Kimco Realty is expanding its shopping center empire, acquiring another owner and operator of American shopping centers.

The company announced an agreement Monday to acquire RPT Realty in an all-stock deal valued at $2 billion. The deal is expected to raise Kimo’s pro forma equity market capitalization to $13 billion and its total enterprise value to $22 billion.

RPT shareholders will receive 0.6049 of new Kimco shares for each share of RPT they held. That represents approximately $11.34 per RPT share based on Kimco’s closing price on Friday, a 19 percent premium on RPT’s closing price at the end of last week.

Kimco will add 56 open-air shopping centers to its portfolio, most of which are wholly owned (the others are part of a joint venture). The gross leasable area of that portfolio is 13.3 million square feet. Kimco will also add RPT’s 6 percent stake in a 49-property net lease joint venture.

The merger is expected to close in the first quarter of next year. RPT stock rallied by nearly 15 percent in premarket trading on Monday; Kimco stock began surging when the markets opened on Monday, though its stock is down more than 11 percent year-to-date.

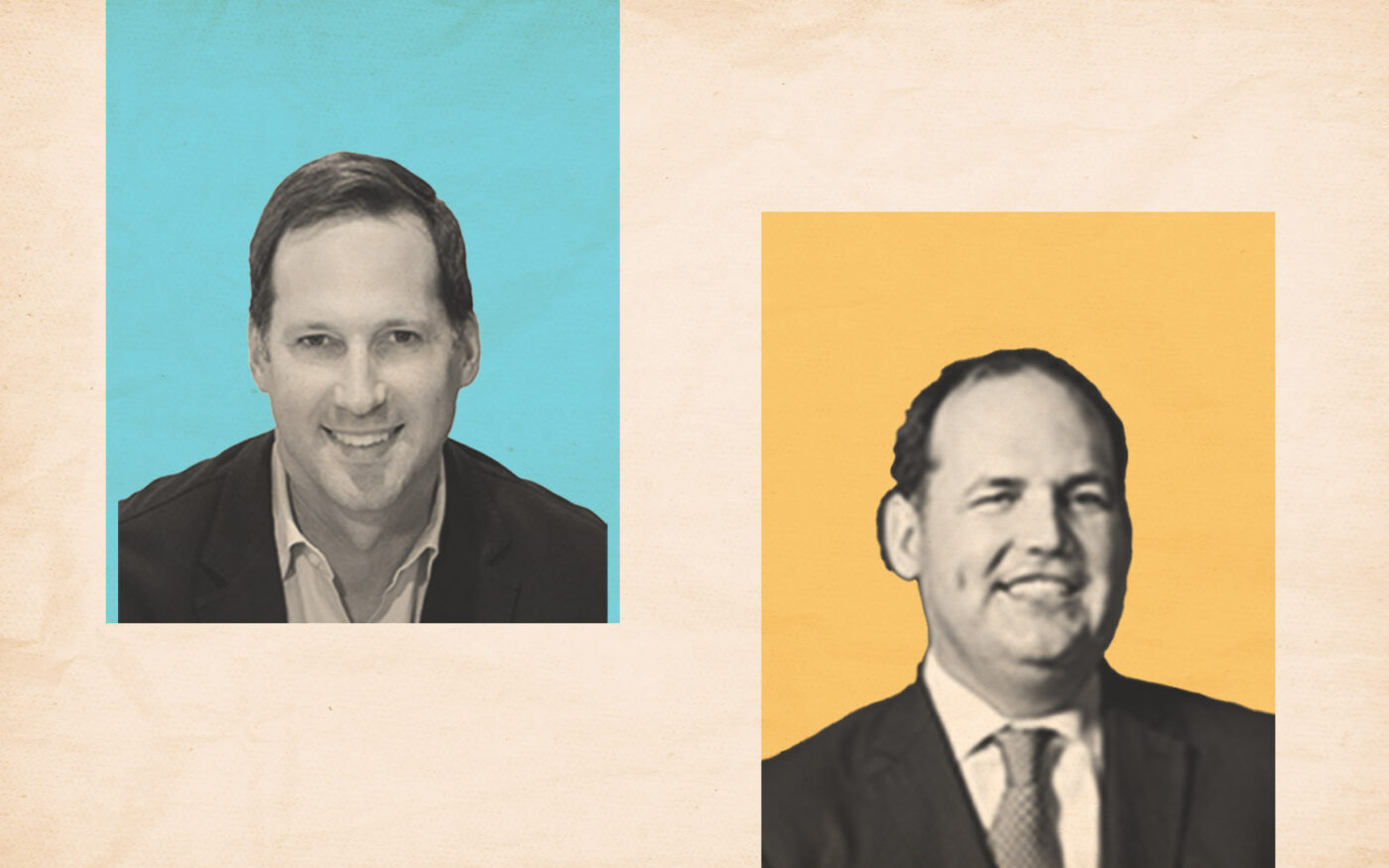

Kimco CEO Conor Flynn noted in a statement the acquisition will give the company a deeper presence in coastal and Sun Belt Markets. RPT chief executive Brian Harper added that it was in the company’s best interest to align with a grocery-anchored shopping center provider like Kimco.

Open-air properties are a highlight for the retail sector, luring in tenants who are seeking a high-quality space. Grocery-anchored shopping centers are also a bright spot, as supermarkets are a consistent driver of foot traffic.

Both firms involved in the transaction have been behind big deals in recent months. Last July, New York-based RPT purchased the Shops at Mary Brickell Village in Miami from Rockpoint for $216 million. Months later, Jericho-based Kimco bought an eight-asset portfolio spread throughout Nassau County from Kabro Associates for $376 million.

Read more