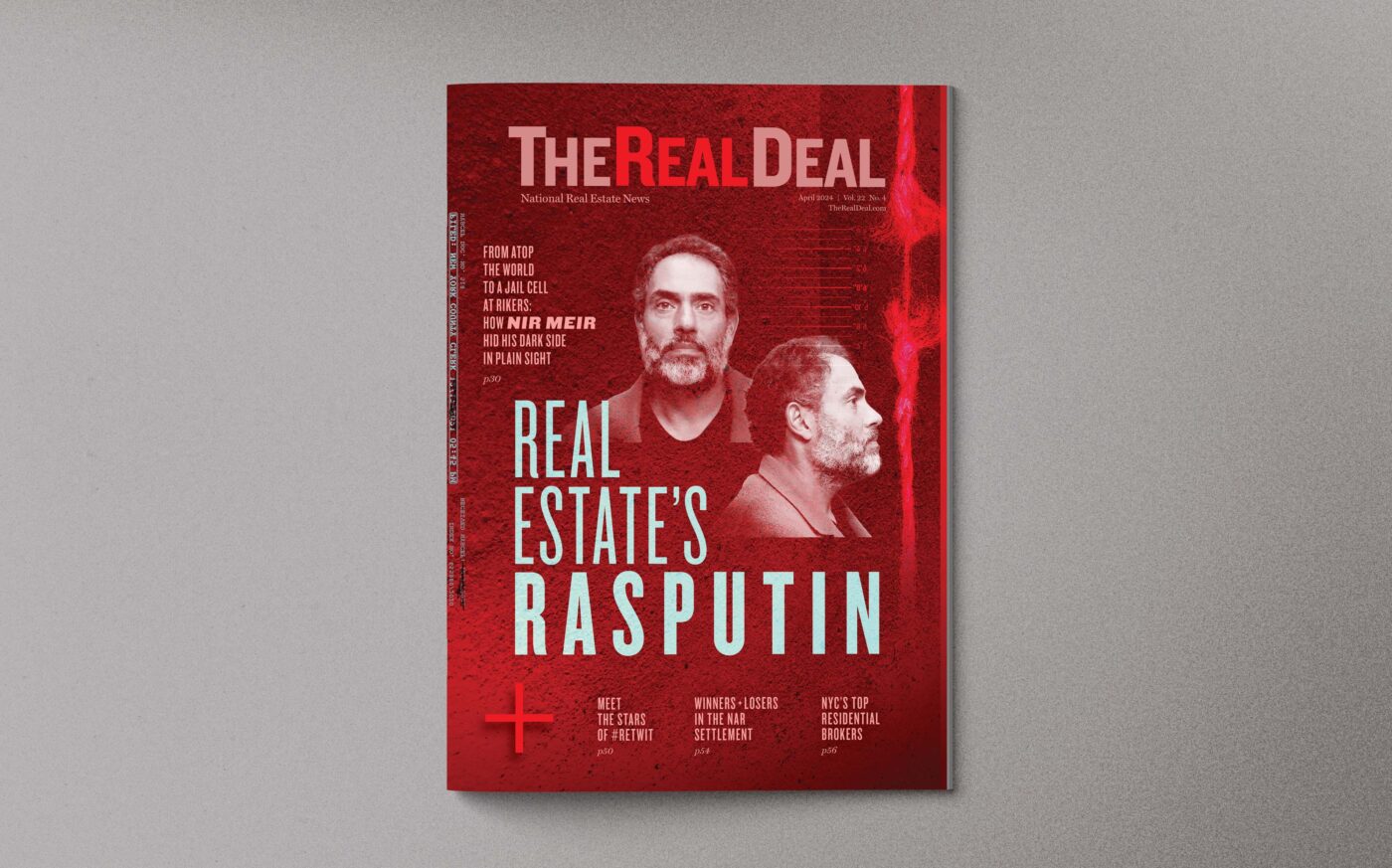

The Real Deal’s April 2024 magazine cover story is a testament to staying on the beat. Senior reporter Keith Larsen has written about former HFZ Capital Group developer Nir Meir for four years. When District Attorney Alvin Bragg indicted the former high roller, Larsen was able to write a story that’s not just about Meir’s rise and fall, but also about his deeper motivations.

In both Los Angeles and Chicago, TRD has been covering skirmishes over the idea that higher taxes on property trades ought to fund social programs. Similar proposals have been floated or enacted around the country, but these two cities pose a stark contrast. In Los Angeles, where the popularity of the transfer taxes — known as Measure ULA — surprised the industry, the real estate industry bears the weight of the policy. Isabella Farr takes stock of the city’s burden one year in.

Chicago is almost a mirror image. There, an early lawsuit from the real estate industry failed in court but appeared to help defeat the proposal at the ballot box, as Kelli Duncan reports: “It was a valuable tool to educate people about how the real estate industry works, commercial real estate industry works and how we are all connected,” in the words of Farzin Parang, head of office group Building Owners and Managers Association. It’s a strategy other cities in the fight might pay attention to.

In San Francisco, another rise and fall is going quite differently. Fifteen years after founding Veritas Investments, CEO Yat-Pang Au defaulted on $1 billion worth of multifamily. Losing the properties was “not a great feeling,” Au said in a rare interview with Emily Landes that fueled a larger profile of the operator, but he understood why it had to be done. He is not discouraged, Landes found, and is already planning an expansion.

There’s lots more in there too.

Subscribers, check the issue out today!

If you’re not subscribed yet, you can sign up here.