Once deemed the world’s most indebted developer, Chinese real estate giant Evergrande will soon be no more.

A Hong Kong judge ordered the developer to liquidate, the New York Times reported. The ruling should set off the endgame for the developer, which has been struggling for years and counts more than $300 billion in debt.

Evergrande’s lawyers argued against liquidation, pleading for more time to strike a deal with the company’s myriad creditors. But the judge presiding over the case argued the lawyers had a year and a half to bring a concrete proposal to the table, with nothing to show for it.

“I think it would be a situation where the court would say, enough is enough,” the judge said.

Evergrande’s portfolio spans hundreds of cities in China and extends beyond the real estate business. It’s unclear what kind of value creditors will be able to extract from Evergrande’s assets.

Evergrande had already filed for Chapter 15 bankruptcy protection in the United States over the summer as part of its efforts to restructure. The company defaulted on an offshore dollar bond in December 2021 and has been fighting for survival ever since, losing $81 billion between 2021 and 2022.

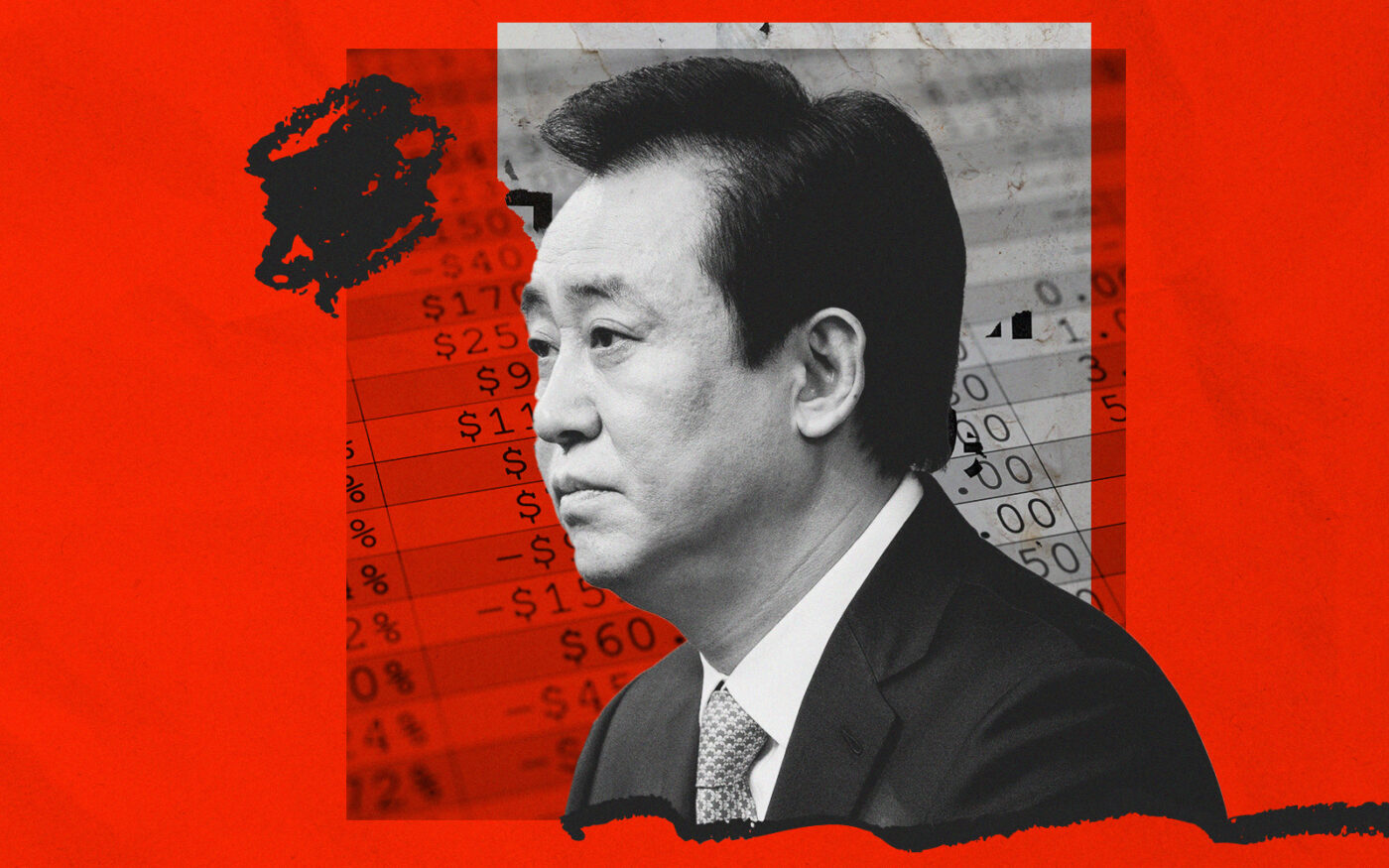

There were talks in the summer with overseas investors about Evergrande’s pile of debt. Those talks were thwarted in September, however, when several company executives were arrested in China and founder Hui Ka Yan was detained.

The impact of Evergrande’s liquidation could go beyond China’s property markets. Foreign investors will be looking to be treated fairly as the liquidation process proceeds. If that’s not how things unfold, foreign investors may be scared away from the country.

The liquidation proceedings may also be held up by the tense relations between China and Hong Kong. While there’s a mutual agreement in place between mainland China and Hong Kong regarding the recognition of court-appointed liquidators, local Chinese courts have rarely granted related requests since 2021, when the agreement was reached.

— Holden Walter-Warner

Read more