WeWork’s implosion isn’t only impacting the co-working giant.

Real estate firms who bet on WeWork when it went public are now experiencing the pain of the company’s slide into potential nothingness, Bisnow reported.

Shortly before the New York Stock Exchange suspended the trading of WeWork warrants, the company said there was “substantial doubt” it would be able to keep the business afloat in the near future.

That was not welcome news to firms like Cushman & Wakefield. When WeWork went public two years ago at an $8 billion valuation, the commercial real estate brokerage invested $150 million. As WeWork’s market capitalization sank to $275 million on Friday, Cushman’s investment also plummeted.

While the exact value of Cushman’s investment isn’t up to date, it disclosed at the end of the first quarter that its stake was valued at $3.8 million.

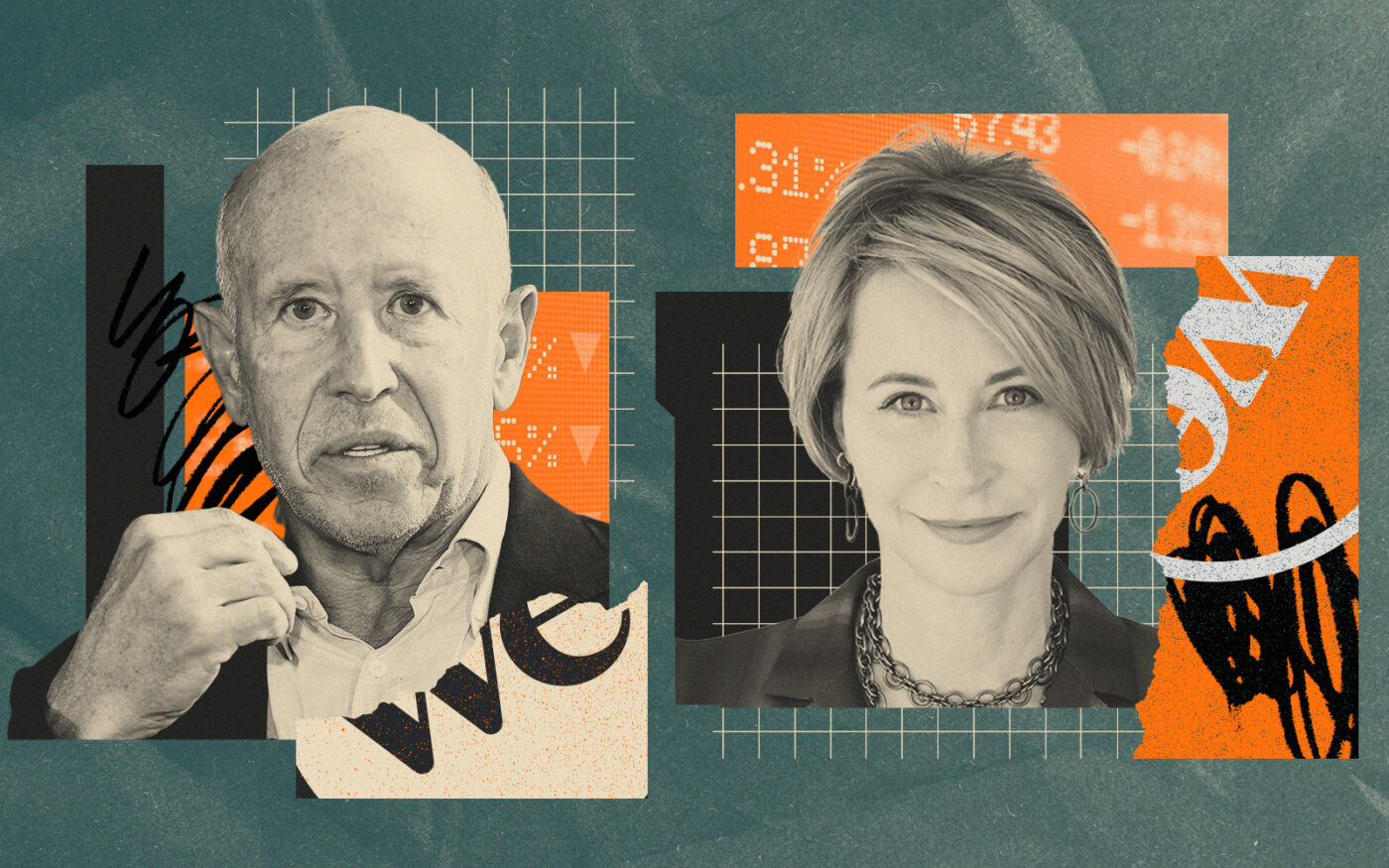

Barry Sternlicht’s Starwood Capital hasn’t fared much better.

Starwood never specified its investment in WeWork, but a document WeWork filed in March with the Securities and Exchange Commission showed two of Starwood’s opportunity funds owned 12.5 million shares. If those shares were purchased at the $10 share price during the initial public offering, the $125 million investment would be down to $1.6 million, as of Friday.

Others set to suffer at the hands of WeWork’s near demise include real estate investor Cohen & Steers (8 million shares owned as of the spring), Chinese investor Oceanwide (1 million shares), development firm war horse (800,000 shares) and naturally, ousted WeWork founder Adam Neumann (20 million shares).

Even NBA legend Shaquille O’Neal owned 12,000 shares as of March. Japanese investor SoftBank is WeWork’s biggest investor, owning more than 450 million shares.

WeWork is planning a 1-for-40 reverse stock split on the New York Stock Exchange next month in an effort to avoid delisting for the company’s moribund stock price, which is mired around 13 cents. Company stock has fallen 99 percent in the 22 months since it went public. The company recently said there was “substantial doubt” about the company’s continued operations due to membership cancellations and a lack of cash.

— Holden Walter-Warner

Read more