After rebuffing one storage giant, Life Storage is being folded into another, poised to create the largest storage facility operator in the country.

Extra Space Storage is combining with Life Storage in a $12.7 billion stock deal, the Wall Street Journal reported. Life Storage stockholders will receive nearly $146 per share, a 30 percent premium of the company’s stock price when it was reported in February that Public Storage made an unsolicited bid for Life Storage.

Extra Space shares closed on Friday at nearly $163, creating a market capitalization of $22 billion. The same day, Life Storage shares closed slightly above $131 for a market value of $11.2 billion. Combined, the company will have an enterprise value of nearly $47 million.

The acquisition comes after a failed bid by Public Storage, the largest storage operator in the country, for Life Storage at $129 per share.

When Extra Space and Life Storage close their deal, it will become the new industry leader in terms of location volume, boasting more than 3,500 spanning 264 million square feet. The addition of the Life Storage portfolio will add 1,200 properties, increasing Extra Space’s portfolio by more than 50 percent.

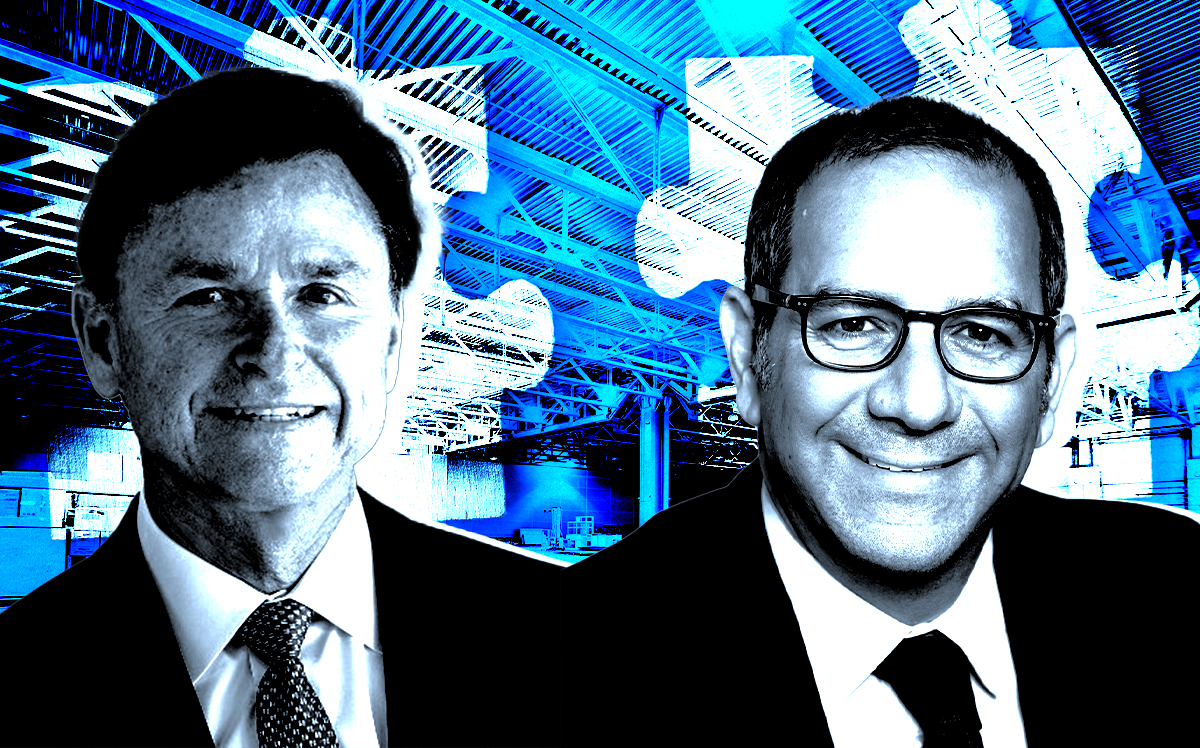

The combined company will operate as a real estate investment trust; shareholders are expected to own roughly 65 percent of the company. Life Storage CEO Joseph Saffire will be one of three from the company to join the combined board of directors, which is expanding from 10 to 12 members.

The deal is expected to close in the second half of the year, according to a press release.

Self-storage was a big property winner during the pandemic as lockdown orders stuck Americans at home or introduced work-from-home arrangements, but the sector has since cooled.

StorageMart is another self-storage player that expanded its base through a deal, agreeing in Nov. 2021 acquire Manhattan Mini Storage for slightly more than $3 billion.

— Holden Walter-Warner

Read more