View’s plummet towards bankruptcy is complete.

The smart glass startup will file for Chapter 11 bankruptcy after reaching an agreement with its stakeholders, Bisnow reported. View plans to go private and maintain business operations as it winds through bankruptcy, which is expected to last fewer than two months, the company said in a statement.

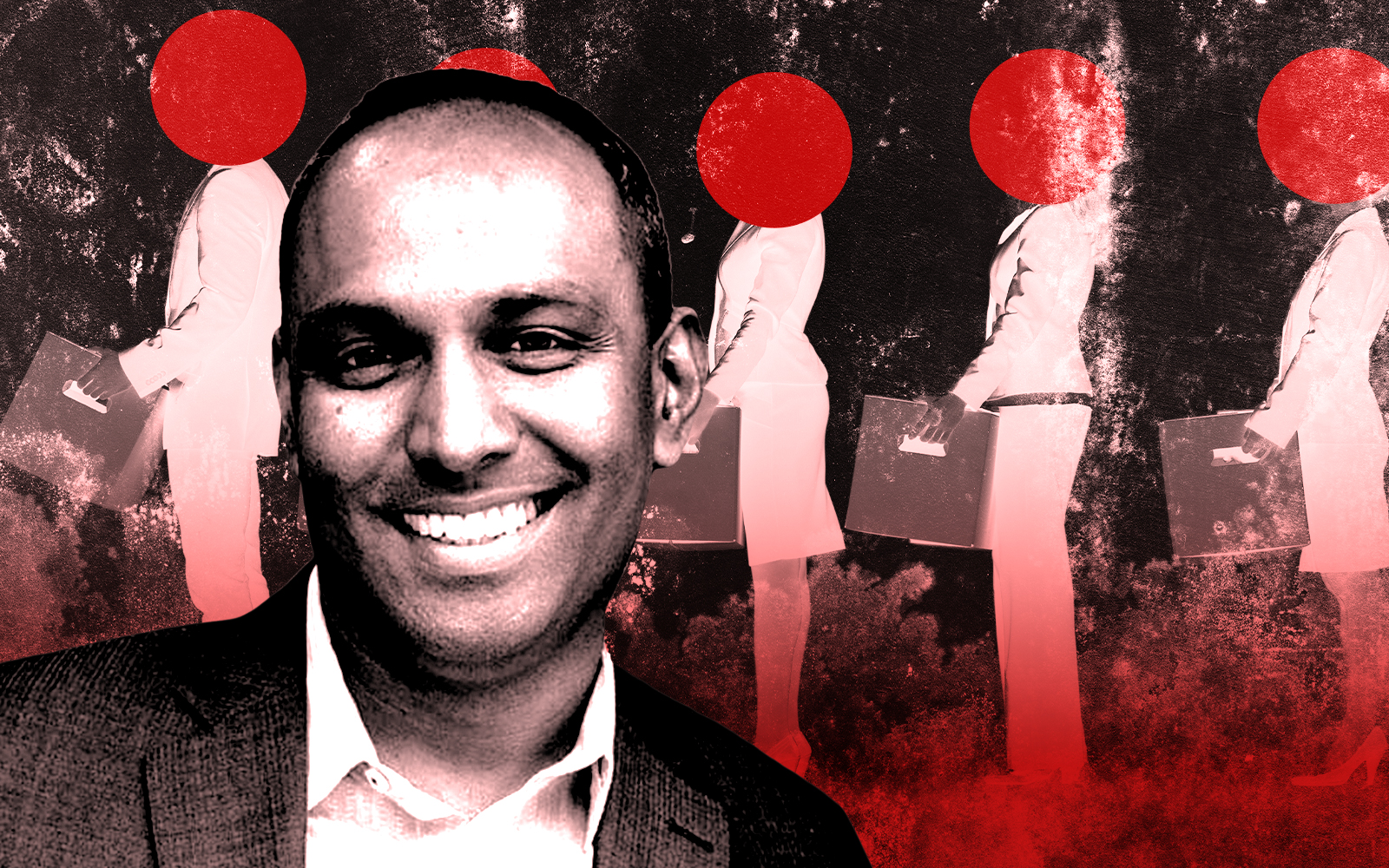

View CEO Rao Mulpuri said the bankruptcy and privatization follows a strategic review to “ensure we have the proper capital structure going forward.”

Mulpuri highlighted the support of two of the firm’s key stakeholders, Cantor Fitzgerald and RXR. Both contributed to a $50 million credit facility in the fall that helped View avoid having its stock delisted, a consequence of being required to audit previous financial reports due to accounting errors.

Cantor Fitzgerald CEO Howard Lutnick expressed support for View’s future in a statement.

But the startup’s past and present landed the company in a tricky position. The manufacturer of “dynamic” glass came to be in 2007, promising windows that could reduce heat and glare, primarily in offices, while adjusting in response to light. The company was once valued at $2 billion and raked in a $1.1 billion investment from SoftBank in 2018.

In December 2020, the company went public via an SPAC with the involvement of Cantor Fitzgerald. At the time, the company was valued at $1.6 billion.

But an array of problems have since cropped up. The company was fined $5 million for unlawfully discharging wastewater in Mississippi. The Securities and Exchange Commission fined the company the same amount after its chief financial officer allegedly misstated the cost of replacing faulty windows.

Last year, the company laid off nearly a quarter of its workforce.

By mid-February, the company held $227.6 million in debt, compared to only $65.3 million in cash on hand. In the prior 12 months, the startup lost $426.4 million while taking in $128.8 million of revenue.

At the time of those disclosures, Cantor Fitzgerald launched discussions with View senior lenders and investors about restructuring debt or having the startup sell some assets.

After closing at $1.10 on Tuesday, View’s stock opened at $0.40 per share on Wednesday and spent several hours hovering around that mark, as of 1:00 pm ET. View’s stock has declined nearly 89 percent year-to-date and 99.93 percent since the initial stock offering.

Read more