Another alarm bell has sounded for troubled Tides Equities, this time set off by the firm’s largest investor.

In an email obtained by The Real Deal, AMC Investments warned limited partners it needs more capital to cover the millions of dollars Tides owes contractors after tapping funds earmarked for renovations to stay current on debt payments.

The investor laid the blame on Tides for concealing property performance and fumbling initial projections that it could pay off its contractors.

“We regret to inform you that we discovered issues with Tides’ lack of transparency which has resulted in unexpected cash shortages,” AMC told its investors.

“The cash shortages were caused by Tides diverting funds meant to pay vendors for work completed to instead pay mortgage payments,” the letter continued.

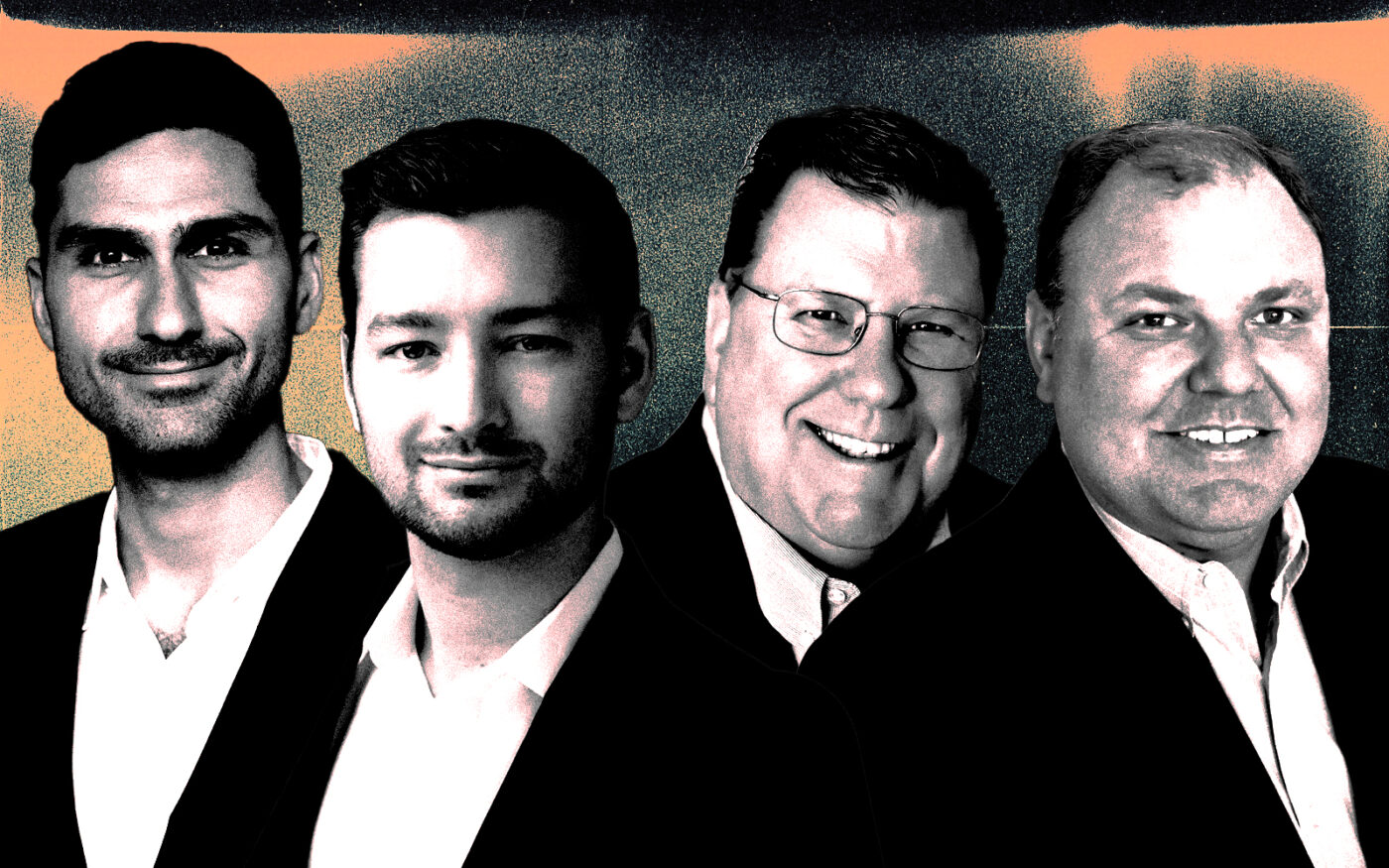

Tides’ Sean Kia and Ryan Andrade told The Real Deal the letter was outdated. In an email, Kia provided what he said was a direct quote from more recent correspondence from AMC “after conducting further due diligence.”

“We (AMC) believe that Tides made decisions based on their best judgment and is now taking all necessary measures to support AMC in resolving the challenges we face and prioritize the best interests of AMC’s investors,” the company wrote, according to Kia.

AMC did not respond to a request for comment.

“This is not meant to be a scare tactic but rather a genuine view of reality.”

AMC Investments

The AMC letter obtained by TRD details that Tides was not only unable to cover debt service with property cash flow but possibly opened itself up to legal ramifications by tapping funds set aside for renovations to bridge the gap.

On some value-add deals, lenders will underwrite an additional debt pool — future funding — that borrowers can draw on to pay for property improvements.

AMC’s letter implies that Tides asked its lenders to free up future funds to pay down invoices, but then diverted those funds to make mortgage payments.

The terms of Tides’ loans aren’t publicly available. However, borrowers typically are not allowed to use future funding to pay debt service unless they have defaulted on the debt, said real estate finance attorney Steven Herman.

The U.S. Office of the Comptroller of the Currency notes that “funds should not be advanced unless the funds are to be used solely for the project being financed.”

When negative cash “grew much faster than initially projected,” Tides amassed a $12 million debt to the firms that renovated its properties.

As borrowing costs have risen and rents in many of its markets slumped, the syndicator found itself needing an additional $14.1 million “to carry the properties through 2023,” AMC wrote.

Without it, Tides risks an unpaid contractor filing a mechanic’s lien, which could trigger a default on the debt backed by the property.

On Wednesday, the Federal Reserve hiked the federal funds rate to between 5.25 and 5.5 percent, a 22-year high. Borrowers with floating-rate loans, such as Tides, will have to cough up more money to meet debt payments.

AMC’s letter said it is meeting with its legal team to “discuss the situation and what additional steps we should take to further protect our investors’ positions.”

It could sue Tides for shuffling funds and failing to disclose it earlier, multifamily investors speaking on the condition of anonymity told The Real Deal.

AMC has put a minimum of $322 million into supporting Tides’ acquisition of at least 45 multifamily complexes across the Sun Belt, according to investment documents written by AMC and obtained by TRD.

Last month, 51 properties linked to Tides were listed on AMC’s website, but all references to the multifamily firm have since been removed.

The email follows a warning from Tides itself to investors that it may need to make capital calls to keep up with renovation costs and bulging debt payments.

“Properties that had previously been positively cash flowing … suddenly became strapped for cash, as the operating revenues increasingly went towards the rapidly rising mortgage payments,” Tides said in its letter last month.

“Capital infusion”

AMC had already begun propping up Tides properties through a “capital infusion” fund, but said in its letter that it needs more. It has formed another such fund, hoping to raise at least $20 million to support properties through the end of next year.

The firm also said it has reached out to its network of well-heeled investors to drum up additional preferred equity in exchange for a 15 percent return and a majority stake in the profits of Tides’ managers “to the extent there are any.”

Preferred equity investments should assuage lenders that Tides and its investment partners aren’t giving up on troubled deals.

“If a borrower is doing a reasonable job operating, and is willing to put more equity in a deal, there’s going to be a lot of flexibility,” a debt fund operator said.

So far, AMC said one well-heeled partner has offered to kick in the capital needed to cover half of the assets needing cash and “several others are evaluating the opportunity.”

But the firm is also asking individual investors — many of them mom-and-pops — to contribute more. It only works if every investor chips in, AMC said in its email.

Read more

“We strongly urge all investors to consider the implications of us not being able to raise the necessary funds promptly,” AMC said.

Absent another capital infusion, AMC said, Tides will be forced to offload properties when multifamily valuations have slipped as much as 25 percent and interest rates have reached their highest level in 16 years.

“In most cases, a sale today will not generate sufficient proceeds to return some or all of our original investment,” AMC said, adding that forced sales “will likely result in Class B members losing some, or all, of their original investment.”

“This is not meant to be a scare tactic but rather a genuine view of reality that everyone needs to fully understand,” the firm said.