

Read more