The angst among commercial real estate players is palpable as they confront the possibility of a financial crisis.

Lenders foresee an increasing number of bad loans in their portfolios, which could limit their ability to provide financing in an already-strained borrowing environment. Institutional estimates of exactly how many bad loans are out there continue to grow quarter-over-quarter.

Blackstone Group’s commercial mortgage arm, for example, jacked up its estimate from about $125 million at the end of 2021 to $326 million last year. Bank OZK’s expected loan losses rose more than 25 percent during that time, from $289 million to $365 million.

There are other concerns in banking as well. Notably, what will happen to Signature Bank’s commercial real estate loans following New York Community Bank’s decision to pass on buying them following the bank’s collapse? NYCB was thought to be an ideal buyer for the loans, as it is the top lender in rent-stabilized space. Insiders have said they don’t believe another institutional investor will step up, leaving it to private entities to pick up the slack.

Take the L

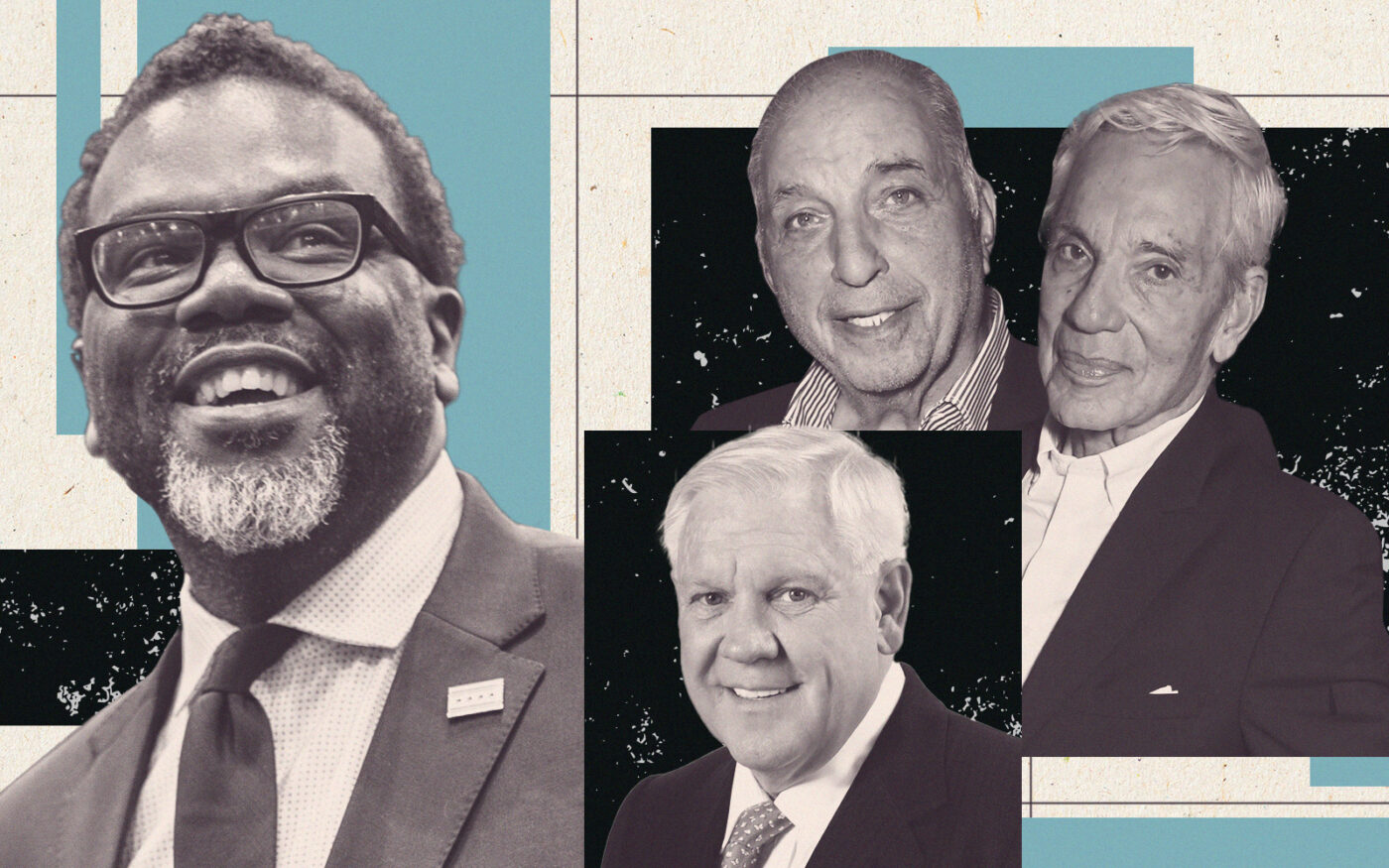

Things just got a bit colder in the Windy City for the real estate community. Brandon Johnson’s narrow victory over Paul Vallas in Chicago’s mayoral runoff. It was a result many in real estate feared, as most backed Vallas with their support and big bucks.

Now they will have to confront Johnson’s proposal to increase Chicago’s real estate transfer tax to 1.9 percent on every property sale north of $1 million.

That said, it didn’t take long for the industry to change course, with several prominent figures — including Paul Tsakiris, Curt Bailey, David Goss and Michael Mini — extending olive branches to the mayor-elect.

(Fore)closure

It’s finally over. In Los Angeles, after a year of litigation, and multiple court delays, the Reuben brothers foreclosed on Michael Rosenfeld’s $2.5 billion Century Plaza development.

Now the U.K.-based David and Simon Reuben own their first L.A. property — a 400-key hotel with 63 units attached to two condo towers.

Busted

In the tri-state area, a tenant watchdog group filed a discrimination suit against 12 Long Island brokerages — including Berkshire Hathaway HomeServices Laffey International Realty and Coldwell Banker American Homes, formerly known as Century 21 American Homes — accusing them of refusing to rent apartments to testers posing as would-be tenants with Section 8 housing vouchers.

“Supreme” ethics violation

In Texas, a bombshell report by ProPublica revealed billionaire Harlan Crow, son of real estate mogul Trammell Crow, has been showering lavish gifts on Supreme Court Justice Clarence Thomas for years, and the jurist has not been disclosing them as required by law.

Thomas and his wife, the rightwing activist Ginni Thomas, have traveled around the world annually on Crow’s megayacht and private jet to places like Indonesia, New Zealand, the Greek islands, California and an ultra exclusive enclave in the Adirondack Mountains, staying at private resorts and luxurious estates while receiving the most high-end accommodations.