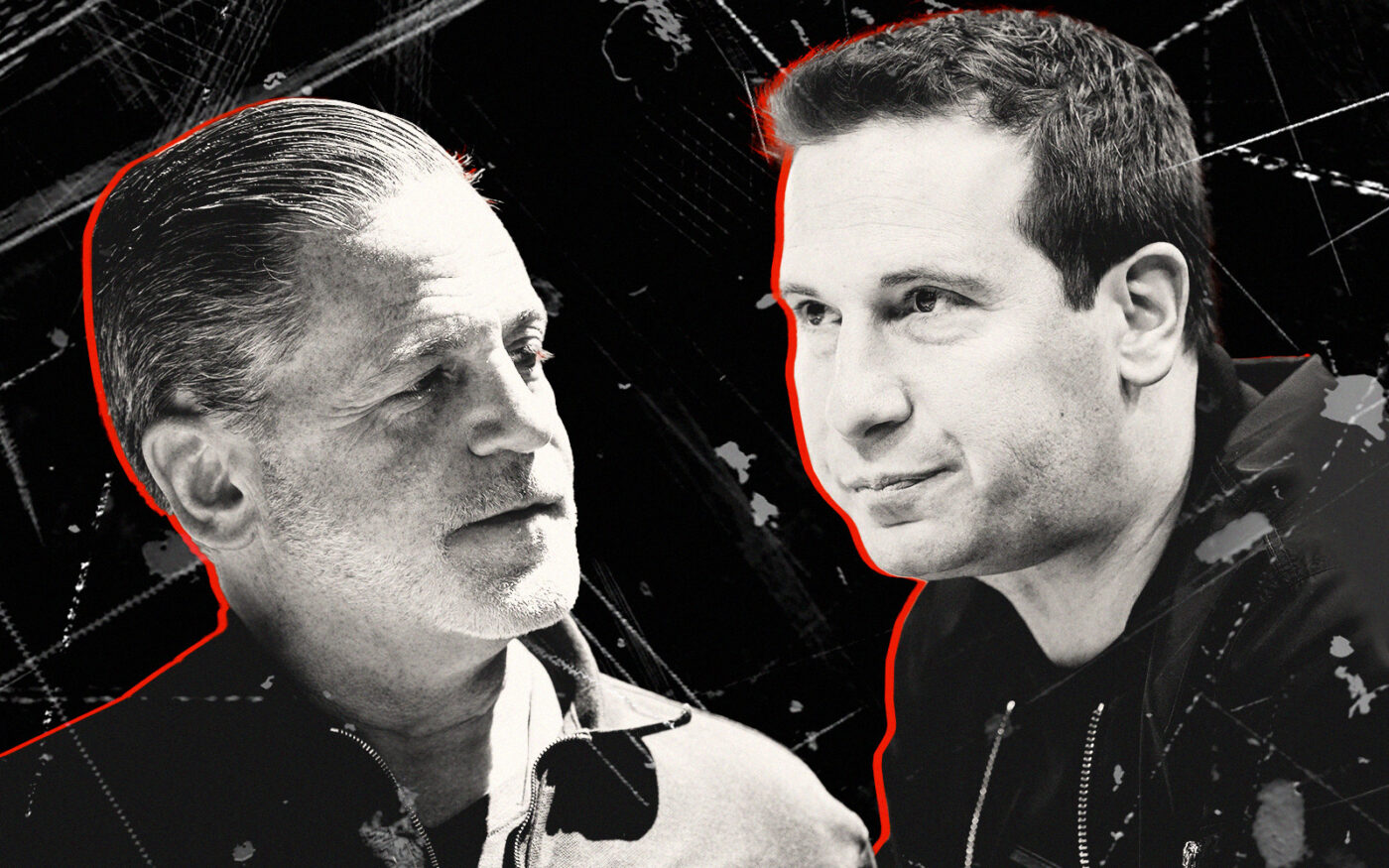

From the hardwood to the hardscrabble world of mortgages, Mat Ishbia is unafraid to pick a fight with his biggest rival.

The head of United Wholesale Mortgage and owner of the NBA’s Phoenix Suns pointed fingers at Rocket Mortgage in the wake of a recent attack on UWM, Inman reported. His verbal jab came after an affiliate of hedge fund Hunterbrook Capital published a controversial report about UWM’s business practices, leading to a lawsuit that alleges Ishbia’s company is harming borrowers.

“That’s Rocket Mortgage and Dan Gilbert doing Rocket Mortgage and Dan Gilbert things…and that’s just what it’s been funded by,” Ishbia told reporters in response to the allegations against his company.

Gilbert is the founder of Rocket Mortgage, UWM’s biggest competitor. Gilbert is also the owner of an NBA team, the Cleveland Cavaliers, and was the lone owner abstaining from a vote that otherwise unanimously approved Ishbia’s acquisition of the Suns and its WNBA counterpart, the Phoenix Mercury, last February.

A spokesperson for Rocket said in a statement that Gilbert and the firm “have no investment, other financial interests or relationship to Hunterbrook Media,” the publisher of the recent report. Hunterbrook Media co-founder Sam Koppelman also denied any coordination, calling it a “baseless conspiracy theory.”

Ishbia and his company find themselves on the defense after Hunterbrook recently shorted the company’s stock and took a long position in Rocket.

The lawsuit that came out of Hunterbrook Media’s report alleges UWM’s “All In” initiative has led mortgage brokers to “artificially steer loans to UWM,” meaning brokers might not be securing the best deals for their clients. The company’s initiative prevents any broker who does business with UWM from working with competitors Rocket and Fairway Independent Mortgage.

UWM has called the lawsuit a “sham,” saying its growth in market share has been driven by its ability to offer borrowers better deals; the “Game On” initiative, for example, brought rates down between 50 and 100 basis points across loan types.

UWM also criticized the report from Hunterbrook Media as being “riddled with inaccuracies and incorrect information,” concluding that “a hedge fund scheme using journalists to short a stock is not only unethical, it may be fraudulent.”

The war of words between UWM and Rocket goes both ways. Last year, Rocket Pro TPO Executive Vice President Mike Fawaz referred to Ishbia as a “playground bully” in a presentation to mortgage brokers.

Read more