The view ahead is looking foggier by the day for a SoftBank-backed smart glass startup.

View doesn’t have the funds to operate beyond September, Forbes reported. Investors are decrying the startup’s past strategies, including going public via a SPAC merger, a measure that has since fallen out of favor.

“It’s an embarrassment,” investor Greg Bohlen told the outlet.

The latest embarrassment came a week ago, when View settled a case with the Securities and Exchange Commission regarding alleged misstatements made by the company’s former chief financial officer, including misreporting the cost of replacing defective windows by $28 million. Because View self-reported the issue, the SEC didn’t impose penalties. The defective models stopped being sold in 2019.

The company went public via SPAC in a merger sponsored by Cantor Fitzgerald in December 2020. View was valued at $1.6 billion at the time, raking in $800 million alone from its public debut. Major investors include SoftBank, which invested $1.1 billion five years ago.

Stock in the company traded for as much as $12.49 in 2021, but that’s nearly $12.49 more than it’s trading for these days, bottoming out at 13 cents on Monday. The market capitalization is down to $33 million.

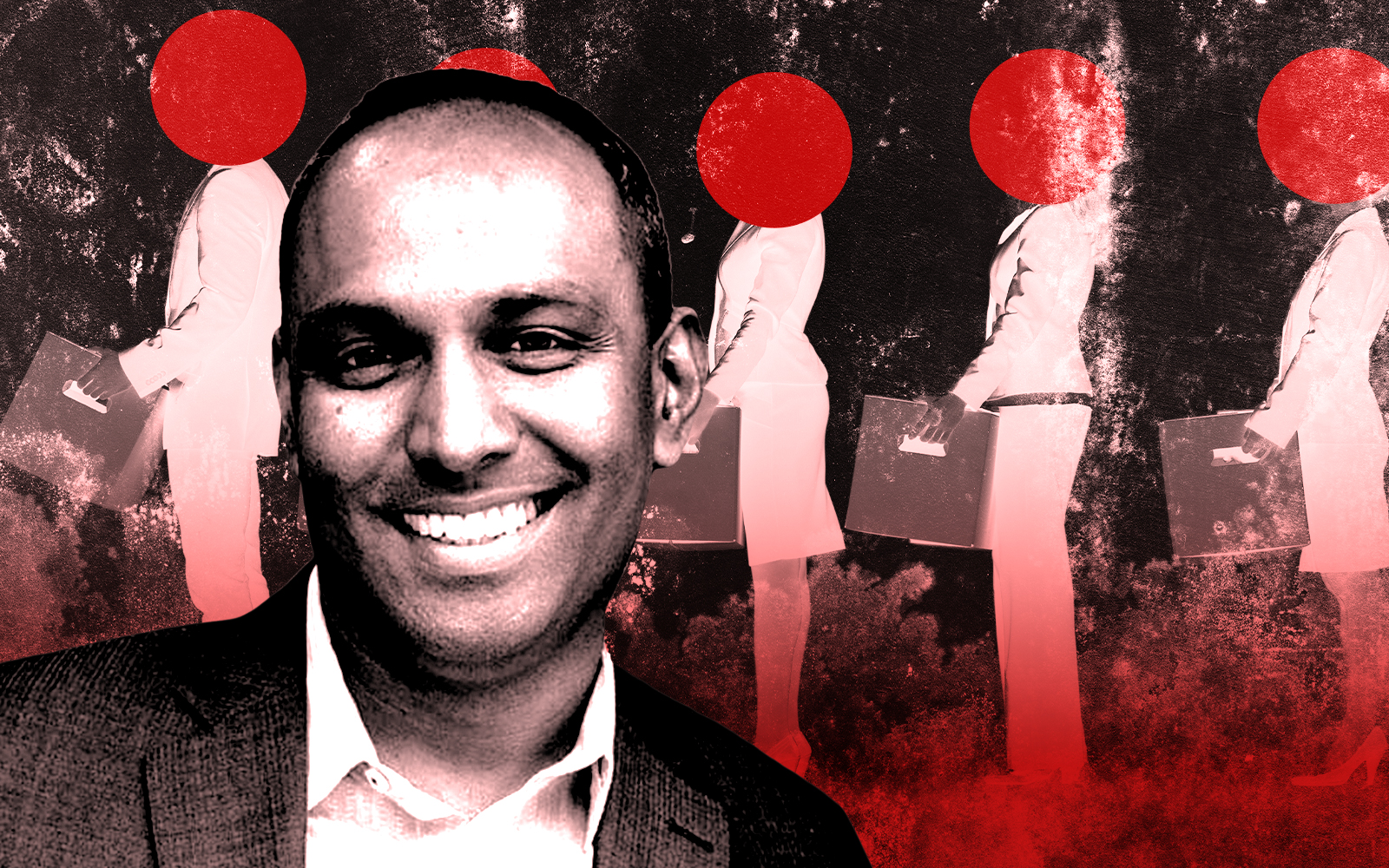

That’s a major problem for Rao Mulpuri’s company, which was warned in February it could be delisted from NASDAQ if the stock doesn’t trade for at least $1 for 10 consecutive days by Aug. 14. With a month to go, the stock has yet to hit that threshold once for the entire year so far.

The company manufactures windows designed to reduce heat and glare while adjusting in response to light. The startup has revealed windows into its struggles, though, such as when it laid off 23 percent of its employees several months ago.

Mulpuri is in discussions to raise a $150 million senior convertible note with existing investors. Even as the company fights for survival, however, issues keep rearing their head, such as an SEC filing that recently included an admission of remaining “material weaknesses in our internal control over financial reporting,” which could lead to a misstatement in the future.

— Holden Walter-Warner

Read more